Silence Is Golden

![]() Why Apple Is Keeping Its Silence

Why Apple Is Keeping Its Silence

Yawn… stretch…

Yawn… stretch…

The Wall Street Journal has a tedious front-page story today keyed to CEO Tim Cook’s much-anticipated dog-and-pony show set for this coming Monday.

There’s some mildly interesting background about a handful of AI recruits from Google a few years back who didn’t fit in with Apple’s culture — and also how the release of OpenAI’s ChatGPT in late 2022 lit a fire under Senior VP Craig Federighi.

Apart from that, it’s a thoroughly predictable snooze: “Apple’s caution and characteristic secrecy, as well as the care it takes in upgrading devices — where hardware and software are seamlessly integrated—have hobbled its early efforts in the AI arena… It now finds itself in the unusual position of having to take risks.”

It’s not that the Journal — and the rest of the corporate media — are wrong. But they’re not telling the whole story.

It’s not that the Journal — and the rest of the corporate media — are wrong. But they’re not telling the whole story.

That’s where Paradigm’s AI authority James Alutcher comes in — fresh from his exclusive Apple’s 10X AI Announcement event last night.

It’s true that AAPL has been quiet at a time when Microsoft, Google and Nvidia are grabbing all the AI headlines.

“But don't let this silence fool you,” said James -- “the tech giant has been quietly working on something big behind the scenes.

“In fact, Apple made more AI-related acquisitions than any other major company this year. With over 20 acquisitions under its belt, it's clear that Apple is gearing up for a major AI push.”

Yeah, you didn’t know about that, did you? That’s because the media has latched onto the Apple is falling behind on AI narrative and won’t let go, even in the face of contradictory evidence.

The fruits of Apple’s efforts will be there for the world to see when CEO Tim Cook speaks on Monday at the company’s annual Worldwide Developers Conference.

As James sees it, “The AI revolution is coming to the iPhone, and it's going to change the game for consumers… With their strong brand loyalty and massive user base, Apple is poised to bring AI to the masses in a way that no other company can.”

Here’s something else the media is overlooking — and it could prove to be immensely lucrative.

There’s a tiny stock that could prove crucial to Apple’s AI foray. James believes it has the potential to grow 10X over the next 12 months.

By the time Tim Cook takes the stage on Monday, it could be too late to act. So if you haven’t seen James’ exclusive Apple’s 10X AI Announcement briefing, you owe it to yourself to watch right away.

Watch here for the immediate replay of Apple’s 10X AI Announcement

![]() Sky-High Job Number Tanks Bonds, Gold

Sky-High Job Number Tanks Bonds, Gold

The May job number is way better than expected — and Mr. Market is throwing a fit, at least in certain asset classes.

The May job number is way better than expected — and Mr. Market is throwing a fit, at least in certain asset classes.

The wonks at the Bureau of Labor Statistics conjured 272,000 new jobs for the month — far more than even the most optimistic guess among dozens of Wall Street economists polled by Econoday.

Thus, the betting in the futures market this morning is that the Federal Reserve won’t cut interest rates until December.

With that, bonds and precious metals are selling off, hard.

With that, bonds and precious metals are selling off, hard.

Remember when it comes to bonds, falling prices translate to higher yields. And the yield on a 10-year Treasury note is up sharply to 4.424% — up huge from yesterday’s two-month low of 4.28%. That’ll leave a mark.

As for gold and silver, those were already tanking as soon as trading opened in London today. But the jobs number gave sellers an additional reason to bail.

At last check, the Midas metal was down $65 to $2,311. Silver was off $1.75, over 5%, to $29.52.

As it turns out, a closer look at the job numbers shows less than meets the eye.

As it turns out, a closer look at the job numbers shows less than meets the eye.

Let’s run down a few things…

- First, remember what we told you on Wednesday: There’s powerful evidence the headline new-job number each month has been vastly overstated going back to last year

- Second, bear in mind these are new jobs, not newly employed people; the number rises even if someone takes on a second job to make ends meet

- Finally, there is once again a huge divergence between the “establishment” survey — in which businesses are asked if they’re hiring — and the “household” survey in which regular folks are asked if they’re working. Again, the establishment survey shows 272,000 new jobs — while the household survey shows a loss of 408,000 jobs.

Even the official unemployment rate suggests the labor market is cooling off; at 4.0%, it’s the highest since January 2022.

Elsewhere, the market reaction is more muted. The major U.S. stock indexes are mixed, the S&P 500 down microscopically at 5,349 — only five points below Wednesday’s record close. Bitcoin is nearly unchanged at $71,227.

Elsewhere, the market reaction is more muted. The major U.S. stock indexes are mixed, the S&P 500 down microscopically at 5,349 — only five points below Wednesday’s record close. Bitcoin is nearly unchanged at $71,227.

Crude’s recovery continues, a barrel of West Texas Intermediate fetching $75.77. That’s up three bucks from the initial swoon after OPEC’s announcement last weekend that it will dial back its production cuts next year.

As it happens, OPEC’s announcement came a week after the Biden administration quietly told the Financial Times that it plans to lift existing limits on U.S. weapons sales to Saudi Arabia. Coincidence? An election-year gambit to keep a lid on gasoline prices? You decide…

![]() Surprise Election Result = Stock Manipulation?

Surprise Election Result = Stock Manipulation?

From India comes an unusual accusation of stock-market manipulation.

From India comes an unusual accusation of stock-market manipulation.

On Tuesday, final results were tallied up from parliamentary elections in “the world’s biggest democracy.” Prime Minister Narendra Modi’s BJP party still has the most seats. But unlike in the last two elections, BJP will have to ally with other parties to form a government.

India’s benchmark stock index, the Sensex, crashed 4% that day — then staged a recovery as the week went on, reaching all-time highs.

The leader of the opposition Congress Party, Rahul Gandhi (grandson of Indira Gandhi) cried foul. As the BBC reports…

He alleged that weeks before election results, Mr Modi, ex-Home Minister Amit Shah and former Finance Minister Nirmala Sitharaman advised people to "buy stocks before June 4", suggesting that the market would surge after, anticipating a BJP victory.

In May, Mr. Shah told NDTV news channel in an interview: "Stock market crashes should not be linked with elections, but even if such a rumor has been spread, I suggest that you buy (shares) before June 4. It will shoot up."

Gandhi calls it “the biggest scam” in the history of India’s stock market — causing everyday Indians to lose trillions of rupees while “dubious foreign investors” collected a huge payday.

We don’t have a dog in this fight… although it seems Gandhi is going to have to come up with more compelling evidence than what he’s got so far…

![]() Get ’Em Started Early

Get ’Em Started Early

In what is too often a dirge of bad news, we bring you something positively uplifting.

In what is too often a dirge of bad news, we bring you something positively uplifting.

