When Will Gold Break Out?

- What’s holding back gold?

- Are stocks really slumping on “rate concerns”?

- Most banks are doing the thing that sank SVB

- Inflation: Krugman beclowns himself

- “Going cashless” exacts a toll.

![]() What’s Holding Back Gold?

What’s Holding Back Gold?

It was 12 years ago this week when the dollar price of gold soared to an all-time high — just over $1,900.

It was 12 years ago this week when the dollar price of gold soared to an all-time high — just over $1,900.

Checking our screens this morning, it’s… $1,922.

To be sure, gold has poked its nose above $2,000 three times since 2020 — but for the moment at least, $2,000 looks like the ceiling.

This morning we revisit a question we first explored in early 2022: Why isn’t the gold price jumping amid persistent inflation? Why isn’t gold fulfilling its role as an inflation hedge?

Explanations abound: Crypto is the new hotness for people looking to escape fiat currencies. The dollar remains strong relative to other major fiat currencies. Rising interest rates mean you can finally get a respectable yield on cash savings — which makes no-yield gold less attractive.

The simpler explanation is the one we proffered 19 months ago, and it continues to hold up: Gold languishes when the stock market performs well. And vice versa.

The simpler explanation is the one we proffered 19 months ago, and it continues to hold up: Gold languishes when the stock market performs well. And vice versa.

Understand, we’re not talking about small time frames here, weeks or months. We’re talking decades.

True, it’s been only 52 years since “the dollar price of gold” became a changeable thing. But it’s enough time for us to draw some broad-brush conclusions.

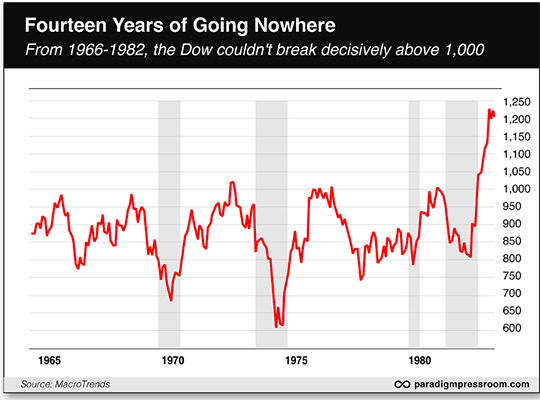

We begin following the breadcrumbs in 1966 — the year the Dow industrials hit the 1,000 level for the first time.

We begin following the breadcrumbs in 1966 — the year the Dow industrials hit the 1,000 level for the first time.

That level proved to be a powerful ceiling. The Dow reached 1,000 several more times throughout the late 1960s and 1970s… but it wasn’t until 1982 that the Dow left 1,000 behind for good…

Now… If you know a little bit of monetary history, you know the gold price in the late ’60s was fixed at $35 an ounce under the Bretton Woods Agreement of 1944.

But savvy people around the world already suspected the United States would be unable to keep that $35 “peg” forever. They saw the massive spending for the Vietnam War and President Johnson’s Great Society programs… and they knew sooner or later, something would have to give.

But savvy people around the world already suspected the United States would be unable to keep that $35 “peg” forever. They saw the massive spending for the Vietnam War and President Johnson’s Great Society programs… and they knew sooner or later, something would have to give.

And so stresses were already appearing in financial markets — stresses that suggested the real gold price was something more than $35. The failure of the “London Gold Pool” in March 1968 — a long story beyond our scope today — was a warning light flashing bright red.

President Nixon’s decision to “close the gold window” in August 1971 was an acknowledgment that $35 gold was a fiction.

As stocks languished throughout the ’70s, gold was the go-to asset.

It climbed past $100 in 1973… $200 in 1978… and $300 in 1979.

Late 1979 brought a full-on panic out of the U.S. dollar — an episode we’ve recounted more than once — which propelled gold past $800 on Jan. 21, 1980.

So we’re talking about a lengthy stretch of time when stocks went nowhere and gold soared. Then came the 1980s and ’90s — and a role reversal.

So we’re talking about a lengthy stretch of time when stocks went nowhere and gold soared. Then came the 1980s and ’90s — and a role reversal.

