(FIT 21)

![]() “Biggest Crypto Week… Ever”

“Biggest Crypto Week… Ever”

“Our argument on the SEC’s approval of the Ethereum spot ETF was simple: The market is too pessimistic,” says Paradigm’s crypto enthusiast Chris Campbell — who includes colleague James Altucher in that assessment.

“Our argument on the SEC’s approval of the Ethereum spot ETF was simple: The market is too pessimistic,” says Paradigm’s crypto enthusiast Chris Campbell — who includes colleague James Altucher in that assessment.

In our Tuesday edition, for example, we highlighted: The odds of a May 23 approval range from Polymarket’s 11% to Bloomberg’s collective ETF analysts’ 75%.

If you’re not familiar with Polymarket, according to Wikipedia, it’s “a decentralized prediction market platform” — which uses Ethereum’s blockchain — “that allows users to place bets on world events.” Using stablecoins, of course… In other words, it’s as DeFi as it gets.

Bloomberg analysts, on the other hand? As TradFi as they come.

All to say, those firmly in the DeFi space were exceedingly more bearish than traditional finance.

“After writing,” Chris says, “the Polymarket betting market now puts an ETF approval at 69%, a shocking reversal from the mere 11%.”

In light of which, Ethereum is up about 20% in 10 days.

“But the ETF drama is just the tip of the iceberg…

“The most consequential event this week was the vote on the Financial Innovation and Technology for the 21st Century (FIT 21) Act,” Chris writes.

“The most consequential event this week was the vote on the Financial Innovation and Technology for the 21st Century (FIT 21) Act,” Chris writes.

“The vote on the FIT 21 Act is seen as an acid test for whether Congress is pro or anti crypto.” And yesterday afternoon, we got our answer…

“This bipartisan legislation, championed by crypto-friendly Rep. Patrick McHenry (R-North Carolina), aims to provide much-needed regulatory clarity for the crypto industry.

“Key provisions of the bill include…

- “Defining ‘digital assets’ under federal law for the first time

- Clarifying the jurisdictions of the SEC and the Commodity Futures Trading Commission (CFTC) over digital assets

- Establishing a decentralization test to determine whether a digital asset is a commodity or a security. (Estimates suggest 60%+ cryptocurrencies would be deemed commodities)

- Providing a path for startups to transition from centralized to decentralized networks.

“Rep. McHenry emphasized the importance of the bill for consumer protection, fostering innovation and providing regulatory clarity.”

Chris concludes: “The past 10 days have been monumental for the crypto industry with major developments on the legislative and regulatory fronts.

“And the Ethereum spot ETF is only one part.

“Biggest crypto week… ever,” Chris recaps.

At the time of writing, the SEC still hasn’t made its decision — one way or the other — on the fate of the crypto ETF. (The deadline is today.) SEC Chair Gary Gensler teases: “Stay tuned.”

Paradigm’s crypto expert James Altucher believes a sliver of a Wealth Window is opening for investors who missed out on the first stage of crypto. If that describes you… Want in?

![]() All Pause, No Pivot and NVDA

All Pause, No Pivot and NVDA

Shortly after we went to virtual press yesterday, the Federal Reserve released the minutes from its early-May FOMC meeting.

Shortly after we went to virtual press yesterday, the Federal Reserve released the minutes from its early-May FOMC meeting.

We remind you that Fed “minutes” are unlike the minutes from your local school board meeting. They’re not an impartial record of attendees and who said what. Instead, the minutes are an entirely political document; in essence, a financial-markets obfuscation.

Included in yesterday’s minutes summary is this broken record: “Participants observed that while inflation had eased over the past year, in recent months there had been a lack of further progress toward the committee’s 2% objective.”

The Labor Department’s most recent consumer price index reading of 3.4%, in other words, was cooler than expected. But summoning the FOMC’s mental math skills, that’s still 1.4% above the Fed’s inflation target rate. Really ground-breaking stuff.

The minutes further reveal that FOMC members voted unanimously to hold its benchmark short-term borrowing rate in a range of 5.25-5.5% — where it’s been paused since July 2023.

In lieu of the six quarter-percentage point cuts Wall Street tried so hard to manifest in 2024, fed funds futures now forecast a 60% chance of the first rate cut in September. But even that likelihood might be diminishing.

In lieu of the six quarter-percentage point cuts Wall Street tried so hard to manifest in 2024, fed funds futures now forecast a 60% chance of the first rate cut in September. But even that likelihood might be diminishing.

“Various participants mentioned a willingness to tighten policy further,” the minutes emphasize, “should risks to inflation materialize in a way that such an action became appropriate.”

This is definitely an instance of the Fed massaging the minutes to achieve a desired outcome; in this case, telling Mr. Market: Slow your roll…

Source: Reddit

Meanwhile, “almost all” FOMC members agreed to scale back the reduction of the Fed’s still bloated $7.30 trillion balance sheet, from $60 billion per month down to $25 billion.

Even before the Fed minutes were released, former Trump economic adviser Peter Navarro — currently serving a fourth-month prison sentence for contempt of Congress (can’t get into it today) — spoke candidly Tuesday about Fed Chair Jerome Powell… whom he dubs “Mnuchin’s folly,” incidentally.

“Powell raised rates too fast under Trump and choked off growth,” Navarro emailed Semafor from the prison’s law library. “To keep his job, Powell then raised rates too slowly to contain inflation under Biden.

“My guess is that this punctilious non-economist will be gone in a hundred days one way or the other.”

There are 166 days until Nov. 5, by the way, and Powell’s a cat who seems to have nine lives. But there’s no telling which number he’s on.

In any event, the Fed minutes have been seriously overshadowed by Nvidia’s earnings report. The upshot? If Nvidia’s any indication, Wall Street ain’t picking up what the Fed’s putting down…

NVDA shares soared to $1,018.50 yesterday after the company announced that revenue and profits beat all previous quarterly records and analysts’ estimates.

NVDA shares soared to $1,018.50 yesterday after the company announced that revenue and profits beat all previous quarterly records and analysts’ estimates.

“Revenue in the latest quarter more than tripled from a year earlier to $26 billion, and net profit soared more than sevenfold to $14.88 billion,” says an article at The Wall Street Journal.

Which is all investors needed to hear to mash the buy button in premarket trading, pushing shares up 7%. (Shares dropped back to earth this morning — below $1,000 — but they’re up 11% at the time of writing to $1,054.66.)

“The AI boom turned Nvidia’s chips into hotly contested commodities, with tech [companies] jostling over who has more of them,” WSJ recounts, including Google, Amazon and Microsoft.

“Determined to stay atop the heap, Nvidia plans to launch a new generation of AI chips late this year, following their unveiling in March at a company conference some dubbed the ‘AI Woodstock’...

“The AI boom,” the article concludes, “is still going strong.”

Stocks today? With the exception of NVDA, meh, pretty much like yesterday…

Stocks today? With the exception of NVDA, meh, pretty much like yesterday…

The tech-heavy Nasdaq is the only U.S. stock index in the green today: up 0.45% to 16,875. At the same time, the Big Board is down almost 1% to 39,290 while the S&P 500 is stuck in the middle, just about ruler-flat at 5,300.

As for the commodities complex, oil is down 0.85% to $76.89 for a barrel of West Texas crude. But precious metals are really selling off. Gold is down $50 to $2,342 per ounce while silver is down, oof, 3.10% to $30.50. “Mr. Slammy,” anyone?

Finally, crypto is of two minds this afternoon. Bitcoin’s down 2.5% to $67,910, but Ethereum is up 1.75% to $3,800.