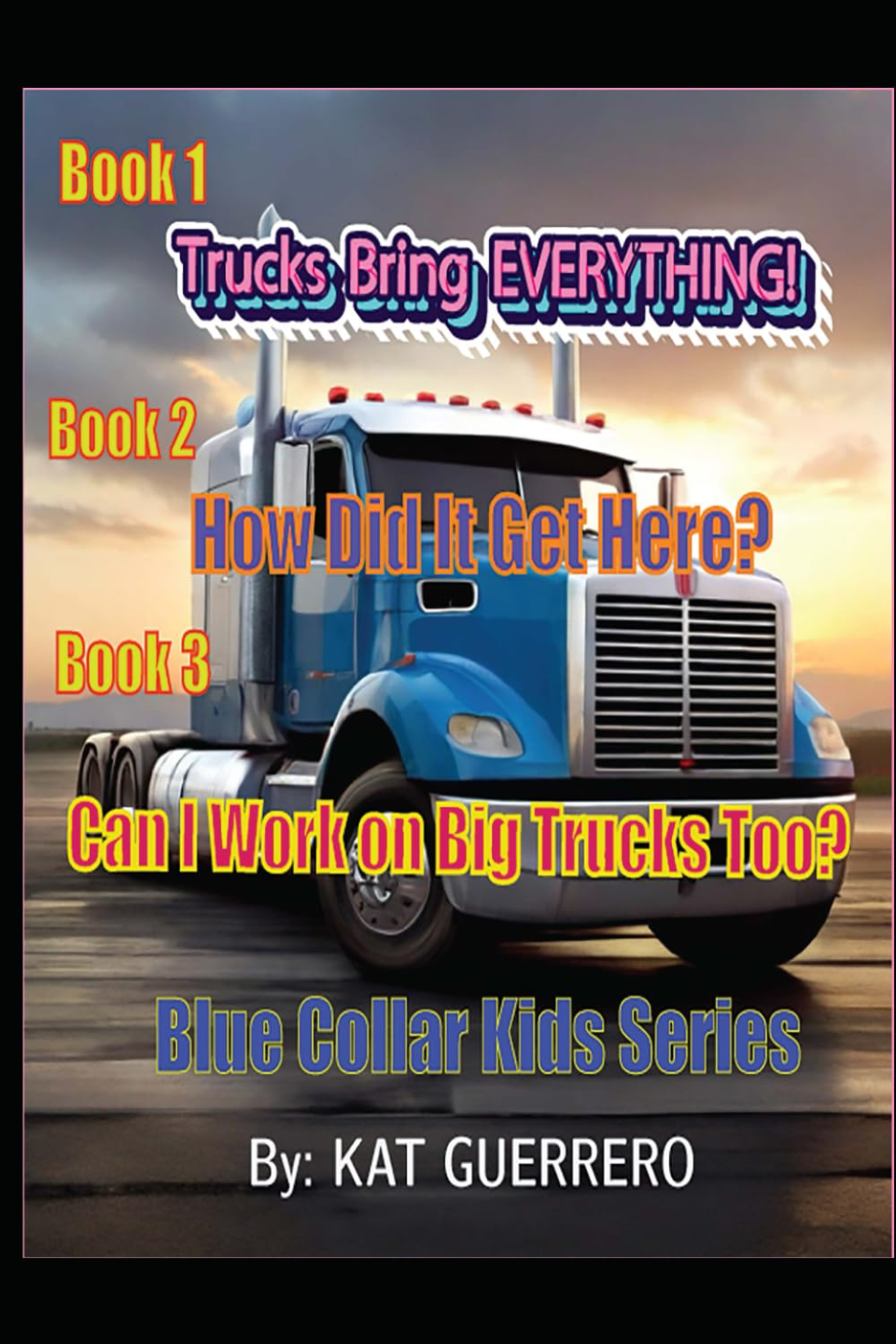

It’s a children’s book series — showing kids how the vast array of merchandise in the stores and online has to be transported somehow, usually on a truck.

But that’s not the only rationale behind the “Blue Collar Kids” series. It’s the brainchild of Kat Guerrero, who works at the truck supplier RIHM Kenworth in the Twin Cities. As she figures, it’s great to encourage teenagers to “learn a trade” — but why not start earlier?

"I started thinking about younger just to expose them to the trucking industry," she tells WCCO-TV.

To be sure, there’s a certain amount of self-interest at work here: There’s already a trucker shortage — about 80,000 nationwide per the American Journal of Transportation — and it’s forecast to double by 2030.

![]() Mailbag: What’s This “Fiscal Dominance” Thing?

Mailbag: What’s This “Fiscal Dominance” Thing?

“Lots of good material,” a reader writes after Tuesday’s edition.

“Lots of good material,” a reader writes after Tuesday’s edition.

“Biden and his people seem to ‘come around’ to mainstream positions or declarations of positions when elections are six months or less away — witness the border chatter. Assuming he wins, expect all this to go away or face insurmountable challenges post election.

“Red Sea troubles would not have existed in colonial times. The world powers would mow down any opposition in these smaller, weaker countries.

“Didn't Reagan propose a constitutional amendment to ban deficit spending? I remember seeing a political cartoon (remember those?) back then showing a staggering Reagan holding a jug of ‘Ol' Deficit’ and slurring ‘They should make this stuff illegal.’”

Dave: Reagan came into office in 1981 promising to balance the budget by 1984 — a promise he abandoned even before 1982. He then backed a balanced-budget amendment during his first term. It passed the Senate, but failed in the House.

Reagan’s all-hat, no-cattle approach to fiscal discipline was such that his budget director David Stockman quit early during his second term.

As Stockman wrote in his 2013 book The Great Deformation, “The Reaganite legend begins with the false proposition that the Reagan administration stopped the march of ‘Big Government’ and brought a new fiscal restraint to Washington.

“Yet after the economy had rebounded and recession-bloated spending had subsided during Reagan’s second term, federal outlays averaged 21.7% of gross domestic product (GDP). That was obviously no improvement at all on the 21.1% of GDP average during the alleged ‘big spending’ Carter years, and compared quite miserably to the 19.3% of GDP recorded during Lyndon Johnson’s final four years of ‘guns and butter’ extravagance.”

“I really enjoyed the Whiskey Bar discussion at the Watergate Hotel,” writes an appreciative reader. “It was very informative.”

“I really enjoyed the Whiskey Bar discussion at the Watergate Hotel,” writes an appreciative reader. “It was very informative.”

“I was wondering if you could repeat/expand on a comment made during that discussion?

“The comment was that inflation was less a result of Fed monetary policy and more a result of government overspending.

“Thanks again for all the great content and the truly excellent Whiskey Bar discussion.”

Dave responds: Sure. It’s called “fiscal dominance” — in the sense that fiscal policy by the White House and Congress overwhelms monetary policy by the Fed.

That’s what we’ve got now: COVID grew the size of the federal budget by one-third, permanently. The government is spending and borrowing so much these days, it swamps the Fed’s ability to move the economy via interest rates and the money supply.

That is, if the inflation rate starts to take off again, the Fed might be powerless to raise interest rates in response — because that would jack up Uncle Sam’s interest expense so much that the bond market would break.

Colleague Sean Ring did a fine breakdown of fiscal dominance last week for The Daily Reckoning. If you ever wondered why the Fed’s mad money printing after the 2008 financial crisis didn’t lead to massive consumer price inflation… while the COVID stimulus did… here’s a good place to start.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets