Era of Uncertainty

- The 21st century: Age of uncertainty

- Is oil back from the brink?

- Democracy in digital handcuffs

- No booze truce for American Whiskey

- Life is just a bowl of cherries

![]() The 21st Century: Age of Uncertainty

The 21st Century: Age of Uncertainty

“Most of the convictions we held in the 20th century weren't genuine truths, crafted from hard work, rigor, grit and sacrifice,” says Paradigm editor — and James Altucher’s close colleague — Chris Campbell. “Instead, they were commoditized truths gilded in a scientific gloss.

“Most of the convictions we held in the 20th century weren't genuine truths, crafted from hard work, rigor, grit and sacrifice,” says Paradigm editor — and James Altucher’s close colleague — Chris Campbell. “Instead, they were commoditized truths gilded in a scientific gloss.

“Lead in gasoline is safe. Sugar is better than fats. Opioids aren’t addictive.

“Take also the leaders of central banks, and their boards of governors,” Chris continues. “From atop their perches, they determine the value of money, the most crucial yardstick for any civilization.

“Fifty years ago, we were absolutely certain they knew what they were doing.

“Now? We know better. But we also know it doesn’t matter — what they say, goes.

“In 50 years, central bankers have gone from monetary scientists to financial soothsayers.

“As Lyn Alden, author of Broken Money, puts it: ‘They divine the tea leaves, and every six weeks, everybody tunes in to see what color smoke's going to come out of the group of 12 people sitting around the table to decide.’

“In short…

“The 20th century was a fever dream of certainty. The experts are now undergoing an ‘ego death.’

“The ‘Age of Certainty’ describes a time when things were believed to be fixed, deterministic and predictable,” says Chris.

“The ‘Age of Certainty’ describes a time when things were believed to be fixed, deterministic and predictable,” says Chris.

“Our institutions, beliefs and systems were seen as stable and unchanging.

“The icon of the 20th century was the atom.

“Singular. Certain. Individual.

“It represented both the promise of atomic energy and the peril of nuclear weapons. It symbolized the reductionist approach of understanding dynamic complex systems by breaking them down into their smallest parts.

“If you invested in atoms in the 20th century, you did pretty well.

“Today, quantum physicists will say, ‘The atom is dead.’

“We now know that, contrary to previous thought, atoms aren’t fixed, deterministic and predictable. They are complex, uncertain and probabilistic.

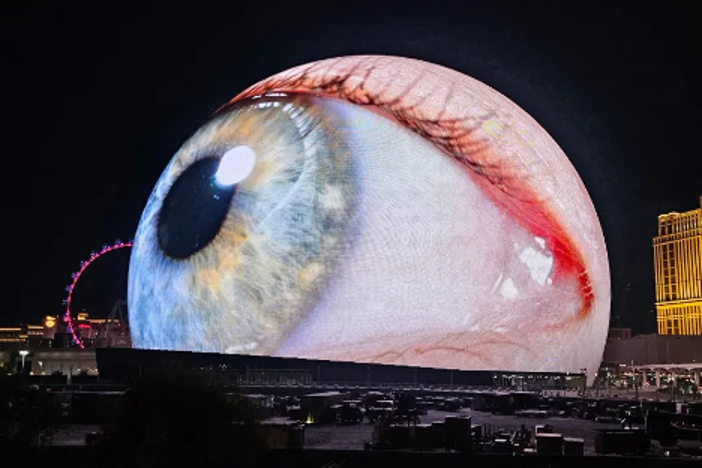

“Thus, we need a new icon to help us understand and master the era of complexity, uncertainty and probability,” says Chris. “I propose this icon is the sphere.

“Thus, we need a new icon to help us understand and master the era of complexity, uncertainty and probability,” says Chris. “I propose this icon is the sphere.

“After all, the sphere is a much more fitting representation of the internet age. It represents a structure without a center or edges, much like networks.

“Boundaries are less rigid, and value is derived from the ability to connect, share and collaborate.

“Consider:

“In the world of quantum mechanics, the ‘Bloch sphere’ is a representation used to visualize the state of a quantum bit (qubit). As quantum computing becomes more mainstream, this spherical representation of qubit states becomes more significant.

“Technologies such as blockchain and distributed ledgers eschew centralized control in favor of a system where all nodes, or participants, operate on equal footing. This creates a spherical topology in which information and value flow freely without central intermediaries.

“With the advent of edge computing and decentralized AI models, artificial intelligence is no longer restricted to central servers or specific locations. Instead, AI processing can occur anywhere in the global ‘sphere’ — from a smartphone in one's pocket to sensors in remote locations.

“And perhaps Sphere in Vegas is just a sign of the times:

“In short…

“The winners of the 20th century invested in atoms. The winners of this century will invest in spheres, or ‘omnidimensional technologies.’

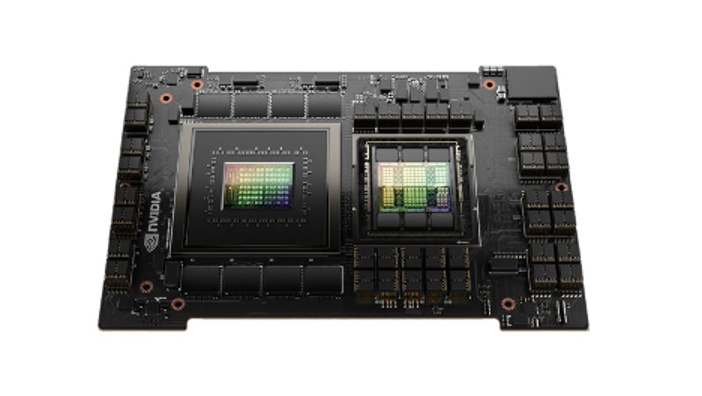

“And here’s one winner you can grab as soon as today: AI is the ultimate omnidimensional technology,” says Chris.

“And here’s one winner you can grab as soon as today: AI is the ultimate omnidimensional technology,” says Chris.

“Just as a sphere is continuous with no beginning or end…

“Artificial intelligence technologies are integrating into virtually every sector and facet of our daily lives — from health care, finance and entertainment to transportation, agriculture and beyond.

“AI will also integrate various domains of knowledge, data sources and computational techniques to arrive at new answers.

“And I don’t want to beat this metaphor to death, but…

“One of the core strengths of AI is its ability to learn and adapt,” Chris closes. “Like a sphere that can roll in any direction, AI can pivot and adjust based on new data or changing circumstances.”

[Paradigm’s iconoclast investor James Altucher has landed on what he calls ‘AI’s Crown Jewel.’

“If you’re looking to cash in on the artificial intelligence boom,” James says, “look no further than this device.”

James recently did a talk at the AI Investors Summit, where he explains:

→ What this device is

→ Why it’s important

→ How it could deliver an embarrassment of riches to investors.

The FULL talk is at the link below…

Click here to see James explain it all.]

![]() Is Oil Back From the Brink?

Is Oil Back From the Brink?

“Oil was about to fall off a cliff until Hamas invaded southern Israel,” says Paradigm editor Sean Ring at Rude Awakening.

“Oil was about to fall off a cliff until Hamas invaded southern Israel,” says Paradigm editor Sean Ring at Rude Awakening.

“But now, oil is looking unabashedly bullish,” he says. “If the war escalates considerably, we’ll see triple digits. The current price objective is $103.

“If it calms down, which I think is unlikely, we could break back down to the $60s. My call is to the upside, however.”

Concerning the price of gold, Sean adds: “I’m still a bull and think we’ll hit an all-time high again soon. Depending on the money printing and the warmongering, we may hit $2,300 by the middle of next year.”

