Crypto’s Make-or-Break Moment

![]() Crypto’s Make-or-Break Moment

Crypto’s Make-or-Break Moment

History shows that now is a dicey time for crypto as an asset class.

History shows that now is a dicey time for crypto as an asset class.

It’s been just over a month since the Bitcoin price peaked near $126,000. This morning, it’s at $106,451 after bouncing off the $100K level a few days ago.

In the 17-year history of crypto, there’s been a reliable cycle that goes something like this…

- A Bitcoin “halving” occurs. From its launch, Bitcoin was programmed so that every four years, give or take, the rewards from Bitcoin mining are cut in half

- The crypto market peaks, typically about 15–18 months after the halving

- The crypto market sinks — and not by a little.

With the aid of the Perplexity AI engine, here’s a table demonstrating how this cycle plays out in the price of Bitcoin…

Ominous, huh?

Time to take profits?

For your editor, this is not a hypothetical question. My wife and I have encountered some unexpected expenses, and we’d just as soon not raid our emergency fund. We’re sitting on some modest crypto profits — enough that if we sold, we’d have the liquidity cushion we desire without a major tax hit.

It feels as if now is a make-or-break moment. Sell now? Or “hodl” for four more years?

Four of the most dangerous words in all of investing are “This time is different.” But Paradigm’s AI and crypto authority James Altucher makes a compelling case that a dramatic sell-off is not in the cards…

For one thing, Wall Street is embracing crypto in a way it was not four years ago.

For one thing, Wall Street is embracing crypto in a way it was not four years ago.

James reminds us of something mentioned briefly in our Oct. 24 edition: “JPMorgan Chase is planning to allow large professional investors to use Bitcoin and Ethereum as collateral for loans by year's end.

“This is massive news. Not long ago, CEO Jamie Dimon called Bitcoin a ‘hyped-up fraud.’

“Now his bank is treating it like gold or stocks. This means large investors can borrow against their crypto instead of selling it when they need cash.”

Elsewhere, “Morgan Stanley plans to allow E*Trade customers access to cryptocurrencies beginning next year. Other financial firms like State Street, Bank of New York Mellon and Fidelity are setting up services to securely store cryptocurrency on behalf of customers.

“Wall Street firms that once mocked crypto are now lining up to get a piece of the action.”

Then there’s a development we mentioned a few days ago — Western Union launching stablecoins.

Then there’s a development we mentioned a few days ago — Western Union launching stablecoins.

“Western Union is a global giant in money transfers, moving over $100 billion annually,” says James. “When a big company like Western Union starts using crypto, it shows that crypto is real and useful.

“Every year, more than $1 trillion is sent by workers to their families back home in other countries. These transactions are often expensive. It takes days for the money to arrive.

“Stablecoins have the potential to make these transactions cheap and nearly instantaneous.”

Really, Western Union sees the writing on the wall: Stablecoins are a profound threat to the company’s 20th-century business model. Adopting a stablecoin is the only way it will stay relevant.

Finally, there’s action in Congress — “partial government shutdown” notwithstanding.

Finally, there’s action in Congress — “partial government shutdown” notwithstanding.

“Last week,” says James, “industry leaders met with senior congressional leadership to talk about new rules for crypto. About a dozen executives, including Coinbase CEO Brian Armstrong, held nearly three hours of meetings with Democratic and Republican senators.

“The bill in discussion would allow banks, businesses and exchanges to provide cryptocurrency services with clear rules on what they can and cannot do.

“While this might seem obvious, it’s a major missing piece for the industry. Right now, the laws are not entirely clear, making things risky for banks and businesses.”

Passage has been slow in coming, but it’s likely next year. When that happens, “we could see a rally similar to what followed the passage of the stablecoin legislation earlier this year.”

So that’s what’s different from 2021… and 2017… and 2013. “The real story isn't in the day-to-day price swings,” James concludes. “It's in the steady march of adoption and support from major banks, global payment networks and government regulators.

“Each of these developments brings us closer to mainstream acceptance.”

![]() Kabuki Theater and a Risk-On Day

Kabuki Theater and a Risk-On Day

Stocks and precious metals are rallying in tandem after a weekend of dizzying developments in D.C.

Stocks and precious metals are rallying in tandem after a weekend of dizzying developments in D.C.

The one you’ve most likely heard about is that the end of the shutdown is in sight: Last night, a procedural vote took place — and eight Senate Democrats crossed the aisle for a filibuster-proof majority of 60.

It’s the first of several votes before the shutdown ends — the House has yet to return to Washington — but it’s the first progress since the shutdown began 41 days ago.

“Kabuki theater,” tweets our favorite political reporter Michael Tracey.

“Just enough Senate Dems bit the bullet to reopen the government (probably because of the airport problems affecting upper-middle class constituents) while also giving politically ambitious Dems an opportunity to rail against the Weak-Willed Party Establishment…

“They orchestrated it so that eight Dems without any upcoming re-election concerns could take the heat for the rest of the caucus, and get the airports functional.”

He has a point: Every Democratic “yea” vote came from a senator who will not face re-election next year — including Minority Whip Dick Durbin (D-Illinois), who’s retiring.

More’s the pity…

Perhaps on the theory that the uniparty’s mad spending spree is about to resume, pumping up assets, it’s a “risk-on” kind of day.

Perhaps on the theory that the uniparty’s mad spending spree is about to resume, pumping up assets, it’s a “risk-on” kind of day.

Among the major U.S. stock indexes, the Nasdaq is posting the biggest gains — up 1.45% at last check to 23,337. The S&P 500 is up more than three-quarters of a percent to 6,782. The Dow, on the other hand, is treading water at just over 47,000.

Meanwhile, gold has raced $90 higher to $4,089 — the highest in two weeks. And silver has soared $1.74 — back within 4 cents of the $50 handle.

(Congratulations are in order for PRO-level readers of Rickards’ Strategic Intelligence – who on Friday collected 325% gains playing call options on SLV, the big silver ETF.)

But bond traders are casting a vote of no-confidence in Uncle Sam’s debt, sending prices down and yields up: The yield on a 10-year Treasury note is back over 4.1%.

If it were just the prospect of Washington getting back to “business as usual,” that probably wouldn’t be enough to send the S&P up 1% and gold up nearly $100.

But there’s more. Read on…

![]() 50-Year Mortgages and Tariff Rebates

50-Year Mortgages and Tariff Rebates

Arguably it started Friday when the president insisted there’s no “affordability” problem in these United States.

Arguably it started Friday when the president insisted there’s no “affordability” problem in these United States.

“Our energy costs are way down. Our groceries are way down. Everything is way down. And the press doesn’t report it. So I don’t want to hear about the affordability. Because right now, we’re much less.”

We’ll leave aside the question of whether he’s right or wrong. You can evaluate his words in light of your own day-to-day experience.

But the perception among his advisers must have been that he put his foot in it. And so on Saturday, he posted the following on his Truth Social site…

This was subsequently confirmed by Federal Housing Finance Agency chief Bill Pulte: “Thanks to President Trump, we are indeed working on The 50 year Mortgage - a complete game changer.”

➢ In case you’re wondering: Yes, Pulte is a scion of the PulteGroup homebuilding family — grandson of founder William J. Pulte.

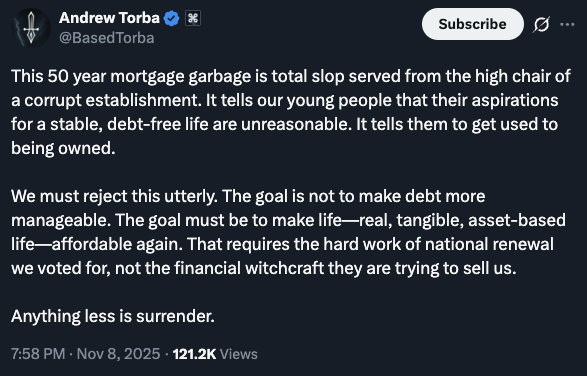

If the idea was to address the “affordability” problem in housing, it backfired spectacularly.

The reaction on social media was almost universally hostile — perhaps most of all among people who supported Trump in the 2024 election. As more than one observer pointed out, it’s the Trumpian version of “You’ll own nothing and be happy.”

Then again, it’s all good if you followed the guidance of several Paradigm editors and bought shares of Fannie Mae a while back: FNMA opened up 2.5% today.

Later on Saturday, Trump pivoted to a different “affordability” tack — defending his tariff regime and promising a tariff rebate of sorts.

Later on Saturday, Trump pivoted to a different “affordability” tack — defending his tariff regime and promising a tariff rebate of sorts.

“A dividend of at least $2000 a person (not including high income people!) will be paid to everyone.”

But then on the Sunday talk-show circuit, Treasury Secretary Scott Bessent tried to lower expectations. In fact, he said the rebate might already be a done deal in the form of tax breaks passed under the “One Big Beautiful Bill Act.”

“The $2,000 dividend could come in lots of forms, in lots of ways. It could be just the tax decreases that we are seeing on the president’s agenda — no tax on tips, no tax on overtime, no tax on Social Security — deductibility on auto loans.”

Quite the climb-down, no?

Also, contrary to what Bessent says, Social Security benefits are still subject to income tax. There is, however, a senior tax credit — which phases out at higher income levels and will expire once Trump’s term is over.

![]() Notes From New Orleans

Notes From New Orleans

What we’ve warned about for nearly two years is now mainstream.

What we’ve warned about for nearly two years is now mainstream.

“If one thing has become crystal clear from attending the New Orleans Investment Conference,” says Paradigm contributor Zach Scheidt, “it’s that energy is now the primary constraint for AI’s development.

“Microsoft CEO Satya Nadella said as much in an interview. According to Nadella, Microsoft can’t even plug in some of its AI chips because there’s simply not enough electricity to power all of the data centers being built.

“Which means the developed world can't afford to turn its nose up at ANY form of energy production. To realize AI’s full potential and vastly grow our economy, we need energy from fossil fuels, renewable sources and nuclear power.

“AI servers in data centers consume about 60% of these facilities' overall power draw.

“The International Energy Agency (IEA) estimates that data centers used about 415 terawatt hours or roughly 1.5% of global energy consumption last year. Consumption rates have grown at 12% per year over the past five years.

“But over the coming years, that rate is expected to increase substantially. By 2030, the IEA predicts data center power use will double as AI demand rises higher and higher.”

Zach is tracking the best-of-breed opportunities both in Altucher’s True Alpha and Rickards’ Insider Intel. Stay tuned…

Meanwhile, our Byron King’s takeaway from New Orleans is that the gold and silver boom is nowhere near over.

Meanwhile, our Byron King’s takeaway from New Orleans is that the gold and silver boom is nowhere near over.

The conference got its start in the 1970s with a precious metals focus, and Byron has attended regularly since the ’90s.

One speaker that caught his eye was Dana Samuelson from the American Gold Exchange, a 45-year veteran of the bullion business. “Globally,” Samuelson said, “there’s extraordinary demand for physical metal.

When it comes to silver, “Industrial use has soared in recent years due to electronics and solar panels. And this has created a structural supply deficit. Sure, there’s metal out there, but it comes from reserve stocks to make up a deficit in output from mines and refineries. And the price has risen to clear markets.”

Silver in the high-$40s-to-$50 range is “about right just now,” in Samuelson’s estimation – with low probability of a major pullback.

As for gold, Samuelson says central-bank demand will continue to put a floor under the price: “They dollar-cost average, but at the end of the day they want the gold.”

(You can see more of Byron’s notes from New Orleans here.)

![]() Mailbag: Appliances, Sales Tax

Mailbag: Appliances, Sales Tax

“I totally get it about the good old reliable appliances,” a reader writes as our thread about durability stretches into a new week.

“I totally get it about the good old reliable appliances,” a reader writes as our thread about durability stretches into a new week.

“I've gone through three dishwashers, three washers, two dryers, three refrigerators – and the one I have now, the ice maker broke within six months. I hired a repairman. It cost me $200-plus and it broke again in five weeks. They wanted me to pay again because it was past 30 days… LOL 😂.

“So I'm doing the ice cube 🧊 trays. They aren't made like the old ones.

“So I miss the Maytag man too.”

“Forget appliances — talk about a far larger purchase, cars,” writes one of our longtimers.

“Forget appliances — talk about a far larger purchase, cars,” writes one of our longtimers.

“Because of CAFE standards, car makers are forced to do all manner of things to hit ever higher MPG mandates. Unfortunately, many of the changes improving mileage are drastically reducing car life, particularly of the engines.

“Plastic engine parts instead of metal to save weight, lower-viscosity engine oil as low as 0/8 and low-friction low-compression piston rings, which score the cylinder walls and burn oil.

“Dodge had a huge engine recall due to using 0/20 in their trucks. If the engine wasn’t already ruined, their TSB said to switch the customer to 0/40 oil, thereby fixing the problem. One of the worst destroyers of engines is the auto engine shutoff every time you stop the car since 85% of engine wear occurs at start up.

“All of this done to stop CO2 pollution while increasing the number of cars that fail instead of lasting 25 years or more.”

Dave responds: Just intuitively, you know that automatic shutoff has to be hard on the starter, right? My wife finds it disorienting. And we’re both discovering the “joys” of it with a new Subaru Outback (which overall we’re fond of).

The bad news is that you have to proactively disable the automatic shutoff every time you start the car. The good news is that it can be done with one press on the touchscreen, so I’m making it part of the ritual each time I climb in.

On the subject of retailers rounding down their sale prices to the nearest nickel because of the penny shortage, a reader writes…

On the subject of retailers rounding down their sale prices to the nearest nickel because of the penny shortage, a reader writes…

“The suggestion that prices would be simply rounded up or down to the nearest nickel makes sense… except that isn't as simple as it sounds because of the effect of sales taxes.

“Say you have a $5.99 item that becomes $6. At an 8% sales tax, the final price is $6.48. Round that up, a final price of 6.50 means the $5.99 item must be priced at $6.02. The pennies are still there. :-)”

Dave responds: Good point. At the convenience store chain Kwik Trip — perhaps the highest-profile company to date to adopt the policy — it’s the final price that’s rounded down.

So a $5.99 item taxed at 5.5% in Eau Claire, Wisconsin (5% state, 0.5% local) would cost $6.32 if you pay with a credit card — but rounded down to $6.30 if you pay cash.

Near as I can tell, the taxman in Wisconsin and Minnesota still collects his full cut and it’s Kwik Trip that eats all the difference. Because the taxman always gets his, right?