The End of Affordability

![]() Two Little Charts and the End of Affordability

Two Little Charts and the End of Affordability

“The American Dream is that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement.”

“The American Dream is that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement.”

So wrote the historian James Truslow Adams during the Great Depression in 1931.

It’s Adams who’s usually credited with popularizing the term “American Dream” in his book The Epic of America.

“It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position.”

In yesterday’s edition, we explored how too many people now feel locked out from that dream — even as the media yammer about a “strong economy.” As it turns out, economic statistics don’t hold up in the face of many people’s lived experience.

But why? What went wrong?

But why? What went wrong?

During the long stretch from the end of World War II until the turn of the 21st century, the American Dream still seemed attainable for all.

Everyone willing to put in an honest day’s work was able to achieve a more prosperous life. And by and large they did, no matter the income level where they started.

“A rising tide lifts all boats,” as the saying goes.

But the tide started going out for many people as the calendar turned to 2000 and the dot-com bust set in.

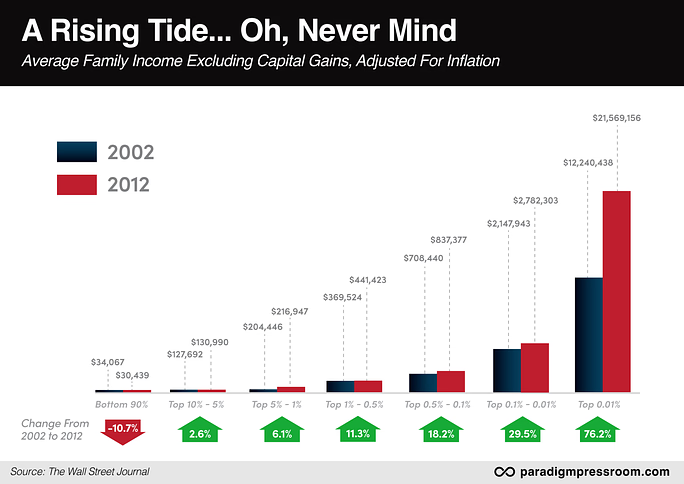

Take a good hard look at the chart below; you can click to enlarge. It came to my attention over a decade ago thanks to Marc Faber, editor of the renowned Gloom, Boom and Doom Report.

“If I were to look at the average family income, excluding capital gains, adjusted for inflation between 2002–2012, it is clear that 90% of these families experienced a decline in real income and another 5% experienced hardly any gains.”

“In fact,” he went on, “it is shocking that only 0.1% of families achieved substantial gains in real incomes. Yet I find it hard to believe that it is because of these 0.1% that the rest of the population suffered.”

Instead, Faber laid the blame where it belongs — at the feet of the Federal Reserve.

Instead, Faber laid the blame where it belongs — at the feet of the Federal Reserve.

“The Fed's monetary policies have failed to boost the real incomes of most people but have had an enormously favorable impact on just 0.1%...

"In fact, I would argue that the Fed is fully responsible for the fact that 90% of U.S. families have had declining real incomes (inflation adjusted) over the last 10 years or so (as money printing raised the prices of energy, food, education, transportation, health care, insurance, etc.) and have experienced a decline in their net worth. After all, it was the Fed that repeatedly and deliberately created and continues to create bubbles, which benefit only a minority, while hurting the majority."

Yes, the chart is over a decade old. Your editor has searched high and low for something more recent. But really, do you think matters have gotten any better?

One of the economists who compiled the chart published a paper on the same general theme, updated through 2022.

His conclusion is that the upheaval wrought by the government’s reaction to COVID made the income disparity even worse than it was before — stimmy checks notwithstanding.

From 2019–2022, the bottom 99% saw their after-inflation incomes grow by 1.0% — compared with the top 1%, who enjoyed 16.1% growth.

“Hence,” wrote UC-Berkeley economist Emmanuel Saez, “top 1% families captured 81% of total real income growth per family” during that four-year span.

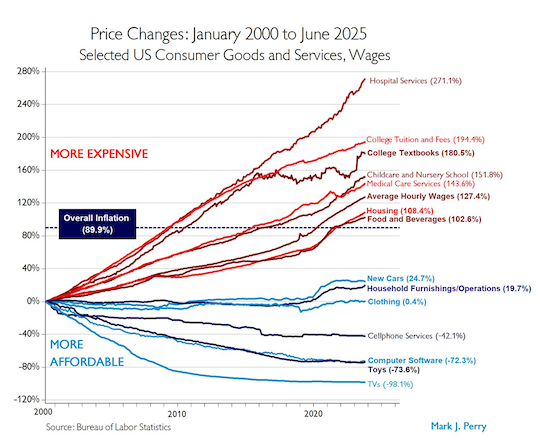

There’s a second chart that helps tell the rest of the story.

There’s a second chart that helps tell the rest of the story.

Since 2006 or so, economist Mark Perry from the American Enterprise Institute has published what’s become known to his followers as the “Chart of the Century.”

His most recent update was only six months ago. It speaks for itself…

Look at what tops the list. Health care and higher education — the two things that government has subsidized the most… mucked up the most… and made ever more inaccessible to the middle class.

Health care spending in the United States now totals nearly $15,000 per person per year — by far the highest in the world, 61% higher than No. 2 Switzerland. For those lucky enough to have insurance, premiums rise at a pace far outstripping the official inflation rate. (If you’re a W2 employee, you probably noticed a meaningful hit to your first paycheck of the year.)

Meanwhile, the promise of higher ed — go deep into debt so you can achieve a higher standard of living than you would without the sheepskin — rings hollow to an entire generation of young adults.

And so the American Dream feels ever more out of reach: Here are the depressing results from a Wall Street Journal-NORC survey conducted last summer.

- Only 25% of Americans believe they have “a good chance of improving their standard of living” — an all-time low in data going back to 1987

- Nearly 70% believe hard work does not translate to getting ahead — a low in 15 years of survey data

- And most revealing… Over 75% doubt that children today will live a better life than their parents.

Is it any wonder the U.S. fertility rate has hit historic lows?

We’ll leave it there for today. As it happens, we have inflation numbers to tackle next…

![]() Markets Today: Inflation, Earnings, Small-Biz Sentiment

Markets Today: Inflation, Earnings, Small-Biz Sentiment

Both earnings season and economic numbers are coming into view as we approach midmonth.

Both earnings season and economic numbers are coming into view as we approach midmonth.

The Labor Department released the December consumer price index this morning. The official inflation rate held steady at 2.7%. The big drivers were shelter, groceries and meals out (oh, and health care); prices for gasoline fell, as did used vehicles.

As always, any relationship between the official number and your own cost of living is purely coincidental.

Meanwhile, JPMorgan Chase started earnings season on a sour note. The headline numbers beat analyst expectations, but revenue from investment banking fees missed expectations badly. With that, JPM is down 2.8% on the day.

Amid those cross-currents, the S&P 500 rests at 6,962 — down less than a quarter percent from yesterday’s record close.

As for precious metals, gold is holding onto yesterday’s gains — inching higher into record territory, now over $4,600. And silver’s rocket ride still isn’t over — up $3.26 as we write to $88.40.

Crypto is hanging tough, with Bitcoin at $93,577 and Ethereum at $3,189.

Small-business owners feel sanguine going into 2026 — if the Small Business Optimism Index from the National Federation of Independent Business is any indication.

Small-business owners feel sanguine going into 2026 — if the Small Business Optimism Index from the National Federation of Independent Business is any indication.

The headline number for December rings in at 99.5 — up from 99.0 the month before and the highest reading in four months. It’s also above the long-term average for this survey, which the NFIB has conducted for over 50 years.

“While Main Street business owners remain concerned about taxes, they anticipate favorable economic conditions in 2026 due to waning cost pressures, easing labor challenges and an increase in capital investments,” says NFIB chief economist Bill Dunkelberg.

On the portion of the survey where owners are asked to identify their single most important problem, taxes have rocketed higher.

In the November survey, taxes were in third place — cited by 14% of respondents. But in December, taxes zoomed all the way up to No. 1, cited by 20% — the highest since May 2021. And “quality of labor” is still up there, with 19% saying their biggest problem is finding qualified help.

Inflation was cited by 12% and poor sales by 10%. Everything else was in single digits.

![]() “I’m From the Government and I’m Here to Help”

“I’m From the Government and I’m Here to Help”

The proverbial “geopolitical tensions” appear to be pushing oil prices over $61 for the first time in two months.

The proverbial “geopolitical tensions” appear to be pushing oil prices over $61 for the first time in two months.

Last night, Donald Trump declared that “Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America.”

So… the trade truce with China is off? The 50% tariff on India goes to 75%?

China is Iran’s biggest trading partner. India is no slouch. Turkey and the United Arab Emirates are also major trade partners with Iran.

This isn’t the first time, but it’s now apparent that Trump tariffs are not aimed exclusively at “leveling the playing field” when it comes to trade, nor raising revenue for a cash-strapped federal government.

“They are sanctions by another name,” tweets Daniel McAdams, executive director of the Ron Paul Institute.

At midmorning today, Trump upped the ante — posting a message on social media addressed to protesters in Iran: “Help is on the way.”

At midmorning today, Trump upped the ante — posting a message on social media addressed to protesters in Iran: “Help is on the way.”

And you thought the U.S. bombing of Iran’s nuclear energy facilities last summer was a one-and-done, right?

At the end of last year, Israeli Prime Minister Benjamin Netanyahu paid another call on the White House and Trump moved the goalposts: Iran’s ballistic missiles became a potential casus belli.

Now it seems the issue is anti-government protests — which, according to The Jerusalem Post, are being ginned up by Mossad agents inside Iran.

Tempting as it might be to dismiss Trump’s statements as bluster, the U.S. State Department is urging all dual U.S.-Iranian citizens to leave Iran now. “Have a plan for departing Iran that does not rely on U.S. government help,” says its advisory.

And we haven’t even gotten to Venezuela yet. That’ll have to wait till tomorrow…

![]() Thought for the Day

Thought for the Day

Along the lines of today’s Bullet No. 1…

Along the lines of today’s Bullet No. 1…

![]() Mailbag: Who We Are and What We’re All About

Mailbag: Who We Are and What We’re All About

“Thank you for sharing information about Paradigm Press and what it entails,” a reader writes after last week’s “Who We Are and What We’re All About” edition.

“Thank you for sharing information about Paradigm Press and what it entails,” a reader writes after last week’s “Who We Are and What We’re All About” edition.

“Although I’ve been a long-time subscriber, it was refreshing to read. I've also subscribed to…

[Here we’ll redact the names of several competitors…]

“Based on my experience, Paradigm Press stands out as the best among them. The high quality of service, friendly customer support team and transparency about products are quite unique.”

“The 5 Bullets on your philosophy has me pondering the past five years,” writes a reflective reader.

“The 5 Bullets on your philosophy has me pondering the past five years,” writes a reflective reader.

“Most of my life was paycheck to paycheck. Then (age 70) I inherited enough to invest $15,000.

“Admittedly, I am an investment advisory ‘fan.’ Over five years I have spent over $35,000 on various investment services. Here is the joy of it all: By studying, the portfolio is up to $135,000.

“Paradigm Press is my favorite right now. Why?

- This national and international climate is the realm of Jim Rickards. Presidential decisions have a particularly powerful impact on the markets. Jim and the team sift through the noise and give readers the ‘signal.’ It saves time, and sanity. With investing, it creates a wide perspective in time and space. [We are thinking in terms of decades, and of every nation on the planet.] Peace and plan come with perspective.

Jim always recommended gold. In this world, gold is truly ‘shining.’ Gold, silver and many minerals are shining. Gold is the everything hedge.

- Reliable information is rare and priceless. Elon Musk risked a lot to take a stand for free speech. Jim Rickards, and team, take that freedom and publish truth and insights. Every person who is well informed radiates a light of truth that protects the whole world. The value of truth blesses everyone on the planet: all nations and generations to come. What a joy to be a part of knowledge!

An educated populace makes ‘democracy’ work!

- Beyond the perspective on investment trends, and the knowledge on current events, for its own value, Paradigm Press completes a lot of research on companies. A lot of research. Some speculative plays are for a week or a month, some investments develop over years. The time frames are reasonably clear in the discussions.

“Yes, 2025 was a bull year. One theme at the Nashville conference was to ‘make the profits, and KEEP them.’ Investors will need to be savvy in the days ahead!

“Another note. We give 10% to our worship community. That provides a certain detachment, and a deep enthusiasm for earning. It gives us a sober awareness of the preciousness of resources.

“Thank you all, for all you do. You are a ‘motley’ crew, presenting facets of the diamond of the investment picture. Thank you for the enthusiasm you bring to this adventure.

“Blessings for 2026.”

Dave responds: Thank you for your kind note.

As I said last week, we don’t want customers — we want happy customers. Glad we can oblige — although we take nothing for granted and we know trust has to be earned anew every day.

“I look forward to the 5 Bullets probably more than the subscriptions that I have!” says another reader. “Keep up the good work.”

“I look forward to the 5 Bullets probably more than the subscriptions that I have!” says another reader. “Keep up the good work.”

“I love your stuff,” says another. “This is the only email where I learn what is truly going on in our country and the world. Thank you for your direct and honest writings!”

Dave: Thank you, sir. However, I’ve long warned that this e-letter is only part of a balanced informational diet!

Along those lines… it’s getting so much harder to separate the news from the noise anymore — even for an old-school journalist like myself.

Sometime in the weeks ahead I hope to devote an entire issue to why that’s the case — and what we can do about it to remain an informed citizenry. Stay tuned…