Gold sank into the doldrums after that blowoff top in early 1980… bottoming near $250 in mid-1999.

Meanwhile, stocks began an epic bull market in mid-1982 — again, the Dow leaving 1,000 behind for good — climaxing with the dot-com bubble in 1999 and early 2000.

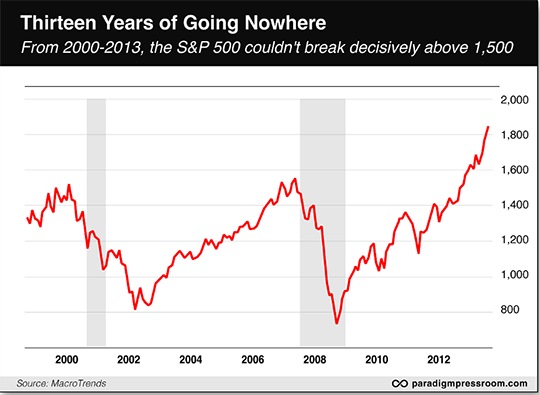

The turn of the 21st century marked the end of the bull market in stocks… and the start of a new bull market in gold.

The turn of the 21st century marked the end of the bull market in stocks… and the start of a new bull market in gold.

From that $250 bottom, gold recovered the $400 level in 2003… $600 in 2006… and finally surpassed the 1980 high of $800 in 2007.

But gold wasn’t done. It pulled back briefly during the 2008 financial crisis, only to soar past $1,000 in 2009… $1,500 in early 2011… climaxing just over $1,900 on Sept. 5, 2011.

Meanwhile, the 2000s were another decade where stocks went more or less nowhere. Here, the high-water mark was 1,500 on the S&P 500. Yes, the index surpassed that level briefly in 2007… but it wasn’t until April 2013 that the old highs were left behind for good.

Now we’re starting to see a discernable pattern: Gold puts in a blowoff top roughly two years — give or take six months — before the stock market leaves behind its old highs forever.

Now we’re starting to see a discernable pattern: Gold puts in a blowoff top roughly two years — give or take six months — before the stock market leaves behind its old highs forever.

Gold sank from those $1,900 highs in 2011… bottoming in late 2015 around $1,050 (our Jim Rickards called that bottom nearly to the day with the help of commodity investing legend Jim Rogers)... climbing steadily to around $2,050 in August 2020. But again, it hasn’t been able to break through since.

Meanwhile, the stock market climbed to one new high after another during the 2010s — the S&P 500 finally topping out near 4,800 on the first trading day of 2022.

Yes, we’re working with a somewhat limited data set… but we can tentatively conclude the start of the next bull market in gold will coincide with a long-term stock market top.

Yes, we’re working with a somewhat limited data set… but we can tentatively conclude the start of the next bull market in gold will coincide with a long-term stock market top.

Hmmm… The stock market has struggled for a year and eight months to reclaim that early 2022 record of 4,800 on the S&P. The closest it got was just under 4,600 at the end of July.

The longer that struggle continues, the more likely it is we’re in for another “lost decade” in stocks… which would be extremely bullish for gold.

Let’s quickly spin a plausible scenario…

- The economy sinks into recession late this year or early next.

- The stock market swoons toward its October 2022 lows of 3,600 on the S&P.

- Now under those circumstances, the gold price will fall short-term — it always does during a stock market panic because leveraged players on Wall Street need to raise cash to meet their margin calls, and selling gold is an easy way to raise that cash.

- But when the Federal Reserve pivots to interest rate cuts and “quantitative easing” to combat the recession... that will light a fire under gold.

You can choose to load up on gold now… or you can choose to wait a bit for this scenario to unfold, if it strikes you as credible and you’d prefer to buy at lower prices than today.

Either way, you’ll want to source your gold from our friends at Hard Assets Alliance. They’ve been doing right by our customers for over a decade with reliable service and some of the lowest premiums in the industry. We like them so much that our firm bought a stake in Hard Assets Alliance in 2020. (As such, Paradigm Press will collect a small cut once you fund your account.) You can get started with Hard Assets Alliance at this link.

![]() Are Stocks Really Slumping Because of “Rate Concerns”?

Are Stocks Really Slumping Because of “Rate Concerns”?

Mainstream financial media have settled on an especially vapid narrative to explain the stock market’s sub-par performance this week.

Mainstream financial media have settled on an especially vapid narrative to explain the stock market’s sub-par performance this week.

CNBC’s take on Wednesday afternoon — and this is typical — was mounting concerns that “the Federal Reserve may not be done hiking interest rates.”

See, there were some minor economic numbers on Wednesday and Thursday — minor enough we didn’t even bother with them — that suggested the economy is still strong enough that the Fed will raise rates one more time before the end of the year.

For one thing, the Fed already said back in June it would raise rates twice more this year — and one of those increases came in July. Why should one more be a surprise? For another thing, futures traders still peg the odds of one more increase at under 50%. So why should that be dragging the market down?

An equally likely explanation: Apple took a blow this week when news broke that the Chinese government is ordering its employees to stop using iPhones at work. Meanwhile Nvidia took a blow when news broke that its much-touted AI chips might underperform a new offering from Intel.

When the biggest company in the world and the buzziest company of 2023 are hit with bad news simultaneously, it’s bound to cast a pall over the rest of the market.

And in any event, the market is on track to end the week down all of 2.7% from its year-to-date high set at the end of July. We have yet to experience a garden-variety 5% pullback this year.

And in any event, the market is on track to end the week down all of 2.7% from its year-to-date high set at the end of July. We have yet to experience a garden-variety 5% pullback this year.

At last check, the S&P 500 is up 0.4% on the day to 4,468. The Nasdaq is up a little more, the Dow is up a little less. Bond yields are easing a bit, the 10-year Treasury at 4.22%.

Gold, as noted earlier, is at $1,922 — little moved on the day. Silver oscillates around the $23 level. Crude is on track to end the week at a 10-month high, $87.70.

![]() The Thing That Took Down SVB? Most Banks Are Doing It

The Thing That Took Down SVB? Most Banks Are Doing It

We now have academic proof of Jim Rickards’ assertion that the crisis in the banks will get cranked up again, likely as soon as this autumn.

We now have academic proof of Jim Rickards’ assertion that the crisis in the banks will get cranked up again, likely as soon as this autumn.

Recall what took down Silicon Valley Bank six months ago: Rising interest rates were hurting the value of the bonds on its books.

It would have been trivially easy for SVB management to hedge that risk with financial instruments called interest rate swaps — but no, that would have cut into their profit margins.

Thus, when SVB got into a cash crunch — depositors earning next to nothing on their savings and fleeing to money market funds — they had to sell their bonds at fire-sale prices and that was the end of SVB.

Now a quartet of researchers from USC, Northwestern, Columbia and Stanford have published a paper revealing that “over three quarters of all reporting banks report no material use of interest rate swaps.”

In other words, managers at the bulk of U.S. banks are making the same mistakes as SVB. That’s no guarantee they’ll meet the same fate as SVB… but it does increase the risk.

In other words, managers at the bulk of U.S. banks are making the same mistakes as SVB. That’s no guarantee they’ll meet the same fate as SVB… but it does increase the risk.

“Banks with the most fragile funding — i.e., those with highest uninsured leverage — sold or reduced their hedges during the monetary tightening,” says the paper. “This allowed them to record accounting profits but exposed them to further rate increases. These actions are reminiscent of classic gambling for resurrection: if interest rates had decreased, equity would have reaped the profits, but if rates increased, then debtors and the FDIC would absorb the losses.”

Write Pam Martens and Russ Martens at Wall Street on Parade: “The use of the phrase ‘classic gambling’ to describe 75% of the U.S. banking system by highly credentialed academics might be something that the U.S. Senate Banking Committee might want to hold a hearing about with some sense of urgency.”

Yeah, we’re not holding our breath. Based on Jim Rickards’ timeline, expect to hear about a bank that’s in trouble later this month or maybe October.

![]() Inflation: Krugman Beclowns Himself

Inflation: Krugman Beclowns Himself

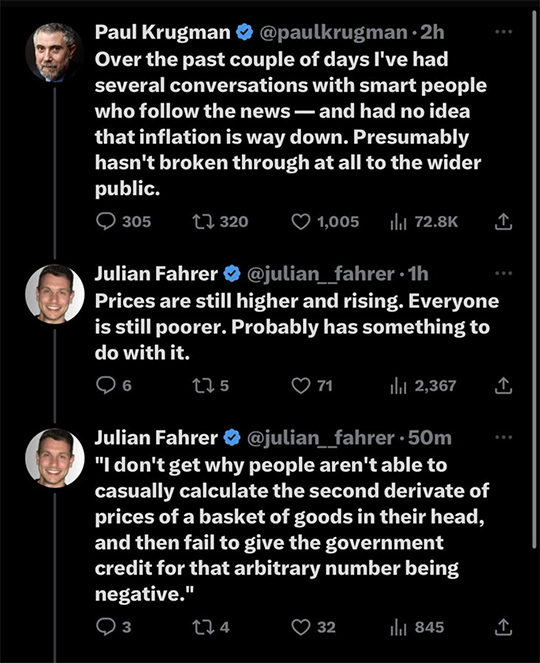

From the same celebrity economist who said the internet’s economic impact would be “no greater than the fax machine’s”…

From the same celebrity economist who said the internet’s economic impact would be “no greater than the fax machine’s”…

Heh. Hat tip to Bitcoin evangelist Dylan LeClair for posting that on Xwitter… and colleague Sean Ring at The Rude Awakening for spotting it.

- Random: Y’know, Sean and I have been colleagues for two and a half years — and we have yet to meet face to face. We’ll remedy that next month when we meet up for the Paradigm Shift Summit in Las Vegas on Oct. 3. Sorry to say, all available seats are full now — but we’ll probably share some video highlights toward the end of the year.

![]() Going Cashless Costs Money

Going Cashless Costs Money

“Where have they been?” a reader writes after seeing the mailbag in Tuesday’s edition — and all the folks who say they’ll refuse to patronize businesses that go cashless.

“Where have they been?” a reader writes after seeing the mailbag in Tuesday’s edition — and all the folks who say they’ll refuse to patronize businesses that go cashless.

“If you purchase gasoline from Sam's or Costco, cash is not an option. Been that way for years. Additionally, toll roads are or are going cashless. Florida has generally gone to a cashless toll and Kansas will be there in 2024. Sports is also going cashless. Want to park at the stadium? No cash accepted. Same for admission to the game and concessions. Cashless is already here; they just don't know it.

“Also would be interested in how much state toll roads lose by going cashless and billing those who do not have accounts. Would think this would be greater than the cost of using cash.

“Enjoy what you do.”

Dave responds: The Pennsylvania Turnpike — where Dallas Cowboys coach Mike McCarthy worked off season while he was a grad assistant at Pitt long ago — has had no human toll collectors since 2020.

The transition to all-electronic was supposed to conclude in late 2021, but the onset of COVID and Pennsylvania’s stay-home orders accelerated the timeline by a year and a half. If you don’t have an E-ZPass, cameras snap your license plate and send you a bill.

Last year, the state performed an audit. “Tolls remain uncollected for a variety of reasons: invoices go unpaid, license plates are unidentifiable and PennDOT has an incorrect address or none at all,” reported the York Daily Record. “The audit found that $104 million remains as uncollected revenue for fiscal years 2020 and 2021…

“The percentage of unpaid transactions is 6–7%, which is what the commission monitors as it collects revenue, he said. The dollar amount owed continues to rise because of the toll hikes and increasing traffic volume.”

The Turnpike did squeeze some extra revenue out of your editor during 2021, when I rented a car for two trips through the Keystone State. I have an E-ZPass and I took it with me — linking the E-ZPass to the rental car license plate number to ensure I’d be charged the lowest rate possible.

Unbeknownst to me, however, my E-ZPass was dying. Sure enough the cameras snapped the plate and the toll ended up tacked onto the car rental bill — at the higher rate for non-E-ZPass drivers.

The amount of money lost wasn’t worth the amount of time it would have taken to straighten out that mess — if it were even possible. Enjoy your extra few bucks, Pennsylvania Turnpike Authority!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets