The Growing ESG Goon Squad

- Help wanted: The mining industry’s massive PR nightmare

- “FOMO latches onto our lizard brains”

- EU strivers try to regulate ESG ratings

- Kenya’s president urges Africa to scrap the USD

- A “Magic” match made in video-game heaven.

![]() The “Filthy” Job No One Wants

The “Filthy” Job No One Wants

“Last year, four U.K. universities… banned mining firms from recruiting on campus and attending career fairs,” says an article at The Wall Street Journal.

“Last year, four U.K. universities… banned mining firms from recruiting on campus and attending career fairs,” says an article at The Wall Street Journal.

It’s “part of a broader trend of college graduates and young workers turning their backs on extractive industries that they fear harm the planet.” A few examples…

- A 2023 global survey from consulting firm McKinsey finds 70% of respondents between ages 15–30 say they probably or definitely would not work in the mining industry

- There were 25% fewer earth sciences and geology graduates in the U.S. circa 2020 compared with 2015… even as the number of overall college graduates increased 8% during that time

- “The people we have in the industry now are typically older and closer to retirement,” says CEO Rohitesh Dhawan of the International Council on Mining and Metals; in fact, more than 50% of U.S. mine workers are 45 years of age or older.

The upshot: “Companies that mine copper, lithium and other metals — viewed as a critical part of the supply chain to produce green energy — say they are struggling to find enough young workers to support the transition,” says WSJ.

In short, the mining industry has a major PR problem.

In short, the mining industry has a major PR problem.

One simple change, according to Paradigm’s geologist and mining expert Byron King, is the nomenclature… Yep, he’s in the “critical minerals” industry now!

(Byron happens to be at a mining conference in Toronto this week. “Don’t hate me,” he said via Slack yesterday — in what, I can only assume, is his knee-jerk response to, well, jerks who would question his attendance at a mining conference! “I’ll have much more to share next week,” Byron promises, and we’ll be sure to pass that along to our readers.)

“As soon as you realize mining is essential, the most important thing is to get involved,” says 24-year-old geology student Lily Dickson of University of Leeds.

“It’s exciting — working on things like a European source of cobalt. That’s something which could actually be beneficial to society.”

Essential, yes. Beneficial? Well, yes and no…

“If there is a way to extract natural resources from Mother Earth that everyone agrees is safe, ethical, sustainable and worthwhile, then nobody has presented it as of yet,” says Paradigm’s small-cap stock authority Ray Blanco.

“If there is a way to extract natural resources from Mother Earth that everyone agrees is safe, ethical, sustainable and worthwhile, then nobody has presented it as of yet,” says Paradigm’s small-cap stock authority Ray Blanco.

Back to our young geologist Ms. Dickson’s point: “A majority of known cobalt deposits exist within the forests of Congo,” Ray says.

“Deforestation and intense infrastructure is required for the mining process… To say nothing of the human rights issues within these mines, such as forced labor and child labor.”

On the other hand, Ray points out: “A 2020 study suggests using deep-sea mining as an alternative to terrestrial mining would reduce emissions for cobalt by 29%, nickel by 80%, copper by 76% and manganese by 22%.”

Underwater mining might also solve another problem: “The demand for cobalt alone is projected to exceed land deposits four times over by 2050.

“Deep-sea mining is a relatively energy-efficient process,” Ray adds, “considering that polymetallic nodules occur above the surface of the ocean floor.

“Deep-sea mining is a relatively energy-efficient process,” Ray adds, “considering that polymetallic nodules occur above the surface of the ocean floor.

“Dark gray lumps of metal, roughly the size and shape of large potatoes — polymetallic nodules consist of high concentrations of nickel, cobalt, manganese and copper.

Source: Wikipedia

Source: Wikipedia

“These metal-rich rocks litter much of the ocean floor,” says Ray, “making the ‘mining’ process more like retrieval than conventional mining. Another argument in favor of the process? Transportation via ship is far more efficient than any method on land.

“The campaign to reduce carbon dioxide emissions worldwide must also be factored in,” he says, “when the materials required to produce clean energy solutions simply cannot be mined on land.”

For now, Ray concludes: “The concerns surrounding potential impacts of deep-sea mining are both legitimate and significant. More research and testing needs to be done.” (Which is precisely why we need more young geology students… not fewer!)

“The processes we use to mine these metals on land, however, also have steep costs,” he concedes, “and mining the oceans might be a significant improvement in many ways.”

![]() “One of the Most Powerful Forces in the Market”

“One of the Most Powerful Forces in the Market”

“When conditions are just right, FOMO latches onto our lizard brains,” says Paradigm’s chart hound Greg Guenthner.

“When conditions are just right, FOMO latches onto our lizard brains,” says Paradigm’s chart hound Greg Guenthner.

“It’s not only retail investors getting ‘dragged’ into this rally,” he adds. “The pros are also getting sucked back into stocks. Fund managers who missed the earlier stages of the rally that began in January are significantly lagging their benchmarks.

“The Big Tech Nasdaq-100 has already gained 35%-plus year-to-date!” Greg notes. “If you’re managing money and you’ve been twiddling your thumbs worrying about elevated valuations in this group, your job might be in jeopardy.

“Now that the herd is backing up the truck and pushing many market-leading stocks to new 52-week highs…

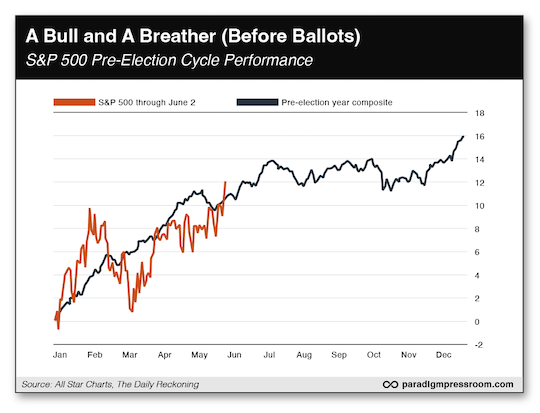

“We should take a moment to see how the S&P fares during a typical pre-election year,” says Greg.

“We should take a moment to see how the S&P fares during a typical pre-election year,” says Greg.

“Here’s a look at the S&P 500’s year-to-date performance, overlaid with a typical pre-election year:

“A couple of key takeaways from this comparison…

“First, don’t get too hung up on the S&P’s performance perfectly mirroring the pre-election year composite. The trend is what counts. And so far this year, it’s closely followed a typical pre-election cycle,” Greg says.

“Next, take a look at how the composite behaves at the end of the second quarter. In a pre-election year, the S&P typically tops out at the end of June and remains in a range until an end-of-year push in November–December.

“Will the market follow the blueprint this year?” Greg wonders. “I doubt it will match up perfectly. But the composite does give us a general idea of what we could expect as this rally matures.”

The market today? Going into this afternoon’s big announcement from the Federal Reserve, the S&P 500 and Nasdaq are both up about 0.40% to 4,385 and 13,635 respectively, but the Big Board’s lost roughly 0.25% to 34,120. (We’ll follow up on the Fed tomorrow, of course.)

Turning to the commodities complex, oil’s been cut down 0.60% to $68.98 for a barrel of WTI. Contrastingly, gold’s gained 0.55% to $1,969.40 per ounce; at the same time, silver’s up 1%, over $24.

And crypto’s treading water: Bitcoin’s just under $26K and Ethereum’s taking a breather at $1,740.

![]() EU Strives to Regulate ESG Ratings

EU Strives to Regulate ESG Ratings

“The European Union on Tuesday proposed new regulations for firms selling environmental, social and governance (ESG) ratings,” Reuters reports.

“The European Union on Tuesday proposed new regulations for firms selling environmental, social and governance (ESG) ratings,” Reuters reports.

“According to the EU's draft legislation, providers” — including Moody’s, S&P Global and Morningstar’s Sustainalytics — “must stop providing consulting services to investors, the sale of credit ratings and the development of benchmarks among other things, to avoid potential conflicts of interest.”