![]() Most Unexpected Breakout of 2024

Most Unexpected Breakout of 2024

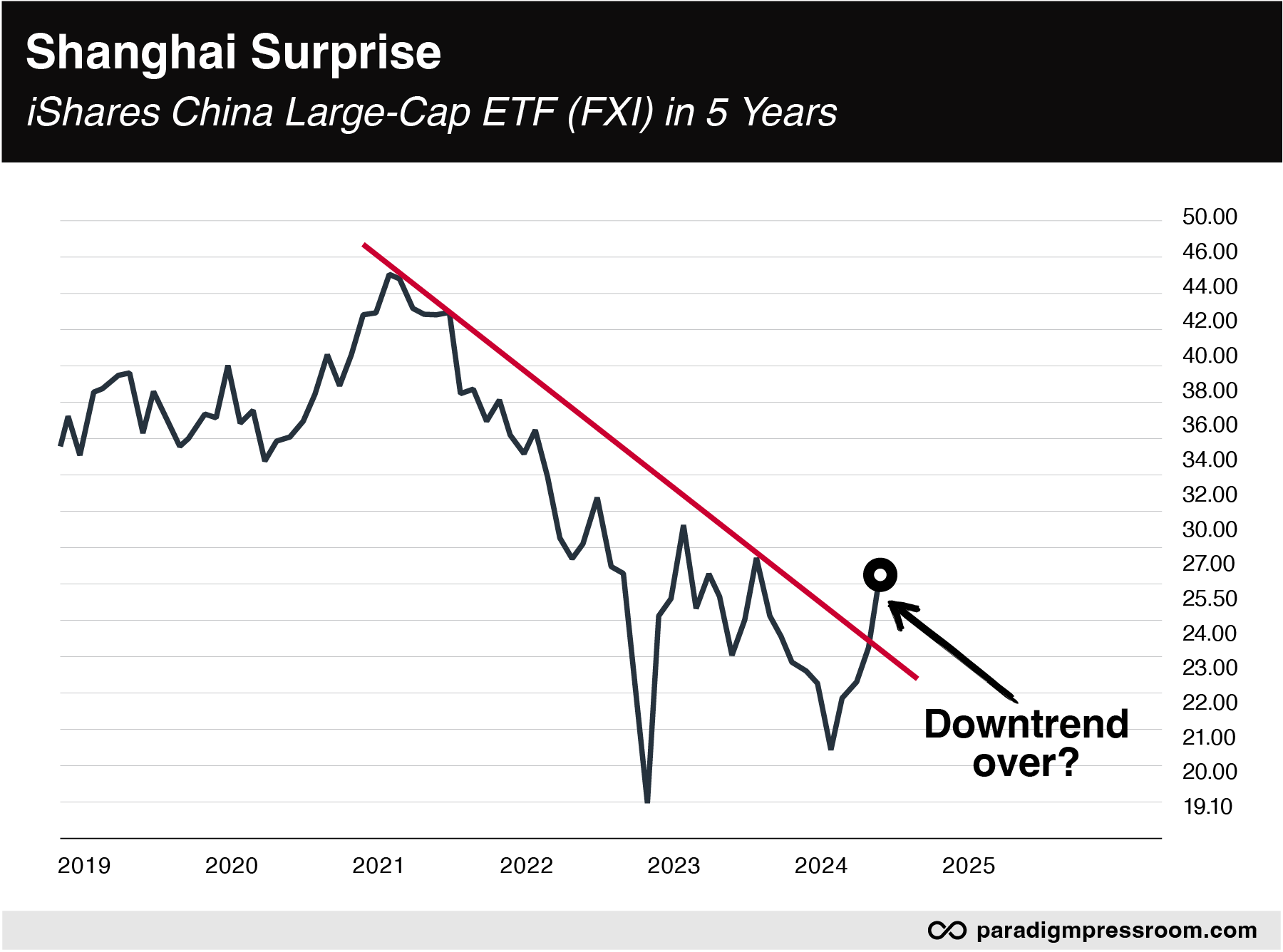

“We could be looking at the biggest snapback trade of the year… in China,” says Paradigm’s trading pro Greg “Gunner” Guenthner.

“We could be looking at the biggest snapback trade of the year… in China,” says Paradigm’s trading pro Greg “Gunner” Guenthner.

Yes, China’s “lagged woefully behind the U.S. and other nations that are watching their respective indexes fly into the stratosphere. In fact, China’s biggest indexes were threatening to retest their 2009 lows as recently as January,” Gunner says.

“But something has changed over the past four months. Instead of breaking down, these stocks are beginning to drift higher. They’ve even outperformed the resilient U.S. averages in April and May.

“Despite this year’s bounce, most investors have little to no exposure to Chinese stocks — a fact that’s quickly changing as the smart money starts to buy into the move,” perhaps most notably billionaire investor and founder of Duquesne Capital, Stanley Druckenmiller.

“I don’t talk about Chinese stocks very often,” Gunner continues. “In fact, I couldn’t immediately recall the last time I spent any significant time discussing China at length.

“Not surprising,” he says. “If you pull up a long-term look at the Hang Seng or Shanghai indexes, the Hang Seng was chopped in half and trading at its lowest levels since 2009, while Shanghai suffered a similar fate.

“Even the most steadfast optimist would have trouble coming up with a positive spin on this ugly bear market…

“This downtrend remained intact until earlier this month, when the iShares China Large-Cap ETF (FXI) finally exploded higher,” Gunner says.

“This downtrend remained intact until earlier this month, when the iShares China Large-Cap ETF (FXI) finally exploded higher,” Gunner says.

“FXI was now up nearly 14% on the month, doubling the performance of the Nasdaq Composite (+7%)...

Granted, “most of the stories you’ll dig up about China right now involve the property crisis, snowball derivatives and a general lack of confidence in its economic prospects.”

In 2023 alone, for instance, the Financial Times reported foreign investors had withdrawn almost 90% of their investments in Chinese stocks.

“While the stories surrounding China and its economy remain overwhelmingly negative,” Gunner concedes, “we’re beginning to see a few glimmers of hope and a few brave fund managers swooping in to buy shares of their favorite Chinese names.

“Remember, price moves first,” Gunner points out, “not the stories told in the financial media!

“This will change once some FOMO kicks in,” he adds. “If Chinese shares continue to push higher, we’ll witness a drastic narrative shift as the herd begins to buy into the move.

“For now, we’re still in the early innings. There’s still time to take a shot at these ‘cheap’ stocks — before the rest of the world catches on.”

![]() (Follow-up File) Gold Miners Wanted

(Follow-up File) Gold Miners Wanted

“Zimbabwe has asked gold miners across the country to ramp up output to support the ZiG currency launched last month,” a Bloomberg article says.

“Zimbabwe has asked gold miners across the country to ramp up output to support the ZiG currency launched last month,” a Bloomberg article says.

In April, we reported Zimbabwe was launching its sixth currency since 2008. Called the ZiG — short for Zimbabwe gold — “the new unit is backed by bullion and foreign currency reserves held at the central bank,” notes Bloomberg.

Source: X

“The ZiG is backed by 2.5 tons of gold and $100 million,” Bloomberg continues.

Now, the South African nation is urging small to medium-sized miners to ramp production — even, according to Bloomberg, for “artisanal and small-scale to produce more gold.” (Yeah, not loving the implications of that. This one comes with its own “trigger warning.”)

Here’s the rub: “Since late 2022 miners have been ordered to pay a part of their royalties to the state partly in commodity and cash, to help increase reserves.” So miners might have some leverage.

We’ll definitely stay on top of this story. For more on gold, this time tangentially related to yellow-gold fever in South Korea, read on…

![]() Mailbag: Gen Z and Plant A Tree

Mailbag: Gen Z and Plant A Tree

“Is it any wonder that Gen Z isn’t interested in gold? Why bother?” a reader asks. Also pertaining to Tuesday’s missive. “Is this related to depressed, angry, moody and hopeless teens?

“Is it any wonder that Gen Z isn’t interested in gold? Why bother?” a reader asks. Also pertaining to Tuesday’s missive. “Is this related to depressed, angry, moody and hopeless teens?

“I have pulled my grandkids back from the abyss many times by reminding them that people all over the world are actively and successfully saving forests, wilderness and numerous species from extinction. I encourage them to get involved as well.

“I remind them that there are more trees and protected land now than at the turn of the last century. I remind them that as little as 50 years ago, when I was in college, scientists were afraid of the coming ice age.

“And I remind them that at the end of the 19th century, the best and brightest predicted horse manure would bury cities like London and New York City.

“Gen Z is understandably not buying gold,” he concludes. “I just wish they weren’t buying everything else they’re being sold.”

Emily: Our reader’s contribution reminds me of a quote attributed to Reformation theologian Martin Luther: “If I knew that tomorrow was the end of the world, I would plant an apple tree today.”

Tomorrow isn’t guaranteed. So today? Hope…

Coming up tomorrow (heh), we’ll feature a classic issue you won’t want to miss — especially if you’re new to the Paradigm family.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets