Vance Vision

![]() Four Pillars of Trump’s AI Strategy

Four Pillars of Trump’s AI Strategy

Earlier this week, Vance addressed the Paris AI Action Summit. His speech was a clarion call for embracing AI’s potential rather than fearing its disruption.

Earlier this week, Vance addressed the Paris AI Action Summit. His speech was a clarion call for embracing AI’s potential rather than fearing its disruption.

Vance, in fact, articulated a pro-innovation stance that stands in stark contrast to the cautious approach of previous administrations and European counterparts.

“We refuse to view AI as a purely disruptive technology that will inevitably automate away our labor force,” he declared, painting a picture of AI as a tool for empowerment rather than displacement.

This perspective dovetails with the Trump administration’s broader economic vision, emphasizing American prosperity and technological leadership.

The Vice President’s words resonated with attendees as he outlined a future where AI enhances rather than replaces human labor.

“The most immediate applications of AI almost all involve supplementing, not replacing, the work being done by Americans,” Vance said, offering a reassuring message to workers concerned about job security in an increasingly automated world.

Vance’s speech also highlighted the administration's commitment to fostering an environment of unfettered innovation.

Vance’s speech also highlighted the administration's commitment to fostering an environment of unfettered innovation.

“To restrict its development now would not only unfairly benefit incumbents in the space, it would mean paralyzing one of the most promising technologies we have seen in generations,” said Vance.

This stance signals a clear departure from regulatory approaches favored by some European nations as well as the Biden administration.

Instead, the Trump administration’s AI strategy, as outlined by Vance, focuses on several key pillars:

- Innovation-first approach

- Deregulation to foster growth

- Protection of free speech

- Support for American workers.

This policy direction has sent ripples through the tech industry, with many experts predicting a potential boom for AI stocks.

In terms of AI, Paradigm’s AI expert, James Altucher, wrote a seminal white paper on the subject when he was a student at Carnegie Mellon University in the 1980s. This week, given a nationwide platform, James weighed in on Vance’s Paris speech.

“Vance knows that regulation slows down innovation,” said James, during a Fox News interview on Tuesday.

“Vance knows that regulation slows down innovation,” said James, during a Fox News interview on Tuesday.

“When [Vance] arrived in Europe,” James continues, “they tried to get him to sign a document [making] AI as inclusive and safe as possible. Which are great-sounding words. But who actually defines what those words mean? Some government bureaucrats. And they’re not going to be as smart or as savvy as the people actually building AI.

Source: Fox News

“Believe me, China will have no regulations slowing them down,” he notes. “If we want to be first [in this AI race], we can either choose ourselves or China. No regulation is the way to choose ourselves.

“Either we’re going to be the leader in AI,” James concludes, “or we’re going to be at the mercy of whoever is the leader in AI.”

[Before we move on today: James Altucher points out a little-known government document… which reveals TRILLIONS of dollars in financial transactions… that have been quietly taking place on Wall Street for weeks.

A document that’s responsible for some of the most explosive tech-and-AI stock gains in recent memory. “Yet almost NO ONE is talking about this besides me,” says James.

“But I believe this will mark the beginning of a new paradigm shift in the stock market. And you’ll want to be ready for the release of big news TODAY.”]

The Trump administration’s approach could unleash a wave in the AI sector, potentially leading to groundbreaking advancements and economic growth.

The Trump administration’s approach could unleash a wave in the AI sector, potentially leading to groundbreaking advancements and economic growth.

And the Vice President’s Paris address marks a significant shift in global AI-policy dialogue. By rejecting the caution that has guided much of European AI regulation, the White House is positioning the United States as a haven for AI innovation and development.

As the world grapples with the implications of rapid AI advancement, the U.S. stance articulated by Vance offers a bold vision for a future where AI and human workers coexist and thrive together.

This optimistic outlook — coupled with the administration’s commitment to deregulation — could usher in an era of technological progress and economic prosperity.

As Vance’s words echo through the halls of power and innovation hubs worldwide, the promise of AI-driven growth looms on the horizon, offering tantalizing possibilities for investors, workers and society at large.

While challenges remain, the Trump administration’s embrace of AI as a force for positive change sets the stage for an exciting chapter in technological history.

![]() Inflation’s Sticky Situation

Inflation’s Sticky Situation

The 5-year breakeven inflation rate is considered a more reliable indicator than the consumer price index (CPI).

The 5-year breakeven inflation rate is considered a more reliable indicator than the consumer price index (CPI).

Not to get too technical, but this inflation indicator is derived by calculating the difference between the yield on a 5-year nominal Treasury security and the yield on a 5-year Treasury Inflation-Protected Security.

In short: This rate represents what market participants expect the average annual inflation to be over the next five years.

- Historically, the 5-year breakeven inflation rate has fluctuated significantly, with a record high of 3.59% in March 2022 and a record low of -2.24% in November 2008

- The current level — 2.64% as of Feb. 13 — while not at historical extremes, remains well above the long-term average of 1.94%.

This market-based indicator, consistently above 2% since late 2024, challenges the Fed’s ability to bring price increases back to its 2% goal anytime soon.

According to the U.S. Census Bureau, month-over-month U.S. retail sales fell by 0.9% in January, a sharper decline than the anticipated 0.2%. In fact, this was the largest monthly drop since March 2023.

According to the U.S. Census Bureau, month-over-month U.S. retail sales fell by 0.9% in January, a sharper decline than the anticipated 0.2%. In fact, this was the largest monthly drop since March 2023.

Some notable findings? Auto dealers saw a 2.8% decrease in sales, while online retail, typically a strong sector, experienced a 1.9% decline.

The sharp drop in retail sales suggests the almighty American consumer might be tapped out. Given that consumer spending accounts for approximately two-thirds of U.S. economic activity, we can safely forecast a slowdown in economic growth for the first quarter of 2025.

Checking on Mr. Market today: Well, he’s struggling. At the time of writing, the S&P 500 index and the tech-heavy Nasdaq — at 6,115 and 19,950 respectively — are barely hanging onto green. Meanwhile, the DJIA is down 0.25% to 44,600.

Checking on Mr. Market today: Well, he’s struggling. At the time of writing, the S&P 500 index and the tech-heavy Nasdaq — at 6,115 and 19,950 respectively — are barely hanging onto green. Meanwhile, the DJIA is down 0.25% to 44,600.

Likewise, commodities are getting clobbered today, with one exception. Oil is down 0.70% to $70.80 for a barrel of West Texas Intermediate. And the price of gold is down almost 1% to $2,916.80 per ounce. Silver, however, is up 1.10%, over $33.

As for the crypto market, Bitcoin’s up 0.60% to $96,750 while Ethereum is up an impressive 2.75% to $2,730.

![]() When NOT to “Stick” to Success

When NOT to “Stick” to Success

“Here’s an important question every investor should consider: What should I do when a popular stock goes parabolic?” asks Paradigm’s chart hound Greg Guenthner.

“Here’s an important question every investor should consider: What should I do when a popular stock goes parabolic?” asks Paradigm’s chart hound Greg Guenthner.

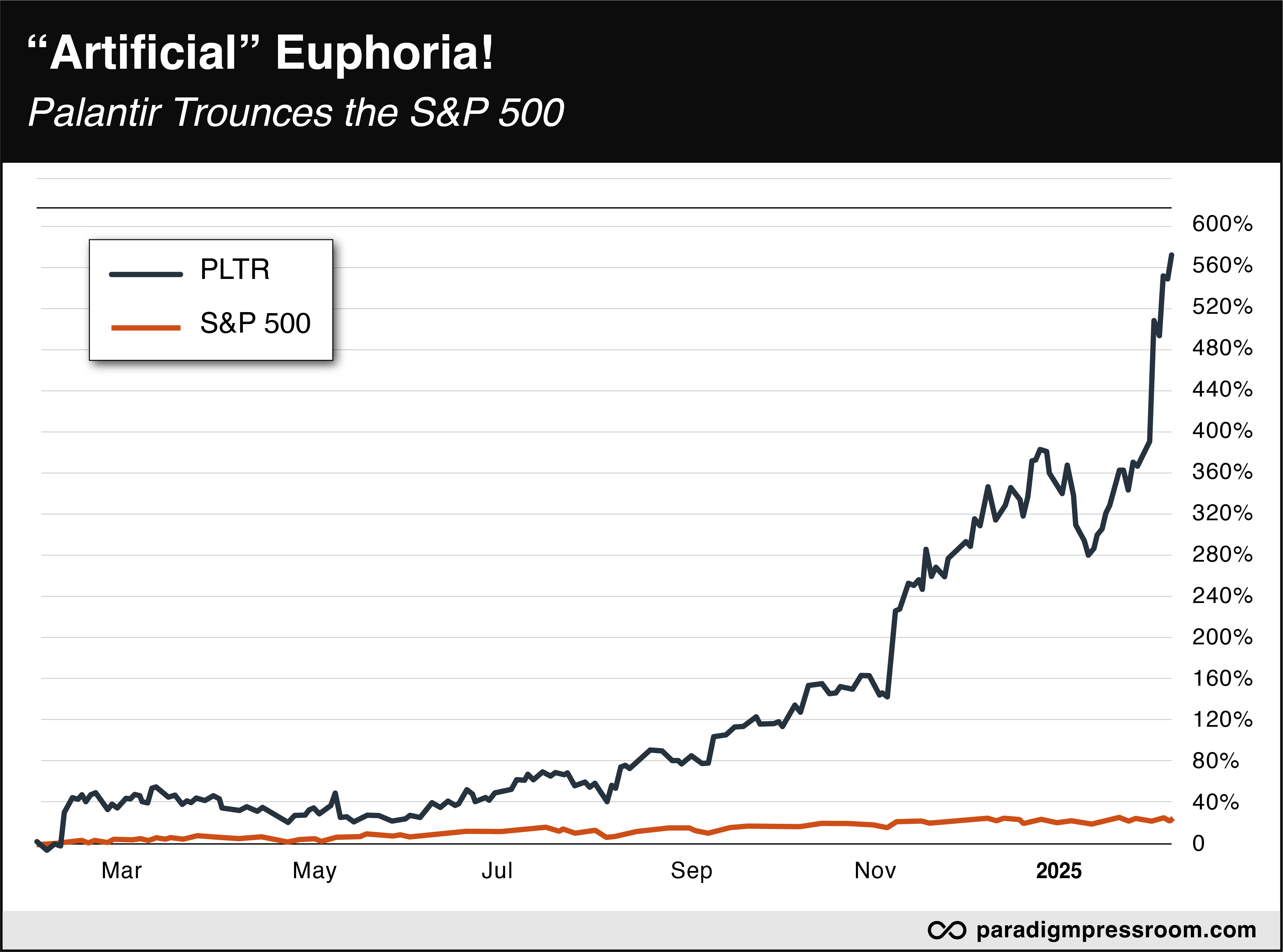

“Today, I’m going to focus on Palantir (PLTR) and its aforementioned 25% earnings rally as a real-world, real-time example of what happens when a hot stock starts to defy gravity,” Greg says.

“PLTR is an intelligence/AI/software mega-play that has been marching higher for the better part of the past 12 months. Most investors can’t seem to articulate exactly what the company does or how it does it, but that hasn’t stopped the herd from running with the bulls.

“PLTR finished 2024 with a gain of nearly 350%, thanks mostly to a fourth-quarter surge that has carried over to the new calendar year. Investors were then treated to an incredible 25% earnings gap last week after the company dropped strong numbers and guidance.

“The one-day move was a marvel to behold. Here we have a stock that had already doubled since its previous earnings report, only to once again appease the animal spirits and leap to new highs.

“But it wasn’t done yet! Instead of attempting to fill its earnings gap (or even rest, for that matter), PLTR continued to rise double-digits since last week’s earnings report, closing at another round of all-time highs Monday afternoon.

“PLTR shares are now up more than 50% year to date, and more than 360% year over year, easily cementing it as one of the most popular stocks on the market today.

“PLTR’s abrupt move that began in January is what folks in the charting world call a hockey stick — a parabolic rally wherein a stock shoots higher in a nearly vertical ascent, forming the namesake shape,” Greg adds.

“PLTR’s abrupt move that began in January is what folks in the charting world call a hockey stick — a parabolic rally wherein a stock shoots higher in a nearly vertical ascent, forming the namesake shape,” Greg adds.

“Obviously, PLTR is overbought following its latest earnings rally,” he continues. “PLTR is expensive by any metric. But it was expensive coming into the year before this latest rally, too. AI has its evangelists and naysayers — and the narrative will evolve no matter what happens to this one specific stock.

“From a purely tactical perspective,” Greg continues, “it’s difficult to imagine a situation where PLTR doubles again before experiencing some sort of dramatic pullback.

- “If I were involved with PLTR, I would take at least partial profits

- And if I were stalking this name, I would not want to start a new position at these levels.

“I’m interested to see how parabolic moves in popular stocks like PLTR affect the market over the next several weeks,” says Greg. “While I’m not officially worried about a broad market drawdown just yet, I am keeping my antennae up for any signs of exhaustion.

“Would a momentum reset in PLTR lead to a bigger market correction? Will we finally see that elusive 10% pullback investors have avoided for the past 16 months?

“These are the questions you should keep in mind as these popular momentum stocks gap higher and run nearly every single day. Right now, the averages are challenging all-time highs and investors are being rewarded for buying the dips.”

Greg warns, however: “Eventually, the hockey sticks will break.”

![]() UPDATE: The AI Power Crunch

UPDATE: The AI Power Crunch

In our ongoing coverage of the AI-driven energy pinch, Google underscores the severity of the grid capacity crisis facing the U.S. — especially in light of the AI race against China.

In our ongoing coverage of the AI-driven energy pinch, Google underscores the severity of the grid capacity crisis facing the U.S. — especially in light of the AI race against China.

This issue has come to the forefront since China’s DeepSeek caused a significant drop in major energy firms’ stock prices in late January due to speculation about DeepSeek’s more energy-efficient AI model.

“We are in an AI race against China right now,” says Caroline Golin, Google’s global leader for energy market development, “[and] we are in a capacity crisis in this country right now.”

That said, four years ago, Google initiated an ambitious plan to operate entirely on carbon-free renewable energy. But according to Golin, Google faced insufficient capacity to support their data centers, leading the tech company to consider nuclear energy as a viable alternative.

In October, Google announced a deal to purchase 500 megawatts of power, using Kairos Power’s small modular nuclear reactors (SMRs).

These advanced designs promise faster deployment of nuclear power due to their smaller footprints and streamlined manufacturing. The first reactor is planned for deployment in 2030, with additional units coming online through 2035.

The U.S. power capacity crisis, highlighted by Google’s concerns about infrastructure for AI development, provides critical context for Vice President Vance’s AI optimism. It underlines the need for innovation not only in AI technology, but also in cost-effective energy solutions.

![]() Nothing Says “I Love You”...

Nothing Says “I Love You”...

…like a reservation at Waffle House?!?

…like a reservation at Waffle House?!?

This Valentine’s Day, Waffle House is serving up romance. Over 200 locations across 22 states are dimming the lights, breaking out the fancy tablecloths and transforming into the hottest date-night spot in town.

Courtesy: Waffle House

For one night only, these 24/7 diners will trade their “always open” policy for an exclusive “reservation required” experience.

The tradition began in Johns Creek, Georgia, where a manager decided to sprinkle some amore into the usual greasy-spoon fare. Now, couples can gaze lovingly into each other’s eyes over a plate of scattered, smothered or covered hash browns.

So if you're looking to impress (er, depress?) your sweetheart without breaking the bank, Waffle House has got you covered. Just be sure to make your reservation between 9 a.m. and 5 p.m. local time.

After all, in these inflationary times, there’s no better (er, cheaper?) way to say, “Be my Valentine.”

Have a wonderful weekend! Check your inbox on Monday — Presidents’ Day — for a special guest essay… We’ll be back to our regularly scheduled format on Tuesday.

Happy Valentine’s Day,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets