The Ultimate Recession Trade

![]() The Twin Engines of a “Once-in-a-Decade Opportunity”

The Twin Engines of a “Once-in-a-Decade Opportunity”

It’s disappointing, but not at all surprising: After a two-week stretch above $2,000, gold has slipped below that tidy round number.

It’s disappointing, but not at all surprising: After a two-week stretch above $2,000, gold has slipped below that tidy round number.

At last check, the spot price is down $22 to $1,982. Futures are down $16 to $1,998.

Silver, meanwhile, already gave up the $23 level on Friday. The bid in the spot market is down almost a quarter today to $22.74.

That said, gold in tandem with another asset class comprise a “once-in-a-decade opportunity,” says Paradigm macro maven Jim Rickards.

That said, gold in tandem with another asset class comprise a “once-in-a-decade opportunity,” says Paradigm macro maven Jim Rickards.

Gold’s rally going back to October “correlated almost perfectly with the rally in 10-year Treasury notes that occurred at the same time,” says Jim.

Recalling that Treasury prices rise as interest rates fall, the plunge in the yield on a 10-year T-note has been one for the ages — from 5% in October to nearly 4.1% last week. “That’s like an earthquake in the world of Treasury notes,” Jim points out.

“This dual rally gives investors a double-barreled opportunity to make huge gains.”

So why are gold and T-notes rallying together? After all, they don’t always move together.

So why are gold and T-notes rallying together? After all, they don’t always move together.

“The simplest explanation for the correlation is that Treasury notes and gold are both high-quality assets that compete for investor allocations. Gold does not have a yield (although it can produce significant capital gains).

“When yields on Treasuries drop, the zero yield on gold is relatively more attractive compared with the note yield and gold prices start to rally.”

And Jim says every indication is that the trend will continue — falling rates (and rising T-note prices) and rising gold.

And Jim says every indication is that the trend will continue — falling rates (and rising T-note prices) and rising gold.

“To forecast rates, we have to look at economic fundamentals.”

The economy as measured by GDP grew an annualized 4.9% during the third quarter — a phenomenal number the Biden administration has been quick to tout. Unfortunately, the latest projections from the Federal Reserve Bank of Atlanta suggest a plunge to 1.2% in the current quarter.

“When growth goes from 4.9% in the third quarter to 1.2% in the fourth quarter,” says Jim, “something extreme happened. It’s almost certainly the case that consumers slammed on the brakes in October.”

Key recession indicator: The mighty American consumer — who did so much to prop up the economy starting in mid-2020 — is exhausted.

Key recession indicator: The mighty American consumer — who did so much to prop up the economy starting in mid-2020 — is exhausted.

“The consumer came out of the pandemic with a head of steam provided by handouts from Trump ($1,800 per adult), and Biden (about $1,400 per adult) between April 2020 and March 2021,” says Jim. “That was supplemented by $900 billion of Paycheck Protection Program loans, which were forgiven one year later.

“Student loan payments were suspended from 2020–2023. The Federal Reserve held interest rates at zero from 2020–2022. Then the misnamed Inflation Reduction Act of August 2022 handed $1 trillion of taxpayer money to Green New Scam businesses and other pet projects.

“With that money, Americans were able to pay down credit card balances and build up savings. It was a powerful double-dose of fiscal and monetary stimulus. Much of this operates with a lag so the growth momentum carried over into 2023.

“Now it’s all gone. Short-term interest rates are over 5%. Mortgage rates are over 7%. Student loan repayments have started again. There are no more pandemic handouts. Americans’ savings are depleted, and their credit cards are tapped out.”

Here’s the most important thing to bear in mind today: “Interest rates do not typically peak at the start of a recession; they peak somewhat after the recession begins,” Jim says. “Businesses see revenues decline and turn to lines of credit to help with cash flow.

Here’s the most important thing to bear in mind today: “Interest rates do not typically peak at the start of a recession; they peak somewhat after the recession begins,” Jim says. “Businesses see revenues decline and turn to lines of credit to help with cash flow.

“Only later, when unemployment goes up and credit losses accumulate, do banks rein in credit and then interest rates start to decline. We may already be at that stage. The fact that interest rates are already in sharp decline suggests the recession has already begun.

“The importance of this for investors is that interest rate declines have much further to go (probably down to the level of 2% or lower over the next six months), which means gold prices have further to rise (perhaps to the $2,300 per ounce level or higher).

“With both trends in place and a positive feedback loop between them, this is a once-in-a-decade opportunity for investors.”

![]() Chinese Millennials Can't Get Enough Gold

Chinese Millennials Can't Get Enough Gold

Here’s an additional tailwind for gold — economic headwinds in China.

Here’s an additional tailwind for gold — economic headwinds in China.

“Gold buyers in China are getting younger,” says a Reuters dispatch, “as a property market downturn, weakening stocks and currency and low bank deposit interest rates have left them with dwindling options to save for rainy days in a sputtering economy.”

As Jim has said for the better part of a year, China’s “roaring comeback” from extreme COVID lockdowns never materialized.

"The employment market has not been very good," says Linda Liu, a 26-year-old worried about how long her pharmaceuticals employer will keep her on the payroll. "Buying gold makes me feel better."

A 38-year-old office worker who would reveal only her surname Yang tells the newswire “the yuan has been depreciating, financial investment is too risky... and the property market remains disappointing. There are not many choices left."

“Chinese social media discussions about steady gold accumulation abound,” says Reuters, “with users recommending small jewelry and marble-like gold ‘beans’ as small as one gram that could be purchased even by those with low incomes for 450–550 yuan ($63–77).”

China’s gold demand so far in 2023 is up 7% over the previous year — and that’s just at the retail level. China’s central bank is stacking at a record pace — and those are just the official figures. As Jim’s been telling us for years, the real figures are likely much higher…

![]() A Lot of Work… For a Low-Probability Payoff

A Lot of Work… For a Low-Probability Payoff

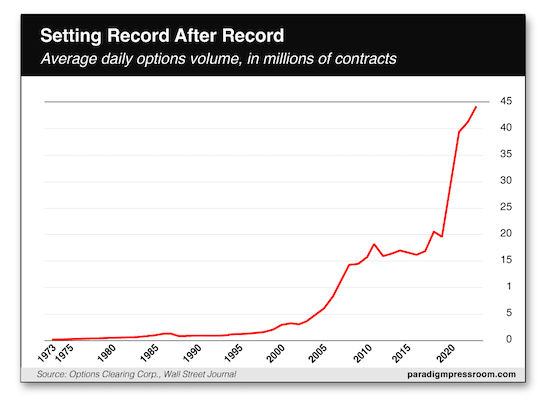

Market milestone: On a typical day this year, 44 million options contracts were traded — double the volume of five years ago.

Market milestone: On a typical day this year, 44 million options contracts were traded — double the volume of five years ago.

That’s according to figures from Options Clearing Corp. This year’s total has already set a record in data going back 50 years.

“Activity in contracts expiring the same day — among the market’s riskiest — has helped turbocharge a mania that began in 2020 during the depths of the COVID-19 pandemic,” says The Wall Street Journal. “Volume has soared, hitting fresh highs in each of the following three years.”

“The share of trading in contracts that expire in five or fewer days touched a record 59% in October and has remained elevated, according to figures from SpotGamma. Many traders are increasingly holding positions for hours, or even minutes, in a bid to rapidly juice their returns. The one-day trades, known by the hashtag #0dte, have gone viral, with tens of thousands of mentions swirling online that have helped draw even more people in.”

Hmmm. These trading vehicles come with the promise of giant returns, yes… but they also come with a low probability of success. And it takes a lot of work to get there — constantly whipping out your phone to check your positions.

All this year, Paradigm trading pro Greg Guenthner has been perfecting a trading strategy that comes with a much higher probability of success… and a lot less work. Result? The best performance among any Paradigm editor in 2023.

So far, this strategy has been available to only a select few among our readership. But in a few days, we’ll be opening it up to a wider audience. Watch this space for details…

Perhaps not surprisingly, the major U.S. stock indexes are taking a breather after all closing at year-to-date highs on Friday.

Perhaps not surprisingly, the major U.S. stock indexes are taking a breather after all closing at year-to-date highs on Friday.

At last check, the S&P 500 is down less than a point at 4,604. The Nasdaq is down about a third of a percent, the Dow slightly in the green.

The market-moving events this week — the ones that are scheduled in advance, anyway — are the official inflation numbers tomorrow, followed by the Federal Reserve’s policy announcement Wednesday.

The Fed will leave the benchmark fed funds rate where it is, 5.5% — that’s a no-brainer telegraphed by the Fed well in advance.

The uncertainty surrounds the Fed’s projections for rate cuts going into next year. As we mentioned last week, there’s a developing disconnect between the Fed’s stated intentions and Mr. Market’s expectations. Now this disconnect has become the stuff of memes…

Elsewhere, oil is nearly unchanged as the week begins at $71.17. The tensions over Guyana’s huge offshore oil find are easing for the moment; the presidents of Guyana and Venezuela will meet on Thursday — on neutral ground in St. Vincent and the Grenadines — to discuss their border dispute.

![]() So Much for “Phasing out Fossil Fuels”...

So Much for “Phasing out Fossil Fuels”...

This morning brought the clearest sign yet that we’ve reached “Peak Green” — the beginning of the end of climate-change hysteria.

This morning brought the clearest sign yet that we’ve reached “Peak Green” — the beginning of the end of climate-change hysteria.

Delegates to “COP28” — this year’s United Nations climate summit in Dubai — have punted on the chance to issue a draft agreement phasing out the use of fossil fuels.

Instead, the document says nations “could” pursue a range of actions that include reducing

“consumption and production of fossil fuels, in a just, orderly and equitable manner so as to achieve net zero [carbon emissions] by, before or around 2050 in keeping with the science.”

The Financial Times says this language came about after oil-producing states led by Saudi Arabia objected to a full phaseout.

As colleague Sean Ring observed last week, it’s been over 30 years since the first “Earth Summit” in Brazil. And after all that time, “a commitment to ditch fossil fuels has never been solidified in a final pact. And it never will be because the UN is toothless.” Nailed it, huh?

Yes, there will still be many battles to fight against the control freaks and power trippers. But reality is settling in, however slowly.

The real news from COP28 is more than a week old now: Two Saturdays ago, the United States and 21 other countries set a goal of tripling their nuclear energy capacity by 2050.

The real news from COP28 is more than a week old now: Two Saturdays ago, the United States and 21 other countries set a goal of tripling their nuclear energy capacity by 2050.

The other countries are a diverse bunch — South Korea, the United Kingdom, the United Arab Emirates. France, too — which already relies on nuclear for two-thirds of its electricity.

Joe Biden’s “climate envoy” John Kerry — yes, he still afflicts the political landscape — has acknowledged that “you can’t get to net-zero 2050 without some nuclear.”

Granted, getting from here to there will be an uphill climb — especially for Western governments hostile to Russia. As it happens, Russia controls a sizeable portion of the globe’s nuclear fuel cycle. “It may not have the uranium in the ground,” Sean Ring writes in today’s Rude Awakening, “But it’s an expert at conversion, enrichment and fuel fabrication.”

A lot of the easy money has already been made in uranium this year. The Global X Uranium ETF (URA) — a basket of uranium mining companies — has rallied 50% off its 2023 lows.

“We may have a ways to go with this rally,” says Sean, “especially if URA breaks above $30.” It opened this morning at $28.62.

![]() Mailbag: Venezuela and Tay-Tay 2024

Mailbag: Venezuela and Tay-Tay 2024

A reader writes on the subject of the Venezuela-Guyana border dispute, the oil riches at stake and possible U.S intervention…

A reader writes on the subject of the Venezuela-Guyana border dispute, the oil riches at stake and possible U.S intervention…

“Hasn't the administration been welcoming large numbers of Venezuelan ‘refugees’ of late? How will these people react if America takes an active role in the Guyana ‘dispute’? And aren't many of these young men members of criminal organized crime gangs?

“The Venezuelan military is no match for the army of defense and oil industry lobbyists who are, as we speak, descending upon Congress with fistfuls of dollars. What could possibly go wrong?”

Dave responds: What I’m about to say won’t be very popular, but that’s never stopped me before…

I don’t get it. There was a time when conservatives welcomed refugees from socialist hellholes like Venezuela. More than anyone else, those immigrants knew firsthand how socialist experiments are doomed to fail, and thus they were the ones most likely to “bootstrap” their way to prosperity in their new country.

But now these refugees are all a bunch of thugs just one step removed from MS-13? What gives?

Anyway, if there’s a huge influx of arrivals from Venezuela, Washington has only itself to blame. As mismanaged as Venezuela’s economy has been during the 21st century, matters were made far worse by the Trump sanctions — which Biden maintains.

“I think you are onto something,“ a reader writes after I spotted some online chatter on Friday about Taylor Swift and the 2024 election.

“I think you are onto something,“ a reader writes after I spotted some online chatter on Friday about Taylor Swift and the 2024 election.

That’s all the reader said. Several others chimed in, also exercising economy with their words…

“If you knew much about the ‘Swifties’ you'd know it's plausible — actually very likely. An army of know-nothings with a few exceptions.”

“An arranged ‘romance,’” says a third, “between Taylor ‘Tay-Tay’ Swift and Travis ‘Mr. Pfizer’ Kelce to ignite the TikTokers. Like a ‘shot in the arm.’”

“A downside to fame and fortune,” writes a fourth, “is the powerful elites trying to use your celebrity status for their purposes. If you don’t play along it could be detrimental to your career. It’s kind of like a deal with the devil. Very few are able to break out from this system.”

And one more: “I am reminded of a headline in The Onion back in the day: ‘Oprah Viewers Patiently Awaiting Instructions.’”

Dave responds: Ah, yes. Back when The Onion was funny…