Portfolio’s Great. Why Am I Unhappy?

![]() Portfolio’s Great. Why Am I So Unhappy?

Portfolio’s Great. Why Am I So Unhappy?

The story of investing during 2025 can be summed up as the tale of Nvidia and Newmont.

The story of investing during 2025 can be summed up as the tale of Nvidia and Newmont.

Nvidia was the darling of the tech-adjacent “Magnificent 7”... the poster child for the AI age… the object of endless discussion on CNBC and investing message boards.

NVDA began the year around $137 and ended at $187 — a solid gain of 36.5%, more than double the performance of an S&P 500 index fund.

In contrast, no one talked about Newmont Corp. NEM is the biggest gold-mining company in the world… but both Newmont and the gold-mining sector as a whole went unloved, overlooked, under the radar.

NEM began the year around $37 and ended just shy of $100 — a stunning one-year gain of 170%. And almost no one noticed.

I don’t even remember when I started investing in the precious metals space in earnest; the easily-accessible records from my brokerage account go back only 10 years. I didn’t do anything wild or crazy — just dollar-cost averaging into the Sprott Physical Gold Trust (PHYS), the Sprott Physical Silver Trust (PSLV) and the Tocqueville Gold Fund of mining stocks (now under the Sprott umbrella trading as SGDLX).

Through all the ups and downs — gold collapsed from $1,900 in 2011 to $1,050 in 2015 — I held fast. I had every confidence that the outperformance of precious metals during the 1970s and the 2000s would recur sooner or later.

2025 was the year my patience started to pay off, gold ending the year north of $4,300.

And I have every confidence the party’s just getting started. Which is really depressing to think about.

And I have every confidence the party’s just getting started. Which is really depressing to think about.

Yes, depressing. On a profound level, the outperformance of the precious metals sector — and the boost it’s given to my portfolio — gives me no joy.

The problem is that precious metals — and the natural resource space as a whole — usually outperform at a time when the world is going to hell in a handbag.

Think about the Great Depression, when — as we saw in yesterday’s edition — the term “American Dream” first came into widespread use.

It was an awful time for both the economy and the stock market. But among the best performing stocks of the 1930s were two gold-mining names — Homestake Mining and Dome Mines. A dollar invested in Homestake in 1928 would have turned into $1.97 by 1932… $4.95 by year-end 1933… and $6.40 by the end of 1934.

The natural-resource sector also thrived during the 1970s — when inflation was ravaging everyday Americans and the era of post-WWII prosperity ground to a halt. (I recall encountering the term “Rust Belt” in U.S. News & World Report way back then.)

The gold price zoomed from $35 to over $800… while individual mining names performed even better. Energy names also thrived during this time.

Like it or not, gold’s success these days goes hand-in-hand with an American Dream that seems ever more elusive.

Like it or not, gold’s success these days goes hand-in-hand with an American Dream that seems ever more elusive.

I’ve been anticipating something like this for the better part of two decades. It gives me no joy that it’s coming to pass.

Gold’s rise in the 2020s is a global vote of no-confidence in the U.S. dollar and U.S. Treasury debt.

Uncle Sam is racking up enormous budget deficits relative to the size of the economy. Politicians in decades gone by could justify deficits of that scale during a world war, a global financial crisis or a pandemic. But none of that is happening now.

It’s no coincidence gold took off in 2022 when Washington froze the dollar-based assets of Russia’s central bank. Governments around the world, wary it could happen to them too, have loaded up on gold as an alternative to dollars and Treasuries.

It’s still the early innings. “Private institutional investors have gold allocations of below 2.0% of total assets,” Paradigm’s Jim Rickards reminded us last month.

“If that expanded to a mere 4.0% allocation, there’s not enough gold in the world at today’s prices to fill those orders.”

And so it goes with all manner of natural resources — tangible wealth. Precious metals, base metals, energy, agriculture…

Yes, the gains to date have been fantastic. But it’s still, at the latest, the fourth inning.

Now I’ll hand it off to Emily for the rest of today’s edition…

![]() The Powell Panic

The Powell Panic

“Not all breaking news matters. The latest story about Jerome Powell is a perfect example,” says Paradigm’s pro trader Enrique Abeyta.

“Not all breaking news matters. The latest story about Jerome Powell is a perfect example,” says Paradigm’s pro trader Enrique Abeyta.

“By now, you’ve seen the headlines…

Source: New York Times

Source: New York Times

“Stocks traded lower and risk assets wobbled as commentators speculated whether this is the beginning of some grand unraveling.

“It was simply the opening of an investigation. Yet the market reacted as if the most extreme interpretation were already fact,” Enrique points out.

“It was simply the opening of an investigation. Yet the market reacted as if the most extreme interpretation were already fact,” Enrique points out.

“If you zoom out and look at what actually matters right now, the disconnect becomes obvious…

- Market strength has been broadening, not narrowing

- Leadership is no longer confined to a handful of mega-cap names

- Interest rates have been drifting lower, easing financial conditions rather than tightening them

- Oil prices are down, which acts as a tax cut for consumers and businesses alike

- And corporate earnings growth remains solid, with margins holding up better than most feared just a few quarters ago.

“Against that backdrop, a knee-jerk sell-off tied to the announcement of an investigation [isn’t] just overblown — it’s absurd.

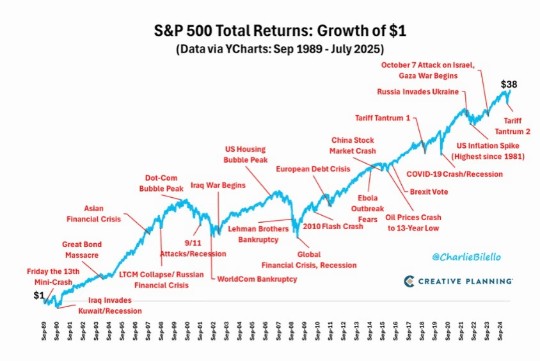

“To prove my point, here’s a great chart from one of my favorite financial voices, Charlie Bilello from Creative Planning. [It] highlights the market's reaction (or lack thereof) to major historical events:

Source: Creative Planning

Source: Creative Planning

“Even significant events like the 2016 Brexit vote barely registered on S&P total returns,” Enrique notes.

“If the U.K. leaving the EU after more than four decades barely impacted the S&P 500's trajectory, do you really think this Powell headline will have a lasting impact?

“The Powell story checks every box of a classic ‘BTSD’ setup,” Enrique adds. Unfamiliar with the acronym? Buy the Stupidity Dip…

“The Powell story checks every box of a classic ‘BTSD’ setup,” Enrique adds. Unfamiliar with the acronym? Buy the Stupidity Dip…

“None of this means volatility disappears or that you should blindly buy every dip,” he says. “Context always matters.

“But in situations like these, where the reaction is clearly disconnected from fundamentals, the playbook is straightforward.

“Slow down. Filter out the noise. And focus on what actually drives markets,” Enrique advises.

“BTSD isn’t just a slogan; it’s a mindset. And on occasions like these, it’s how investors make real money.

“Over and over again, the market sells first and asks questions later,” he concludes. “When cooler heads prevail, prices quietly recover.”

Stocks are hitting the skids this afternoon. The Nasdaq is getting the worst of it; the tech-heavy index is down 1.45% to 23,365. Faring slightly better, the S&P 500 has lost about 1% market cap to 6,895 while the Dow’s down 0.50% to 48,935.

Stocks are hitting the skids this afternoon. The Nasdaq is getting the worst of it; the tech-heavy index is down 1.45% to 23,365. Faring slightly better, the S&P 500 has lost about 1% market cap to 6,895 while the Dow’s down 0.50% to 48,935.

Meanwhile, oil’s rebounding, up about 0.85% to $61.68 for a barrel of West Texas crude. But precious metals are in record-breaking territory. Gold’s up 0.45% to $4,620.20 per ounce, but it’s silver that’s stealing all the shine: up 5.15% to $90.74.

Crypto, likewise, is rallying today. Bitcoin’s up 3.65%, just under $98K, and Ethereum’s up 5.35% to $3,375.

![]() Who Pays for the AI Boom?

Who Pays for the AI Boom?

Trump is making affordability a frontline issue, now aiming squarely at the soaring energy costs tied to America’s AI boom.

Trump is making affordability a frontline issue, now aiming squarely at the soaring energy costs tied to America’s AI boom.

On Tuesday, Trump announced his administration is partnering with major tech companies to ensure the massive data centers powering artificial intelligence do not push electricity bills higher for American households.

“We are the ‘HOTTEST’ Country in the World, and Number One in AI,” Trump wrote on Truth Social. “Data Centers are key to that boom, and keeping Americans FREE and SECURE but, the big Technology Companies who build them must ‘pay their own way.’”

Data centers, especially those designed for AI workloads, consume enormous amounts of electricity and water. A single large facility can use as much power as a small city and up to a million gallons of water per day. The International Energy Agency estimates that global electricity demand from data centers could double in 2026 — compared with 2022 levels — roughly equivalent to the annual electricity use of Japan.

Microsoft president Brad Smith details his company’s commitments at a White House-area event titled Community-First AI Infrastructure. Smith says Microsoft would ensure its electricity use does not raise local utility rates and that it would forgo tax breaks or discounted power prices in communities hosting its facilities.

The announcement comes amid bipartisan backlash. Communities in states as politically diverse as Oklahoma, Tennessee, Oregon, California, New York and Wisconsin have raised alarms over higher power bills, water strain and environmental impact. In rural Wisconsin, Microsoft recently scrapped plans for a new data center after residents objected to potential electricity rate increases.

Trump has spent his second term courting tech leaders and deregulating AI development to speed innovation. But as affordability pressures mount, the White House is reassessing — pressing tech giants to absorb the costs of growth rather than passing them onto already stretched-thin American families.

![]() WFH = City Budget Crisis

WFH = City Budget Crisis

America’s remote-work experiment is no longer reshaping office culture — it’s reshaping city balance sheets.

America’s remote-work experiment is no longer reshaping office culture — it’s reshaping city balance sheets.

In a recent Demography Unplugged analysis, demographer Neil Howe and Christian Ford argue that the work-from-home shift has moved beyond workplace policy and into the realm of municipal economics.

While many white-collar employees now split time between home and office, a notable segment remains fully remote. Across U.S. metro areas with populations over 1 million, about 15% of workers now telecommute every day, with even higher concentrations in cities including Austin, Raleigh, Denver and Portland.

Notably, these workers haven’t fled urban life altogether. They still live near restaurants, culture and amenities — but they no longer anchor downtown business districts with daily commutes. As Howe and Ford note: “The economic impact on city centers is becoming increasingly hard to ignore.”

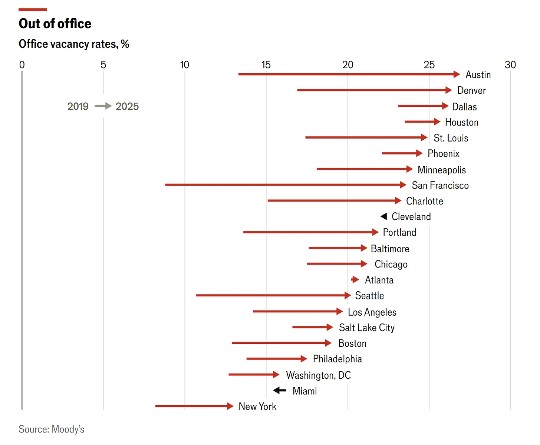

The most obvious pain point is office real estate. In Austin and Denver, for instance, more than a quarter of office space now sits vacant, the highest share among major metros.

Source: Moody’s, Demography Unplugged

Source: Moody’s, Demography Unplugged

Those vacancies ripple outward. In San Francisco, the collapse in office demand is expected to reduce property-tax revenue between $150–200 million per year from 2023–2028.

Housing markets are also adjusting. According to Parcl Labs, more than half of homes currently listed in Austin and Denver have already reduced their initial asking prices. In Austin alone, residential property values are projected to fall by 10% in 2026 — a sign that demand has softened, compounded by higher interest rates.

City governments are now responding with austerity. Denver has eliminated city positions equal to 7.6% of its workforce. Austin has scaled back funding for emergency medical services and public parks. San Francisco’s mayor has instructed departments to identify $400 million in budget cuts for 2026.

“Remote work is no longer just a fight between workers and bosses,” say Howe and Ford. It has become a stress test for urban centers — one that forces cities to shrink and rethink what a downtown economy looks like when fewer people show up for work each morning.

![]() Proof of Life: An App for That

Proof of Life: An App for That

The hottest new app in China does almost nothing… And that’s precisely the point.

The hottest new app in China does almost nothing… And that’s precisely the point.

It’s called Si Le Ma, which roughly translates to “Are You Dead Yet?” Once a day, users tap a single oversized green button. Miss two days in a row, and the app automatically emails a designated emergency contact, urging them to physically check on you.

Just basic proof of life.

“When I looked at Maslow’s hierarchy of needs, I saw that safety needs are deeper and apply to a much broader group of people. That felt like a good direction,” says the app’s Gen-Z developer Guo.

Guo and his team originally charged 1 RMB (about $0.14) for lifetime access, later raising it to 8 RMB (roughly $1.15). The app reportedly cost around $200 to build.

But the concept — part utilitarian, part gallows humor — hit hard, making Are You Dead Yet? the No. 1 paid app on China’s Apple App Store while climbing overseas rankings without paid advertising.

Guo’s team has since been contacted by more than 60 investors, all clambering for a stake in the parent company, Moonscape Technologies. “We knew there would be some traction, but the scale of this completely exceeded our expectations,” Guo notes.

The app’s popularity reflects reality. According to China’s 2020 national census, 25.4% of households consist of just one person, up from 14.5% in 2010. While older adults still dominate that category, more young people are living alone.

The team, however, announced this week it would rebrand the app globally as Demumu, a softer name inspired by viral plush toy Labubu. Boo!

Fans were underwhelmed. On the Chinese social media platform Weibo, one of the most-liked comments says: “Baby, your previous name was the reason you went viral.”

Indeed… Take care of yourself, and look out for your neighbors! We’ll be back tomorrow.