Cuba’s Quality of Life, Coming to America

- Cuba’s present, America’s future

- How to make hay from a falling dollar

- RIP Yellow (and other miscellany)

- Accuracy, shmaccuracy

- Gold and the IRS

![]() Cuba’s Present, America’s Future

Cuba’s Present, America’s Future

“Vintage American cars still live at the heart of Havana,” says an unhelpful entry at Wikipedia called “Vintage automobiles in Cuba.”

“Vintage American cars still live at the heart of Havana,” says an unhelpful entry at Wikipedia called “Vintage automobiles in Cuba.”

“The cars run the gamut from mint condition to downright dilapidated,” says a more illuminating article at the website Anywhere Cuba.

“After the Cuban Revolution, the U.S. embargo was erected and Castro banned the importation of American cars and mechanical parts. That’s why Cuba is the way it is today — essentially a living museum for classic cars. The old American autos are often kept running with parts and pieces that were never intended for them.”

Not all vintage American cars in Cuba are as well-preserved as this 1953 Chevrolet 210 [Photo by Wikimedia Commons user Laslovarga]

Not all vintage American cars in Cuba are as well-preserved as this 1953 Chevrolet 210 [Photo by Wikimedia Commons user Laslovarga]

To be sure, there are other vehicles out there — to the extent anyone in Cuba can afford a car. “Of the cars imported since 1959, Russian-made Ladas are the most common. You’ll see these small, boxy cars everywhere you go. More recently, Chinese Geelys, Citroens and Nissans have entered the scene. The Geelys are a popular rental car, and you’ll see tourists driving them around most of Cuba.”

But it’s the presence of the old American vehicles — Chevys, Fords, Pontiacs, Buicks, Dodges, Plymouths, Studebakers — that make Cuba a unique relic on the surface of this pale blue dot.

Except that Americans face the fate of Cubans if new regulations proposed on Friday by the Biden administration come to pass.

Except that Americans face the fate of Cubans if new regulations proposed on Friday by the Biden administration come to pass.

The climate-change hustlers at the National Highway Traffic Safety Administration want to jack up fuel economy standards for model years 2027–32.

As it is, the automakers are required to achieve an average 49 miles a gallon across their fleet of light-duty cars and trucks by 2026. Beyond 2026, the number ramps up to 58.

“The agency’s proposal doesn’t mandate that automakers offer electric vehicles,” points out The Wall Street Journal, “but would likely force the industry to sharply increase EV sales in order to comply.”

These regulations more or less jibe with separate tailpipe-emissions rules issued by the EPA last spring — which the auto industry says would effectively require two-thirds of all new vehicles be electric by 2032.

At the moment, EVs account for only 7% of new U.S. auto sales.

The upshot of these rules is that new vehicles — of any type — will be less and less affordable for the duration of the Flaming Twenties.

The upshot of these rules is that new vehicles — of any type — will be less and less affordable for the duration of the Flaming Twenties.

As it is, the COVID lockdowns of 2020 have altered the availability of new vehicles for good.

In June of 2019, there were 3.8 million new vehicles either sitting on dealer lots or on their way there from the factory. Now? According to Wards Intelligence, fewer than 2 million.

Supply and demand have done their thing: The price of a new vehicle in June of 2019 was $33,741, according to J.D. Power. Now? $46,229.

Yes, EVs are becoming more affordable of late — down 30% from a year ago. But that’s mostly reversion to the mean after Russia invaded Ukraine, fuel prices soared and demand for EVs spiked.

EVs are still more expensive than comparable internal-combustion vehicles — and they’re especially costly if you want an SUV: Bigger vehicle, bigger battery, higher cost. That’s just physics.

But no matter: The administration is “nudging” Americans into EVs, like it or not.

If Americans want affordable transportation, many of us will have no choice but to keep our clunkers going for as long as possible — not unlike the Cubans.

If Americans want affordable transportation, many of us will have no choice but to keep our clunkers going for as long as possible — not unlike the Cubans.

The good news is that vehicles today are more durable than what you could get in the ‘50s. A contemporary car with a conventional engine can typically keep running up to 200,000 miles without resorting to chewing gum and baling wire. And parts should still be available, more or less.

But as it is, the average age of a passenger vehicle on U.S. roads is up to a record 12.5 years, according to S&P Global Mobility.

At the very least, expect that number to continue to grow as long as the climate-change grifters continue to control the regulatory levers.

And at the very worst… well, it’ll be a peculiar badge of honor in 2035 to be tooling around in a 2005 Chrysler PT Cruiser.

![]() How to Make Hay From a Falling Dollar

How to Make Hay From a Falling Dollar

The U.S. dollar begins a new week poised to resume its sharp drop of the last two months.

The U.S. dollar begins a new week poised to resume its sharp drop of the last two months.

The dollar index has rebounded in recent days to 101.6 — but the chart damage was done when it fell below 100 earlier this month. Nearly all of the Paradigm experts are in agreement that a further drop to 95 or even lower is in the cards.

On Wall Street, the perception — right or wrong — is that the Federal Reserve is done with its rate-raising cycle that began in March of last year. Under that circumstance, “international investors tend to look for currencies where they can get a better return,” says Paradigm income investing specialist Zach Scheidt.

“As this capital flows out of the U.S. dollar, the value of the greenback, compared with other currencies, is declining.”

“Two major categories of investments will do well as the U.S. dollar falls,” Zach goes on.

“Two major categories of investments will do well as the U.S. dollar falls,” Zach goes on.

Start with commodities: “Most commodities including gold, oil, industrial metals and agricultural commodities are priced in U.S. dollars. So as the value of the dollar drops, it naturally takes more dollars to buy an ounce of gold, a barrel of oil or a bushel of corn.

“So if you own these commodities, the dollar value of your holdings naturally increases as the dollar weakens.” Zach is particularly keen on gold right now.

The other beneficiary? Companies with international customers. “That's because when the U.S. dollar is weak, other currencies are comparatively stronger. So customers who hold euros, yen or other international currencies can better afford U.S. goods and services.

“This helps to drive stocks like Procter & Gamble (PG), Coca-Cola (KO) and Caterpillar (CAT) higher as international customers buy the products these blue chip companies produce.” [Disclosure: Zach has a CAT position in his personal portfolio.]

If inflation is going to rebound for the rest of this year — and that’s the way it’s shaping up even if Wall Street is still in denial — you need bigger investment gains to offset your rising cost of living. Commodity plays and multinational blue chips will go a long way toward that objective.

![]() RIP Yellow (and Other Market Miscellany)

RIP Yellow (and Other Market Miscellany)

The economic disruption will likely be minimal — but be that as it may, Yellow Corp. is effectively no more.

The economic disruption will likely be minimal — but be that as it may, Yellow Corp. is effectively no more.

The trucking firm shut down operations around midday yesterday; a bankruptcy filing is sure to follow. Yellow employed 30,000 people including 22,000 members of the Teamsters, moving “less than truckload” freight for Walmart and Home Depot, along with a host of smaller companies.

Yellow had been circling the bowl for weeks; a missed pension contribution earlier this month was a sure sign that its days were numbered. Most of Yellow’s customers saw the writing on the wall and already made alternative arrangements to get their goods from here to there.

The obituary in this morning’s Wall Street Journal attributes Yellow’s demise to “a string of mergers that left it saddled with debt and stalled by a standoff with the Teamsters union.”

Yep, the debt. It’s manageable when interest rates are low. But when they’re rising and your debt obligations roll over, resetting at a higher rate… too much debt can be fatal.

Yellow is perhaps the biggest victim to date… but it won’t be the last.

In the meantime, the looming Chapter 11 filing appears to be a signal for the “meme stock” crowd to pile into Yellow, much as it did before with Bed Bath & Beyond and Hertz. At last check, YELL shares are up 110% on the day.

Elsewhere, the most notable mover on our screens this morning is crude — once more at the highest level since mid-April.

Elsewhere, the most notable mover on our screens this morning is crude — once more at the highest level since mid-April.

A barrel of West Texas Intermediate is up 55 cents as we write, over $81. A little over a month ago, it was under $68. Gasoline prices are finally catching up; AAA pegs the national average today at $3.76, up 16 cents in just the last week. (In your editor’s neck of the woods, the jump is more like a quarter.)

As for stocks, all the major U.S. indexes are up between a tenth and a quarter of a percent. The S&P 500 sits at 4,588 — another high-water mark last seen in April 2022.

“It's clear that many investors completely missed the start of the rally back during the first half of the year and are doing anything in their power to catch up,” says Paradigm’s chart hound Greg Guenthner. [Greg’s Trading Desk readers rode that momentum to near triple-digit gains this morning playing options on Palantir Inc. — and in just one trading day!]

“But that doesn't mean the market will never see a red day. In fact, I'm guessing we'll get quite a few shakeouts in August -- maybe even an extended move lower that really scares the new bulls. That's always how it works.”

Precious metals are marching higher, gold at $1,966 and silver at $24.73.

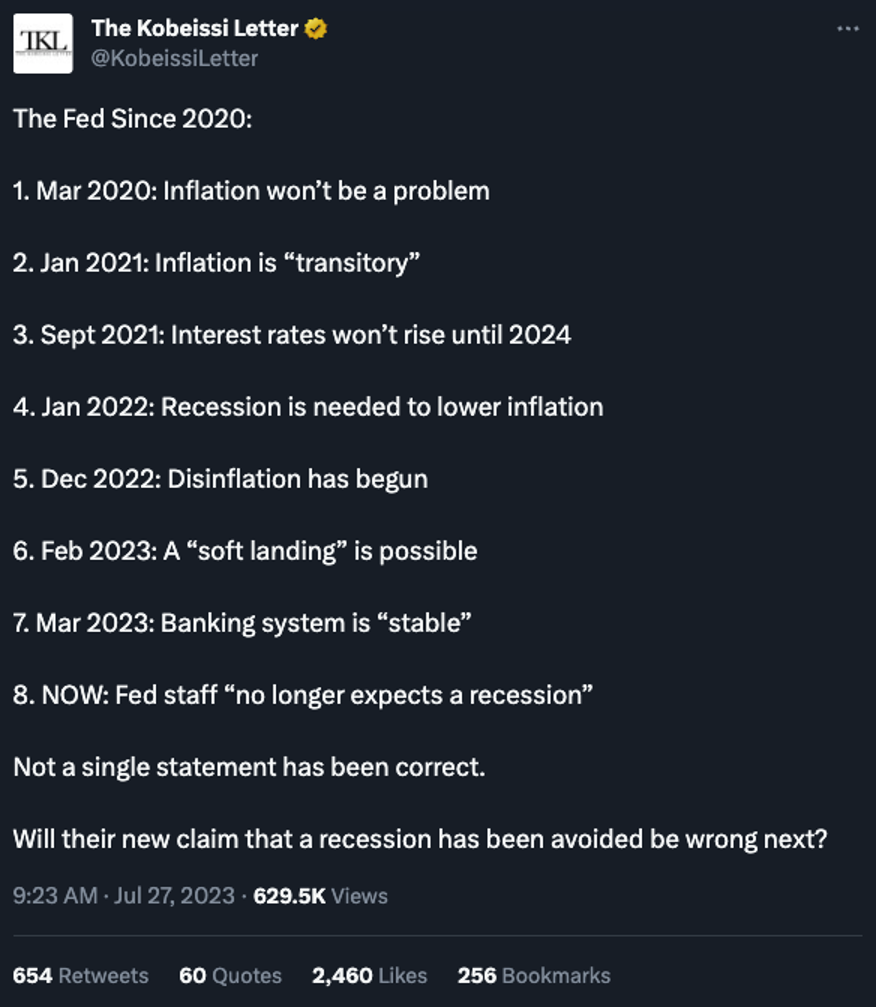

We won’t dwell on Federal Reserve policy today other than to point out…

We won’t dwell on Federal Reserve policy today other than to point out…

This is your friendly occasional reminder that another “partial government shutdown” is looming.

This is your friendly occasional reminder that another “partial government shutdown” is looming.

The U.S. House is now on its summer recess and won’t reconvene until Sept. 12. That leaves all of three weeks to pass a budget for fiscal year 2024 by Sept. 30, the end of fiscal 2023.

House Speaker Kevin McCarthy’s fractious and slender GOP majority is split over a proposal by the House Freedom Caucus to cut $115 billion in spending.

Even that amount — a mere 1.67% of the White House’s $6.9 trillion budget request! — is too much for the GOP’s so-called “cardinals” — the powerful subcommittee chairs on the Appropriations Committee.

“I won’t vote for them,” says Rep. Mike Simpson (R-Idaho), chair of the Interior-Environment subcommittee. According to Politico, that’s “an unheard-of threat from an old-school appropriator.”

Come October, here we go again: Shuttered national parks and all that. And at the end of the process the Republicans always look like the bad guys and cave. Good times…

![]() Accuracy, Shmaccuracy

Accuracy, Shmaccuracy

So a media company tried using AI to generate articles and they were riddled with mistakes. And management decided, “Screw it, we’re gonna keep doing it.”

So a media company tried using AI to generate articles and they were riddled with mistakes. And management decided, “Screw it, we’re gonna keep doing it.”

G/O Media is the name of the company owned by private-equity operators that in recent years acquired websites like The Onion, Gizmodo and Jezebel.

Earlier this month, G/O embarked on a “modest test” with AI-created articles. The first one was promoted as a “chronological list” of Star Wars movies and TV shows. It was out of chronological order and a couple of titles were missing altogether. Subsequent articles were also a hash.

In a memo to staff, Editorial Director Merrill Brown acknowledged that AI bots “alone (currently) are not factually reliable/consistent.”

But they’re just going to barrel ahead anyway: “It is utterly appropriate — and in fact our responsibility — to do all we can to develop AI initiatives relatively early in the evolution of the technology.”

The articles do come with a measure of disclosure that they’re AI generated — for instance, bylines like “Gizmodo Bot.” So at least you can exercise discretion in deciding whether what you’re reading is valid.

Anyway, you should probably have low expectations from an outfit called G/O. After all, those are the last two letters of an old saying among computer programmers. “GIGO: Garbage in, garbage out.”

![]() Gold and the IRS

Gold and the IRS

We heard from an alert reader after our “Truth About Gold IRAs” edition on Friday…

We heard from an alert reader after our “Truth About Gold IRAs” edition on Friday…

“One minor correction to your point that ‘because the IRS classifies [collector coins] as collectibles, [they] presumably would not be subject to confiscation.’

“As I understand it, the IRS also treats straight bullion (whether coins or bars) as collectibles for tax purposes, resulting in a higher maximum long-term capital gains rate of 28%.

“The argument that actual collector coins would be less likely to be confiscated than straight bullion is not without merit, supported by both a strong rational argument as well as precedent (the likes of collectibles and jewelry being exempted from the 1934 confiscation), but is unrelated to the IRS' treatment thereof for tax purposes.”

Dave responds: A fine distinction, but an important one. Thanks.

By the way, for anyone concerned about gold confiscation in the present era, there’s just not enough gold in private hands to make it worth the government’s while.

What’s more — and as Jim Rickards has explained more than once — gold confiscation in the 1930s did not entail sending G-men house-to-house. In fact, law-abiding folks for the most part didn’t even need to show up at the bank to exchange their gold coins for paper money. They’d already been conditioned over the previous couple of decades to use convenient “gold certificates” instead of coins.

A more likely threat Jim has identified over the years is a windfall profits tax on gold. But under the Constitution, any tax has to go through Congress first — so you’d have sufficient time to get ahead of any tax grab.

And if, in a truly dystopian scenario, a president chose to ignore such a basic procedural requirement of the Constitution… well, a windfall profits tax on gold might be the least of our problems.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Just got the all-clear from publisher Matt Insley to make it official: Last year’s wildly popular Paradigm Shift Summit is set for a repeat engagement in Las Vegas.

We have fewer than 500 seats available for this year’s edition of our subscriber conference, set for Tuesday, Oct. 3.

All of the Paradigm editors will speak — Jim Rickards, Byron King, Zach Scheidt, James Altucher, Ray Blanco and Alan Knuckman. This year we’re adding Rude Awakening editor Sean Ring to the bill, which will surely up the educational and entertainment value!

Here’s your formal invite from VP of Publishing Doug Hill. I hope you can join us.