“ESG ratings agencies that score companies on governance factors are completely unregulated so it's very difficult to compare ratings by different agencies,” says Mairead McGuinness, European commissioner for financial services.

“We have no clarity on how these ratings are reached and there appears to be conflict of interests. We want them [ratings] to be reliable and comparable.”

Heh, she’s a card…

For now, ESG-ratings providers will need “to be authorized and supervised by the European Securities and Markets Authority (ESMA),” Reuters says, “and breaching the new rules could land them with a fine of up to 10% of their annual net turnover.”

![]() UPDATE: The U.S. Dollar Loses Ground In Africa

UPDATE: The U.S. Dollar Loses Ground In Africa

On Tuesday, Kenya’s President Ruto called on African nations to dump the U.S. dollar for the settlement of intracontinental trade.

On Tuesday, Kenya’s President Ruto called on African nations to dump the U.S. dollar for the settlement of intracontinental trade.

For some context, we reported how Kenya’s government declared war on citizens hoarding U.S. dollars as a hedge against the devaluation of the Kenyan shilling. The government even issued an “invitation” for Kenyans to cash in their dollars.

At the time, Jim Rickards pointed out the “invitation” was more, like, kinda compulsory — “the government will either seize the dollars or make them non-convertible in the near future,” Jim said.

And President Ruto’s remarks supported Jim’s thesis, when the president told his countrymen in March: “You better do what you must do because this market is going to be different in a couple of weeks.”

A “couple of weeks” later…

“During his recent address at the Djibouti parliament, President Ruto highlighted the need to abandon reliance on the U.S. dollar for trade transactions between Djibouti and Kenya,” says Today News Africa.

“President Ruto emphasized that the African Export–Import Bank (Afreximbank) has provided a mechanism that enables traders within the continent to engage in trade using their respective local currencies.”

We won’t even get into the stability (or instability) of local African currencies today; suffice it to say, the march toward de-dollarization continues.

![]() Television Walked… So Gaming Could Run

Television Walked… So Gaming Could Run

Next-level “product placement”: Food brands, restaurant chains and even luxury brands are marketing products to gamers.

Next-level “product placement”: Food brands, restaurant chains and even luxury brands are marketing products to gamers.

The marketing evolution into the video game industry seems organic enough, the next phase post-television, wherein everything from the evening news to your favorite sitcom has been the “filler” between commercials.

(It seems reasonable enough, too, seeing as the gaming industry will be worth almost $385 billion in 2023; to give you an idea, that exceeds the combined market cap of all North American sports plus the global movie industry.)

“With the entirety of Generation Alpha (the cohort succeeding Gen Z) predicted to partake in gaming,” Food & Wine says, “brands are testing the landscape with their millennial and Gen Z audiences.”

For instance, founder of Tripleclix, marketing guru Chris Erb, says of his agency: “We find a game that best fits with the product’s target audience and make sure they offer consumers the best experience and value possible.”

Perhaps not since peanut butter and jelly has there been a more brilliant pairing than this…

Perhaps not since peanut butter and jelly has there been a more brilliant pairing than this…

“Hot Pockets changed their packaging from their iconic red to the five main colors from Magic the Gathering,” says Food & Wine. “Hot Pockets also released an exclusive ‘Pizza of the Veil’ black box filled with bonus content (and Hot Pockets, of course) available exclusively at Walmart.”

Courtesy: Twitter

Courtesy: Twitter

C’mon! Hot Pockets, gaming… and Walmart?!

But if your tastes are on the more sophisticated side, in honor of Porsche’s 75th birthday, the German automaker has designed 75 Xbox Series X consoles to give away to lucky sweepstakes winners (Heh, meaningfully, no purchase necessary.)

Courtesy: porschexboxsweepstakes.com

Courtesy: porschexboxsweepstakes.com

Wait, did we say “sophisticated”? Looks as if a circus had one too many Hot Pockets…

Take care! And we’ll be back tomorrow with another round of 5 Bullets.