These Numbers Shouldn’t Be Rising

![]() These Numbers Shouldn’t Be Rising

These Numbers Shouldn’t Be Rising

Amid the “partial government shutdown,” we’ve had no official job numbers since August — and the official inflation numbers won’t arrive on schedule this Thursday.

Amid the “partial government shutdown,” we’ve had no official job numbers since August — and the official inflation numbers won’t arrive on schedule this Thursday.

So what’s the state of “the economy” right now, really?

In the first place, we’ll remind you that official economic statistics are mostly bunk. Both the job numbers and the inflation numbers are gamed to make matters look better than they really are. If government economists used the same yardsticks they used 50 years ago, we’d be looking at inflation north of 10% and unemployment would be on the order of 25%.

But that’s a story for another day. What can we deduce from the figures we have available to work with?

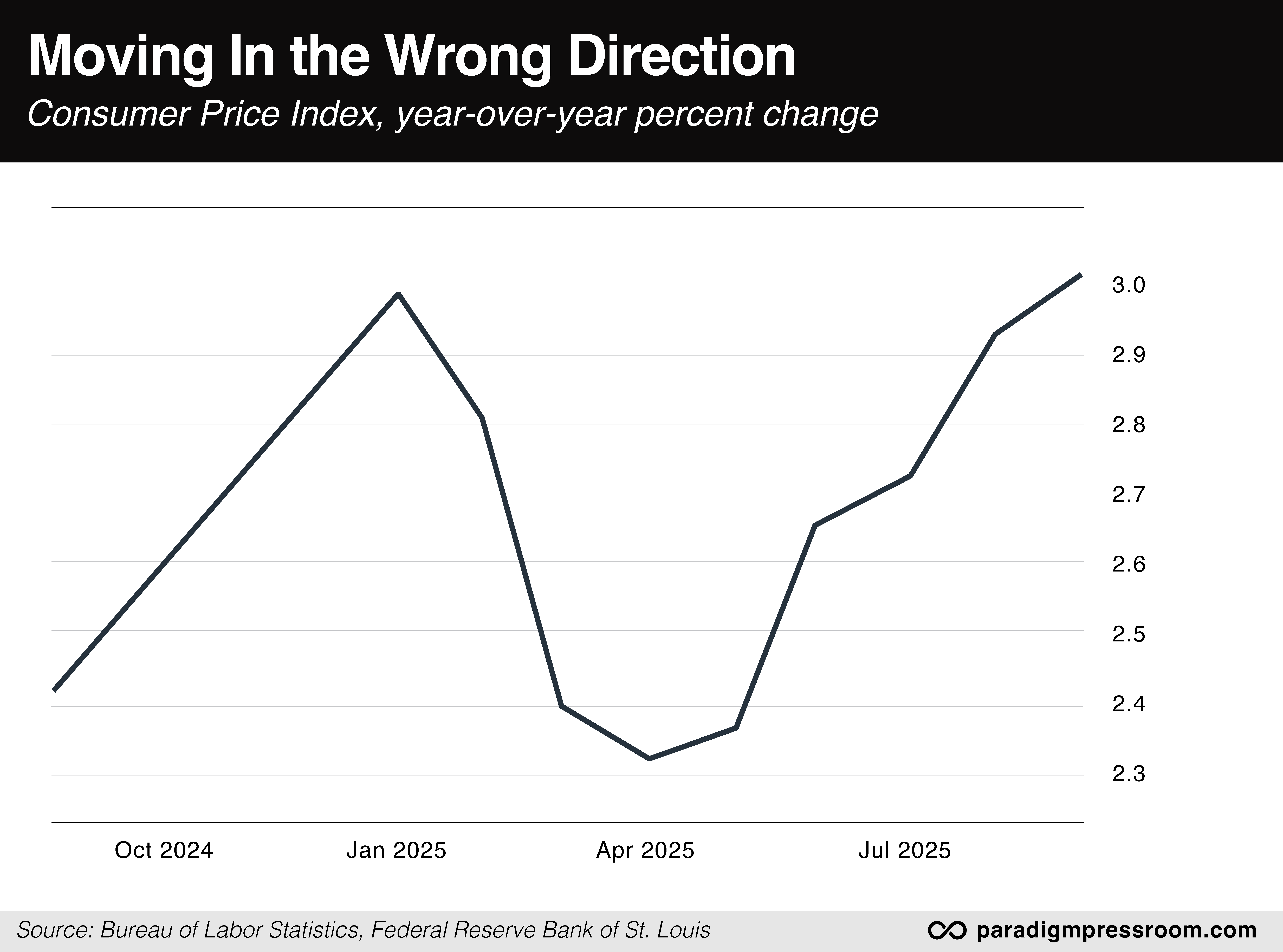

In the first place, it’s clear that inflation is moving in the wrong direction.

In the first place, it’s clear that inflation is moving in the wrong direction.

Shutdown notwithstanding, the Bureau of Labor Statistics cobbled together a September consumer price index released back on Oct. 24. Really there was no choice: The 2026 Social Security cost-of-living increases hinged on those numbers.

With that release, the official inflation rate is 3.0%.

That’s way better than the 9% peak in the summer of 2022. But it’s also up substantially since last spring, advancing almost as steeply as it did in the final months of 2024.

“There’s nothing benign or comfortable about 3.0% inflation,” says Paradigm’s macroeconomics maven Jim Rickards.

“That rate will cut the value of the dollar in half in 24 years. It will cut it in half again in another 24 years. That means in a 48-year working career from age 17 to age 65, the dollar will lose 75% of its purchasing power. What are you working for unless wages are going up faster than inflation is devaluing the dollar?”

![]()

Unfortunately, “the news on the unemployment front is even worse,” says Jim.

Unfortunately, “the news on the unemployment front is even worse,” says Jim.

Granted, the figures are woefully out of date by now. But even the available figures are concerning — an official unemployment rate of 4.1% in June, 4.2% in July and 4.3% in August.

That’s still low by historical standards. But it’s higher than at any time in 2023. And like inflation, it’s trending in the wrong direction.

There’s a handful of private-sector figures to work with. None of them is encouraging. The payroll firm ADP says employers added a meager 10,000 jobs during August, September and October.

And as mentioned here last week, the outplacement firm Challenger, Gray and Christmas finds that employers cut over 153,000 jobs during October — the worst October on record since 2003.

Under the circumstances, Jim believes the Federal Reserve will cut its benchmark fed funds rate again at its next meeting a month from now.

Under the circumstances, Jim believes the Federal Reserve will cut its benchmark fed funds rate again at its next meeting a month from now.

Accelerating inflation notwithstanding, the Fed is putting greater emphasis right now on the weakening job market.

Wall Street might interpret rate cuts as “stimulative.” But as Jim sees it, it’s bad news. Markets are already driving many short-term interest rates lower without the Fed’s help. That’s a sign “that growth is slowing, and the U.S. economy is heading into a recession (at worst) or sliding sideways (at best).”

Jim is on guard for the stock market to react badly — which might easily drive a fear trade into gold. As we keep emphasizing, Jim recommends keeping 10% of your investable assets in physical gold.

Yes, gold prices are up substantially from where they were at the start of the year. But if you’re not at 10% yet, it’s still not too late to start. Use dollar-cost averaging: Buy a little bit every week or every month to take advantage of periodic price dips as you work your way up to 10%.

That way you’re set no matter what the stock market does.

And on that score…

![]() The Post-Shutdown Stock Market

The Post-Shutdown Stock Market

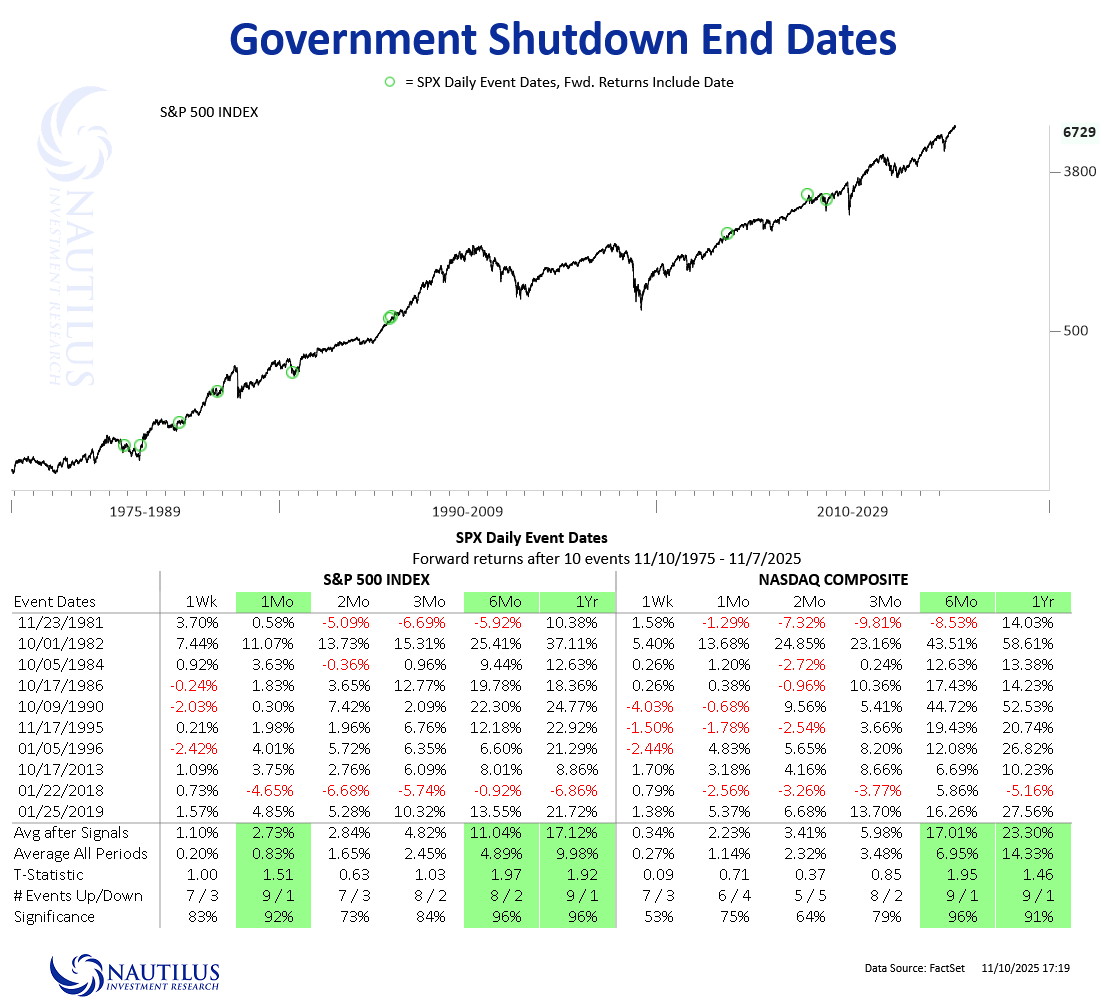

The shutdown isn’t over, but it’s closer to being over now than at any time in the last 42 days — which historically bodes well for the stock market.

The shutdown isn’t over, but it’s closer to being over now than at any time in the last 42 days — which historically bodes well for the stock market.

Paradigm trading pro Enrique Abeyta has been adamant in recent days about how the end of a government shutdown typically signals a stock market rally.

On the Paradigm mobile app today, Enrique shared this chart from Nautilus research showing the post-shutdown performance of the S&P 500 and the Nasdaq Composite going back to 1981. The little green circles indicate when each shutdown ended.

The typical outcome is “higher 90% of the time six months and one year later — with strong double-digit returns.”

But the shutdown’s not over yet — and both the S&P and the Nasdaq are in the red today.

But the shutdown’s not over yet — and both the S&P and the Nasdaq are in the red today.

Nothing major: At last check the S&P remains over 6,800 and the Nasdaq is well over 23,000. And the Dow has rallied nearly a half percent.

Congratulations are in order for Rickards’ Strategic Intelligence readers, who collected nearly 70% gains playing Intel in just over a year. “Intel is sensitive to the economy. Its stock could correct due to rising recession risks,” counsels analyst Dan Amoss.

Precious metals are digesting yesterday’s big gains — gold still over $4,100 and silver comfortably above $50. Crude has rallied over a buck to $61.18.

But crypto is slumping, Bitcoin sinking toward $103,000 and Ethereum under $3,500.

Only one economic number of note came out today — and it merits a bullet of its own. Read on…

![]() Why Is Good Help So Hard to Find?

Why Is Good Help So Hard to Find?

Aside from rising jobless rates, something truly whacked-out is going on in the U.S. job market.

Aside from rising jobless rates, something truly whacked-out is going on in the U.S. job market.

This morning the National Federation of Independent Business issued its monthly Small Business Optimism index. This survey, conducted regularly since 1973, offers a valuable snapshot into what’s happening in Main Street America.

The headline number is a snooze: Optimism dipped from 98.8 in September to 98.2 in October — still slightly higher than the survey’s long-term average. “Owners report lower sales and reduced profits,” says NFIB chief economist Bill Dunkelberg.

Often the most eye-opening part of the survey is where owners are asked to identify their “single most important problem” from a list of 10 possibilities. At various times this year, the list has been topped by taxes, inflation and “quality of labor.”

In October, “quality of labor” shot up the charts. For many small-business owners, good help isn’t just hard to find, it’s nearly impossible.

In October, “quality of labor” shot up the charts. For many small-business owners, good help isn’t just hard to find, it’s nearly impossible.

Quality of labor was cited by 27% of respondents — up dramatically from 18% the month before. It hasn’t been this high on the list since 29% in November 2021, the worst of the post-pandemic labor shortage.

Nothing else came close — taxes cited by 16%, inflation by 12%, poor sales by 10%.

Some detail the NFIB’s report: “Labor quality reported as the single most important problem was the highest in the construction, transportation and professional services industries… Nearly half (49%) of small businesses in the construction industry reported labor quality as their single most important problem, 22 points higher than for all firms.”

The report is silent about why this might be the case. Each month’s report includes comments from a cross-section of business owners. The only comment from the construction industry comes from Oregon, and it has nothing to do with labor quality: "Government continues to put more financial pressure on the construction business. There are more regulations and higher OSHA fines against the people who actually build this country."

At the risk of getting too far out over our skis… is it a case of small construction and transportation businesses losing labor from illegal migrants?

“Perhaps,” says Jim Rickards’ senior analyst Dan Amoss, “there is an illegal immigrant dynamic here of self-deportation or moving to the underground/cash economy (this is a touchy subject, but economically important).”

As long as the NFIB report is mute about the potential causes behind this phenomenon, we’re hard-pressed to imagine it’s anything else.

(Of course, we have small-business owners among our diverse readership. If you have any insights, please share: feedback@paradigmpressroom.com)

If our thesis is correct, there’s the potential for a ripple effect to reach the big publicly traded homebuilders — whose costs of doing business could jump big-time.

![]() The Ring of Truth

The Ring of Truth

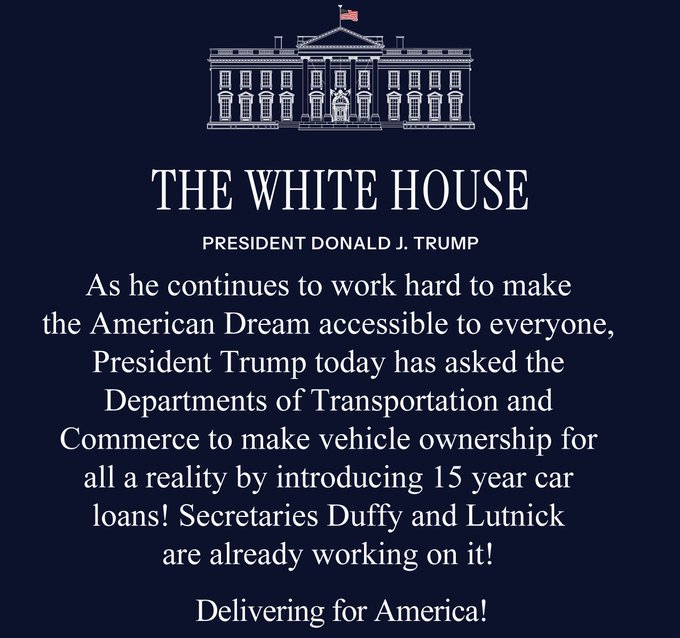

Your editor started the day spending the better part of 10 minutes trying to figure out if this screenshot is authentic…

Your editor started the day spending the better part of 10 minutes trying to figure out if this screenshot is authentic…

For sure, it went viral on social media, shared widely — including by people who voted for Trump last year.

“Now it’s ****ing 15 year car loans,” tweeted Breck Worsham, who goes by the handle The Patriotic Blonde. “I. CAN’T. TAKE. IT.”

As far as I can tell, there’s nothing to it. If it were for real, corporate media would be reporting it. But a Google News search turns up nothing. Nor does anything turn up on the president’s Truth Social feed — which is where you’d expect to find it first if it were legit.

So why mention it at all? Because it’s a sign of the times.

So why mention it at all? Because it’s a sign of the times.

On the heels of the real and nearly-as-daft proposal for 50-year mortgages, are 15-year auto loans that much more far-fetched?

Whoever devised the screenshot realized it had verisimilitude — the ring of truth.

It reminds me of an episode 20 years ago: The website Capitol Hill Blue reported that in a fit of anger, President George W. Bush snapped at a group of lawmakers, "Stop throwing the Constitution in my face! It’s just a g–d—-- piece of paper!"

No one ever substantiated the account — and in fact Capitol Hill Blue retracted the story. But coming from the guy who signed the Patriot Act into law, it had the ring of truth, didn’t it?

We chronicled a more recent instance in this space two years ago — when Joe Biden supposedly said he was thinking about emptying the Strategic Petroleum Reserve. Again, it was bonkers — but at the same time, almost believable.

The takeaway is this: Memes like the phony 15-year auto loans don’t catch on unless there’s already a receptive audience.

And there wouldn’t be a receptive audience if there weren’t a lot of economic distress out there…

![]() Mailbag: Crypto Winter?

Mailbag: Crypto Winter?

After yesterday’s crypto-themed Bullet No. 1, we heard from a member of our Omega Wealth Circle…

After yesterday’s crypto-themed Bullet No. 1, we heard from a member of our Omega Wealth Circle…

“Dave, I invested in GBTC in my IRA back in 2018 after doing a similar analysis to what you showed, expecting it might go up 20X or more. It went up about 10X and I held on hoping for more, only to watch it go back down into the next trough. This time, I sold it back in August, missing the very top by about 10% (assuming the top for this cycle is in).

“As many have noted, Bitcoin now tracks fairly closely with tech stocks, many of which appear to be in a bubble. No telling when that may pop, but even if the reason for the decline is different, I would not be surprised by a drop of 50–75% in Bitcoin (and tech stocks) over the next 12–18 months. Should that happen, I might well buy another Bitcoin ETF to try to ride the cycle again.

“And with my GBTC proceeds I invested in silver miners, which are thus far up nicely, and would seem to me to have less downside for the moment. We shall see.”

Dave responds: Hmmm… sell crypto, buy silver miners. Sounds like an intriguing pair trade!