Taking a look at commodities today, the price of crude has slipped 2.7% to $83.23 for a barrel of West Texas Intermediate. Precious metals? Gold’s down $2.30 per ounce to $1,970, according to Kitco. And silver’s down 0.65%, but still hanging onto $23.

Meanwhile, stocks are in the green — the three major U.S. indexes are all up about 0.50%. And crypto is rocking-and-rolling at the time of writing: Bitcoin has surged over 8%, approaching $34,000 and Ethereum is up almost 5%, a few dollars shy of $1,800.

The lone noteworthy economic number today, the composite flash PMI for October, came in at 51, up from September’s composite number: 50.2. Both manufacturing PMI and services PMI crept higher than anticipated — to 50 and 50.9 respectively. Which are barely in expansion territory, we note.

Nevertheless, economist Chris Williamson of S&P Global Market Intelligence says: “Hopes of a soft landing for the U.S. economy will be encouraged by the improved situation seen in October.”

Again with the “soft landing.”

![]() Democracy in Digital Handcuffs

Democracy in Digital Handcuffs

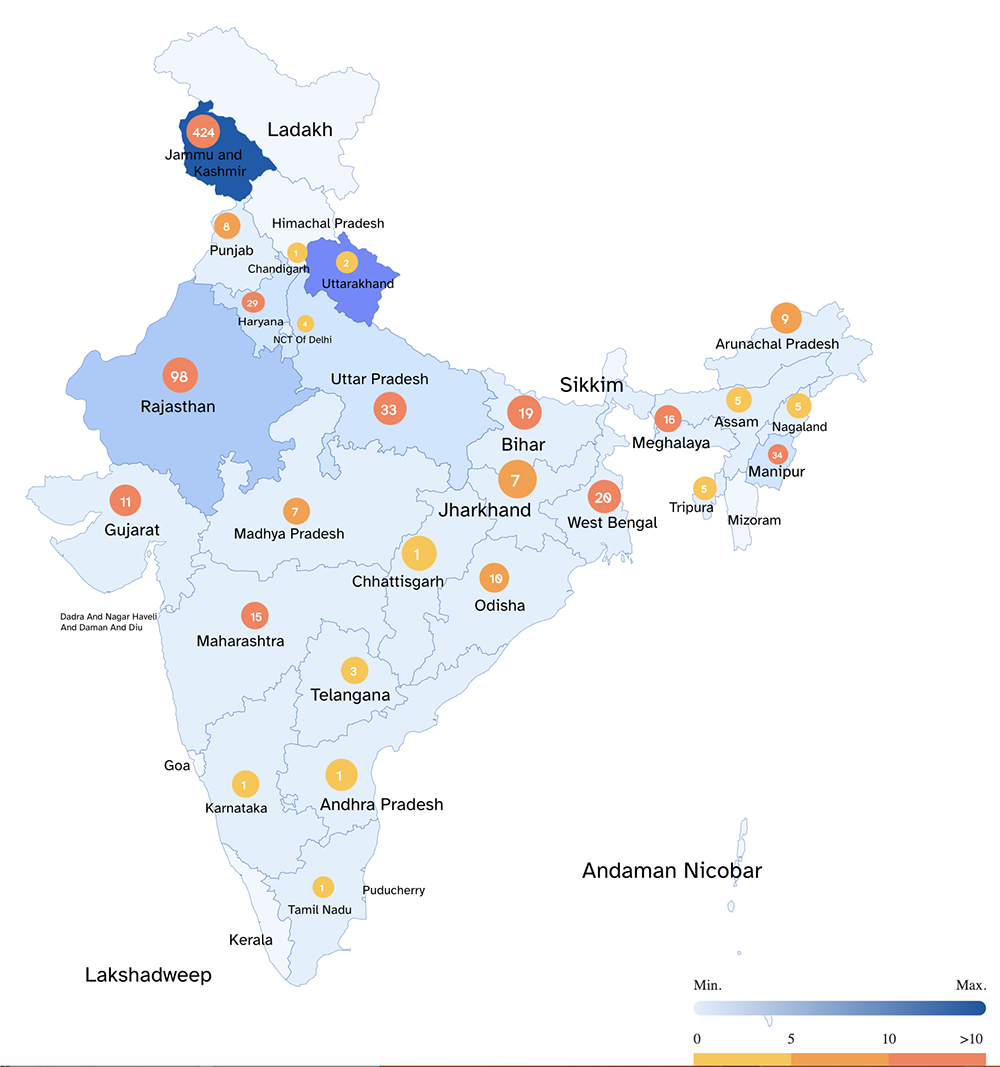

Follow-up file: India routinely resorts to internet blackouts whenever the government seeks to “restore public order.”

Follow-up file: India routinely resorts to internet blackouts whenever the government seeks to “restore public order.”

Since 2012, an Indian website called Internet Shutdown Tracker has counted 769 such events throughout the, ahem, largest democracy in the world.

“For the past five years, India has shut down the internet more times than any other country — a total of 84 times just last year alone — affecting over 120 million people,” The Guardian says.

India’s weaponization of the internet has real-world economic consequences, a matter that’s been largely overlooked by the mainstream media.

India’s weaponization of the internet has real-world economic consequences, a matter that’s been largely overlooked by the mainstream media.

To wit, in September, the internet was finally restored in the state of Manipur… after a five-month long blackout.

“The government’s justification for cutting off the internet in Manipur was the outbreak of ethnic violence between the state’s two tribes,” The Guardian reports.

“In Manipur, the impact of over 140 days without internet has been significant,” the article continues, with — as one might expect — the spread of misinformation. (You know what they say about nature and vacuums.)

“The economic impact has also been sizable.

“According to a calculation by the Internet Society, the shutdown in Manipur has cost the state $6 million and led to countrywide losses of over $4 billion.”

“According to a calculation by the Internet Society, the shutdown in Manipur has cost the state $6 million and led to countrywide losses of over $4 billion.”

Manipur resident Bryan Akoijam, for instance, once hosted a thriving YouTube channel, promoting local cinema and entertainment. Before the internet shutdown in May, his channel drew 9 million views per month. Since? Mr. Akoijam has had to close his channel.

“I was employing 27 people but I had to lay off all of them,” he says. “Because of the internet shutdown imposed by the government, the entire business model of people like me comes crashing down.”

Good point.

“[On] one hand the country is boasting about how digitized our systems are and telling the world to follow us, and on the other they are imposing frequent internet blackouts so none of these digital systems can work, impacting millions of people and costing millions of dollars,” says Raman Jit Singh Chima of Access Now.

It’s a particular conundrum for Prime Minister Narendra Modi, especially in light of his years-long promotion of a cashless society… What a mindscrew.

![]() No Booze Truce for American Whiskey

No Booze Truce for American Whiskey

Tit-for-tat tariffs on many adult beverages were suspended for five years in 2021… but that didn’t include American whiskey.

Tit-for-tat tariffs on many adult beverages were suspended for five years in 2021… but that didn’t include American whiskey.

In 2021, trade publication The Spirits Business reported: “The 25% EU tariff on U.S. rum, brandy and vodka has been suspended, as well as the 25% U.S. tariff on liqueurs and cordials from Germany, Ireland, Italy and Spain, and certain cognacs and other grape brandies from France and Germany, the latter of which was implemented in January 2021.”

The article commented: “The trade war between the European Union (EU) and the U.S. is part of a 16-year spat between aircraft manufacturers Airbus and Boeing.” That’s right, these pandemic-era alcohol tariffs resulted from a trade dispute between… Airbus and Boeing? (Make it make sense.)

“The EU and U.K. [continued] to impose a 25% tariff on American whiskey as part of the steel and aluminum dispute” — good grief — until January 2022. But Team Biden failed to convince European Commission president Ursula von der Leyen to permanently strike the American whiskey tariff when they met in D.C. on Oct. 20.

So the tariff could get much worse in a matter of months…

All to say, American whiskey (or is it whisky?) is still awaiting its own tariff reprieve.

![]() Life Is Just a Bowl of Cherries

Life Is Just a Bowl of Cherries

“In July, we drove from Boston to California for a wedding, and we took a month for the round trip, visiting many of the national parks,” a reader writes.

“In July, we drove from Boston to California for a wedding, and we took a month for the round trip, visiting many of the national parks,” a reader writes.

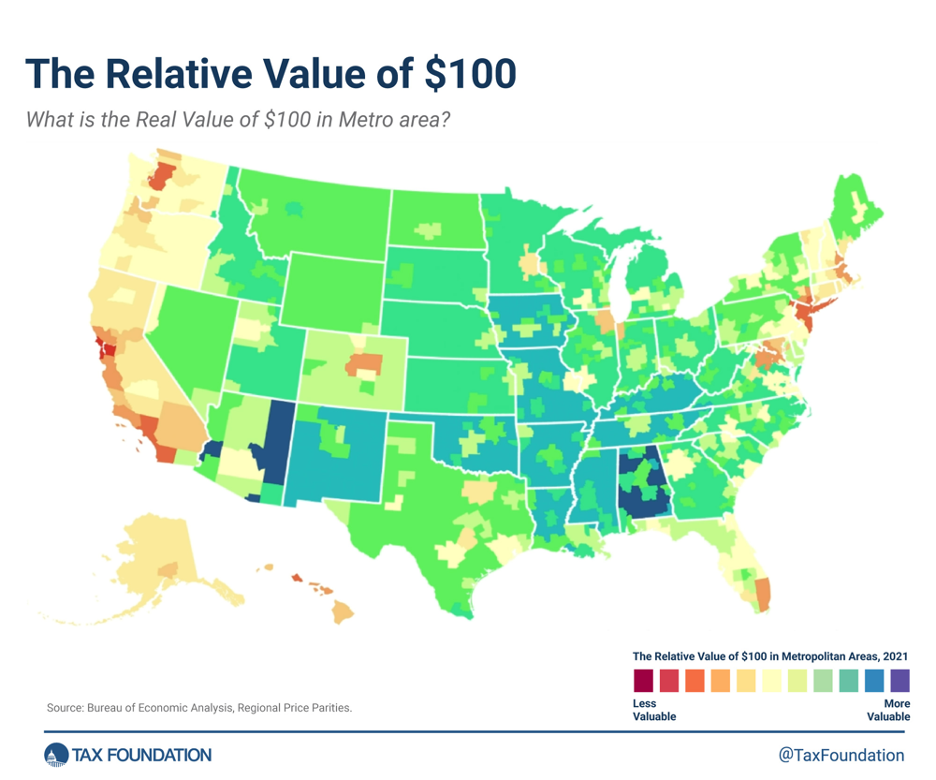

His topic? Our Saturday highlight issue featuring regional price parities (RPPs) — specifically, the purchasing power of a single “Benjamin” from coast-to-coast.

“I noticed the price of cherries because we bought fruit to munch on during the drive,” says our reader. .

“In California, they were $1.99/lb. That was true all the way back across the states until we were back in the Northeast. We can't remember if it was in Illinois or Pennsylvania where we last bought them at that price, but I know for certain that once we were in New York and then back in Massachusetts, they were $4.50–5.00/lb.!

“It is just one item from the trip that stood out. The other, of course, being the price of gasoline and diesel from state to state.”

We wonder if our reader purchased cherries in San Francisco… According to the Tax Foundation, using data available from 2021, the Bay Area was the most expensive metro area in the U.S. “where $100 would buy goods and services only worth $83.45 compared to the national average.”

With that, we’ll wrap our issue today… Have a great day, and check back for more 5 Bullets tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets