“Orphan” Drug Breakthrough

![]() Hope for Patients, Opportunity for Investors

Hope for Patients, Opportunity for Investors

After James Altucher’s A-list event last night, he finally introduced The Chairman — none other than Paradigm’s own tech-investing whiz Ray Blanco.

After James Altucher’s A-list event last night, he finally introduced The Chairman — none other than Paradigm’s own tech-investing whiz Ray Blanco.

Ray, you might recall, went on record at our Seven Predictions Summit in December where he predicted a major biotech boom. Eight months later, the investment possibilities are finally coming together.

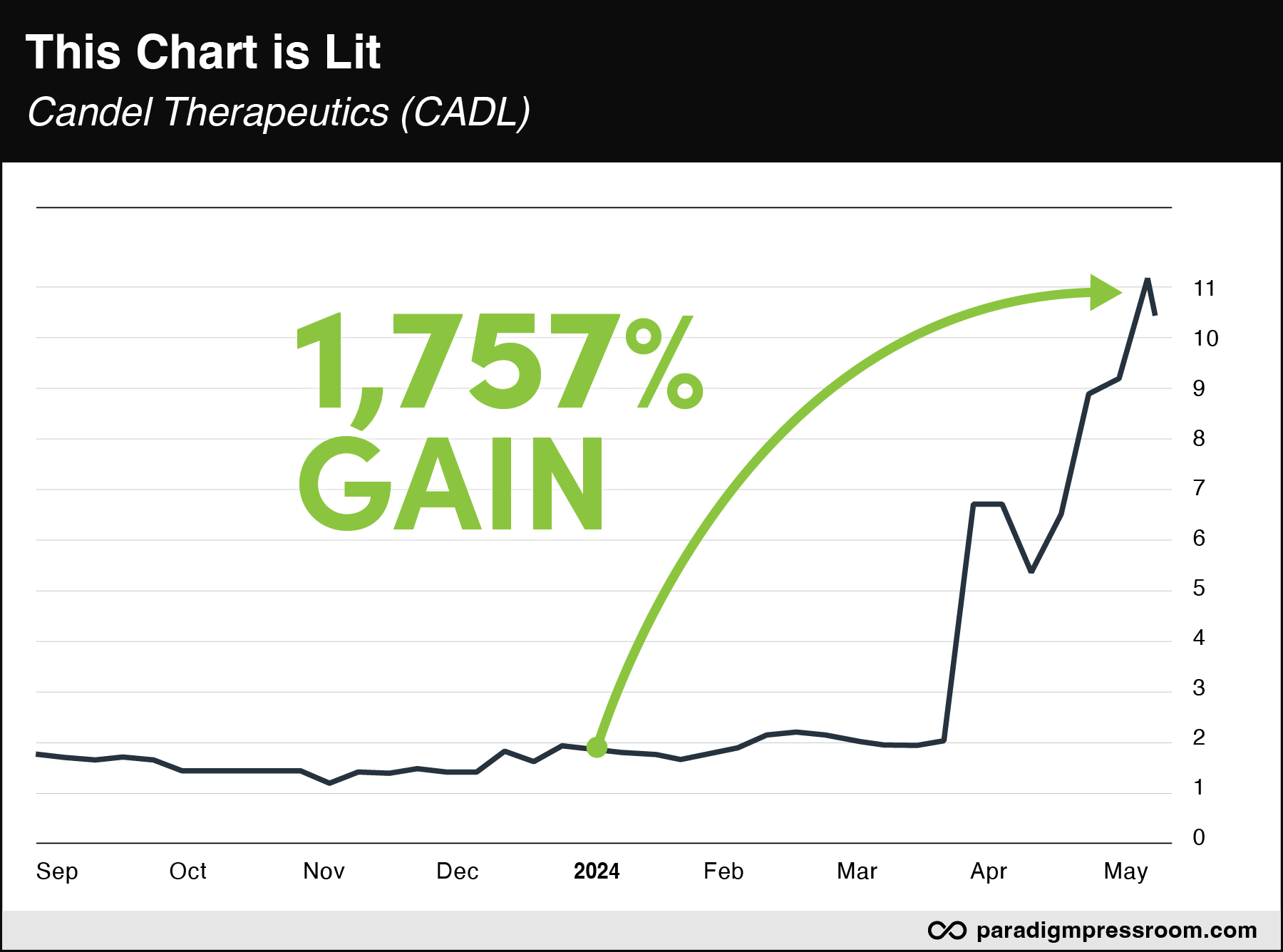

One of Ray's most compelling charts yesterday?

For cancer patients and their loved ones, this chart is even more compelling…

That’s because the FDA granted Candel Therapeutics’ immunotherapy candidate CAN-2409 Orphan Drug Designation for the treatment of pancreatic cancer. Pancreatic cancer is one of the most lethal forms of cancer, with a survival rate beyond 10 years around 5%.

That’s because the FDA granted Candel Therapeutics’ immunotherapy candidate CAN-2409 Orphan Drug Designation for the treatment of pancreatic cancer. Pancreatic cancer is one of the most lethal forms of cancer, with a survival rate beyond 10 years around 5%.

Orphan Drug Designations are granted to medicines intended to treat rare conditions and come with benefits such as tax credits for U.S.-based clinical trials and potentially seven years of market exclusivity upon agency approval.

- The drug works by inducing T-cell response at both the targeted tumor and at distant metastases. While Candel believes the drug could work as a monotherapy, it is currently evaluating the therapy in combination with GSK’s antiviral medication Valtrex (valacyclovir) for the treatment of pancreatic cancer.

After the company announced promising results for its new cancer treatment in late May, shares surged higher. So far this year, the stock price has grown about 2.5X its original value.

As a cancer survivor himself, Ray understands the importance of the U.S. biotech sector's focus on groundbreaking treatments which offer significant hope for patients — and exciting opportunities for investors.

![]() Indicators Point to Economic Slowdown

Indicators Point to Economic Slowdown

U.S. single-family homebuilding dropped in July, with housing starts decreasing 14.1% from June’s reading, marking five consecutive months in decline. Year-over-year? Starts are down almost 15%.

U.S. single-family homebuilding dropped in July, with housing starts decreasing 14.1% from June’s reading, marking five consecutive months in decline. Year-over-year? Starts are down almost 15%.

Although mortgage rates have settled to 6.45% from a peak of 7.22% in May, the increase in housing inventory — reaching levels not seen since 2008 — may hinder any recovery in construction activity. In terms of future construction, permits dipped 0.1% in July.

“As prices fall in formerly hot housing markets and builder margins shrink,” notes Paradigm analyst Dan Amoss, “building activity is slowing rapidly — with big multiplier effects on other industries.”

Speaking of, I failed to include some important economic numbers in yesterday’s edition. Which I will remedy today:

- Mid-Atlantic manufacturing is back in negative territory (-7) — far worse than July’s 13.9 reading as well as the consensus forecast of 5.4, according to the Philadelphia Fed Manufacturing Index

- Then there’s the Empire State Manufacturing Index: Any number above zero indicates growth; August’s headline number came in at -4.7, little changed from July

- For the first time in four months, industrial production fell to 0.6% in July, below the 0.1% economists predicted. Manufacturing likewise dropped 0.3%. All told, 77.8% of America’s industrial capacity was in use in July — below the 50-year average of 79.7%.

Keep in mind, industrial activity often serves as a leading indicator for overall economic health. Widespread weakness across multiple manufacturing metrics — coupled with soft housing starts and permits — suggests a slowdown in the broader economy.

Looking at our screens today, stocks are treading water, with the techie Nasdaq faring best: up 0.30% to 17,645. At the same time, the Dow and S&P 500 are neck and neck — up 0.20% to 40,645 and 5,550 respectively.

Looking at our screens today, stocks are treading water, with the techie Nasdaq faring best: up 0.30% to 17,645. At the same time, the Dow and S&P 500 are neck and neck — up 0.20% to 40,645 and 5,550 respectively.

Meanwhile, crude’s down about 1.75% to $76.78 for a barrel of West Texas Intermediate. Precious metals, however, are both in the green. Gold is up 1.70% to $2,543.10 per ounce — another record high, we note — and silver is up 1.55%, just about $0.15 under $29.

Closing out the week, crypto is similarly positioned in the green. Bitcoin? Up 2.20% to $58,355. And Ethereum has gained 1.80% to $2,590 at the time of writing.

![]() A Month of High-Impact History

A Month of High-Impact History

“We still have two weeks to go in August… Should we brace for surprises?” posits Paradigm’s macro expert Jim Rickards as a follow-up to yesterday’s “Myth of August.”

“We still have two weeks to go in August… Should we brace for surprises?” posits Paradigm’s macro expert Jim Rickards as a follow-up to yesterday’s “Myth of August.”

August, in fact, has been a month of really significant historical events — ranging from outbreaks of major global conflicts… to geopolitical and market shifts… and natural disasters.

The month of August, for instance, saw the beginning of World War I in 1914 when Germany and Russia declared war on each other. Three decades later, in August 1945, the United States conducted the first and only nuclear attacks in history against Japan, leading to the end of World War II.

August has also witnessed numerous political crises. Some examples?

- Richard Nixon's resignation in 1974

- Saddam Hussein's invasion of Kuwait in 1990

- An attempted coup in the Soviet Union in 1991.

Significant terrorist attacks have also occurred in August, including the 1998 U.S. embassy bombings in Kenya and Tanzania. Alongside natural disasters including Hurricane Katrina in 2005.

As well, August has seen its share of economic turmoil: Russia's debt default in 1998, early rumblings of the financial crisis of 2007–2009 and China's yuan devaluation in 2015.

Jim advises: “Don’t spend time worrying about what extreme event might happen. Just don’t be too surprised if one does.”

Surprise?

The mainstream is trying to float a story about the September 2022 Nord Stream pipeline bombing. Again.

The mainstream is trying to float a story about the September 2022 Nord Stream pipeline bombing. Again.

In one of our Saturday highlight issues on April 8, 2023, we outlined a theory pushed at both The New York Times and German weekly newspaper Die Zeit on March 7.

Citing CIA sources, the articles both claim a “pro-Ukrainian” gang of six — using counterfeit passports — hired the Andromeda, a 49-foot yacht, to carry out the Nord Stream attack.

Courtesy: X, WSJ

At the time, Pulitzer-prize winning journalist Seymour Hersh plus two mainstream German outlets, Der Spiegel and Bild, questioned the veracity of the CIA’s narrative.

- First, how could a yacht this size (see above) carry the amount of explosives necessary — up to two tons, by some estimates — to blast two pipelines into oblivion? And where’s the crane to hoist the explosives overboard?

- Second, the site of the blast is 260 feet below the surface of the Baltic Sea; it would require highly skilled divers to carry out such a mission. Plus? A decompression chamber for said divers which, you guessed it, the Andromeda isn’t fitted for.

- Last, the photo of the yacht shows the glorified sailboat has no license number, something legally required for such a vessel. And the coup de grace: A couple sham passports were conveniently left behind.

As I mentioned in April: That’s some Scooby-Doo-level sh*t right there.

Here we go again? Wednesday, the Wall Street Journal published its own “scoop” — the narrative is curiously exactly the same as the 2023 article. Hmm…

The only difference being the WSJ puts Ukraine’s President Zelenskyy in the frame.

The only difference being the WSJ puts Ukraine’s President Zelenskyy in the frame.

“The whole thing was born out of a night of heavy boozing and the iron determination of a handful of people who had the guts to risk their lives for their country,” an unnamed officer tells the WSJ.

Who talks like this?!?

According to the report, Zelenskyy — under pressure from the CIA — tried to cancel the operation, but it was too late.

Why is the mainstream floating this story, again, now? “An effort to deflect toward Zelenskyy,” says Paradigm editor and former U.S. Navy officer Byron King. “I would not want to be his life insurance underwriter just now.

“Meanwhile, taking out three of four major pipelines [is] NOT for amateurs after a night of drinking on a yacht. It was a military-grade op,” he adds. “Someday, we may learn the truth.” For now, this account might be the best we’ve got.

![]() AI: Legal Debate Ahead

AI: Legal Debate Ahead

On Monday, a California judge ruled that a group of artists can proceed with their lawsuit against several AI companies.

On Monday, a California judge ruled that a group of artists can proceed with their lawsuit against several AI companies.

The cadre of artists — including concept artist Karla Ortiz who’s worked on several Marvel movies — claims that AI image generators like Stable Diffusion are infringing on their copyrights.

District Court Judge William Orrick ruled that the artists made a reasonable case that companies including Stability AI, Midjourney, DeviantArt and Runway AI violated the artists’ rights by illegally storing their artwork in their AI systems.

The artists argue that Stable Diffusion — the AI model used by all the companies involved — contains “compressed copies” of their artwork used for AI “training” purposes. (To that end, according to an A.V. Club article, about “5 billion images” have been “scraped from at least 4,700 artists.”)

Courtesy: Replicate.com, Stability AI sample

The Salvador Dali influence is unmistakable

Judge Orrick finds this claim plausible enough to allow the case to continue to the next stage of the legal process. His ruling, however, doesn't address the main argument — whether using artists' work to train AI systems directly violates copyright, or whether the AI companies' use of this material falls under fair use.

These core issues, rife as they are with complexity, will be debated as the case moves forward. We’ll keep you posted…

![]() EVERYBODY Beats the Wizz

EVERYBODY Beats the Wizz

Hungarian budget airline Wizz Air is trying to stoke interest with its new unlimited “all you can fly” subscription service.

Hungarian budget airline Wizz Air is trying to stoke interest with its new unlimited “all you can fly” subscription service.

The annual subscription starts at an introductory price of €499 ($547.54) good through today, Aug. 16, with the rate jumping to €599 ($657.27) thereafter. Still, an incredible deal, right?

Plus, starting in September, the subscription will include access to Wizz Air’s extensive network of 950 routes across Europe, North Africa, the Middle East and Asia.

But there’s a catch. Several, actually.

First, if you’re someone who prefers not to fly by the seat of your pants, so to speak, this isn’t for you: You can only book flights 72 hours in advance.

Also, in light of the EU’s Entry/Exit System launching in November — an automated system that will monitor the movement of non-EU nationals — airlines will need to submit passenger information 48 hours before departure. That tight timeframe could create, well, some train wrecks for travelers.

On top of that, each flight comes with an additional €9.99 fee. And don’t forget about baggage and seat selection fees — those aren’t included in the subscription either, and can range from a few euros to over a €100 depending on the flight.

Fine print aside…

If you’re not a frequent flier, Wizz Air has a plan for that: a monthly MoviePass, er, MultiPass optionpays for a one-way flight each month, but it comes with its own set of costs and commitments.

If you’re not a frequent flier, Wizz Air has a plan for that: a monthly MoviePass, er, MultiPass optionpays for a one-way flight each month, but it comes with its own set of costs and commitments.

Perhaps the most glaring reason to skip the subscription service — in terms of passenger experience, Wizz Air was recently dubbed the worst airline of 2024 by a U.K. consumer group.

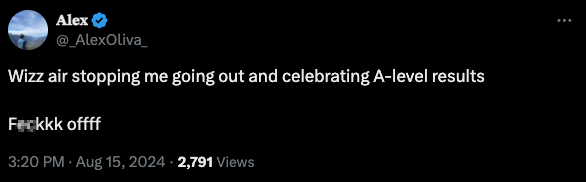

But don’t take their word for it:

Courtesy: X

“Shambolic.” Nice.

On the other hand, Wizz Air has been named the world’s most environmentally friendly airline for two years in a row. But by encouraging unlimited air travel, the airline will probably lose its environmental title (while reinforcing the former).

The bright side? Wizz Air’s fleet is Airbus all the way. Not a Boeing on the tarmac.

Have a wonderful weekend!