Today’s Issue Is Not About Tesla

![]() The Tesla Paradox: When Facts Don’t Matter

The Tesla Paradox: When Facts Don’t Matter

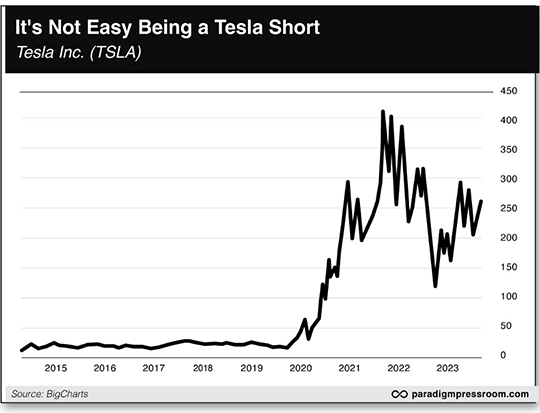

Pity the “Tesla shorts” and the $TSLAQ community.

Pity the “Tesla shorts” and the $TSLAQ community.

They emerged somewhere around the mid-2010s — finance professionals, many of them congregating on Twitter, who believed Tesla Inc. is at best massively overvalued. Or at worst, an outright fraud. (The “Q” at the end of a ticker symbol indicates a company is bankrupt.)

For years, they’ve put their money where their mouth is — betting against TSLA stock, either by short selling or via put options.

Their reasoning was sound, their research flawless.

Didn’t matter. Time and again, the Tesla shorts have had their asses handed to them…

By mid-2020, Tesla founder Elon Musk couldn’t resist razzing the Tesla shorts — and indulging in his pubescent sense of humor — by marketing a pair of Tesla Short Shorts for the price of $69.420.

Sure, some of the Tesla shorts might have caught a lucky break with their timing — i.e., the big drop in 2022 — but the case that “Tesla is a zero” just hasn’t panned out. Here in late 2023, Tesla’s market cap of $801 billion is as big as the rest of the top 10 global automakers combined.

The day might come when the Tesla shorts are vindicated. But if you follow their lead, you risk losing a bundle long before that day arrives.

All of this serves to spotlight a frustrating reality: Investment “fundamentals” often just don’t matter.

All of this serves to spotlight a frustrating reality: Investment “fundamentals” often just don’t matter.

“Many diligent market watchers — especially newer investors — love to dig into news articles, analyst ratings and earnings statements,” says Paradigm trading pro Greg “Gunner” Guenthner. “They want to feel informed. After all, the more you know, the better chance you have at picking a winner.”

But frequently, it’s all for naught. And there’s no better example than Tesla.

“TSLA currently trades for 54X forward earnings estimates,” Gunner says. “Legacy automaker Ford Motor Co. (F) trades a little more than 6X forward earnings estimates.

“Does this mean Ford shares are a better ‘deal’ than Tesla right now? Will Ford outperform Tesla over the next three years because Tesla stock is too richly valued? Or is Ford stock cheap because it simply can’t compete with Tesla?

“Perhaps Tesla is on the cusp of a major breakthrough in its autonomous driving technology that will cement it as the most important transportation and technology company in the world. Or maybe the opposite is true — Tesla’s biggest growth days are behind it and the company struggles to meet its aggressive goals over the next several years.

“No matter how much research we do (you can replace forward earnings with your metric of choice and repeat this process ad nauseam), we cannot confidently answer any of these questions.”

![]() If the Fundamentals Don’t Matter, What Does?

If the Fundamentals Don’t Matter, What Does?

“Fundamental and economic analysis is undeniably important in the long term — but it’s useless for attempting to determine when to buy or sell stocks,” Gunner says.

“Fundamental and economic analysis is undeniably important in the long term — but it’s useless for attempting to determine when to buy or sell stocks,” Gunner says.

As we mentioned last month, this is why he long ago gave up on “investing” and adopted the mindset of: Think like a trader.

What does that entail?

“The first step is a complete reliance on price,” Gunner says. “A trader insulates his mind from the news and hype, opting instead to focus on price action and other irrefutable facts.

“Why is price irrefutable? As legendary technician Ralph Acampora explains, unlike earnings, price is never restated. If a stock closes at $50, that is the closing price on that date forever. End of story. There is no debate as to the price of a security at any given moment. The quote is the quote.

“This means we can accurately plot a price chart over any time frame. Thanks to the marvels of modern computing, this requires no research or skill whatsoever. We simply pull up an interactive chart from our brokerage trading platform, or any other stock market research site of our choosing. Price is at our fingertips over any time frame we choose.”

Which means “charts are a trader’s best friend,” Gunner continues.

Which means “charts are a trader’s best friend,” Gunner continues.

Many trading newbies seem to believe there’s something magical about lines on a chart.

Not so, he says: “These lines simply connect price points of interest. Since price is never restated, we can use our price charts to pinpoint areas where large groups of traders and investors have exchanged shares. That’s important information!

“If price is churning sideways and continues to get rejected every time it rallies toward $50, we can assume this is an important price for this particular stock. This is an area where shares have exchanged hands on multiple occasions, and the stock is running into sellers every time it teases these levels.

“If our fictional stock finally moves above $50 after multiple attempts at this area over a significant amount of time, this tells us that the sellers have been overrun by more aggressive buyers, which typically leads to a strong move higher.

“Now you have a situation where anyone who bought shares at $50 is more reluctant to sell as the stock moves higher. Why would they sell now? They’re showing strong gains! That creates a snowball effect, leading to a fast move higher as fewer eager sellers can drag the price down.

“This is what happens when a stock breaks out — it clears a level that has acted as resistance and is moving into blue skies. No magic required!

“If we are able to find and harness these breakouts, we can buy a stock just as it’s making a strong move higher,” Gunner concludes.

“If we are able to find and harness these breakouts, we can buy a stock just as it’s making a strong move higher,” Gunner concludes.

“The fundamental reasons for the move — if any — simply don’t matter. All we have to do is play the percentages.

“Some breakouts fail. Some market conditions aren’t as conducive to trading them. But over a long enough time frame, the odds will work in our favor if we’re managing our risk properly.”

If this sounds like an appealing strategy, you’re in luck.

For much of this year, Gunner’s Trading Desk advisory has been available only to a select group of readers. Along the way, he’s racked up the best track record among everyone at Paradigm Press, with a model portfolio that’s grown 254% since May.

“This is NOT another newsletter,” he says. “It’s a community. It’s mentorship. It’s a place where you can get analysis EVERY DAY the market is open.”

As such, we’re still keeping a tight lid on membership — we’re accepting only 50 people today.

After all, this approach isn’t for everyone. To see whether it’s right for you, Gunner asks that you complete a brief assessment. Follow this link for a brief rundown of what to expect and to fill out the assessment.

![]() The U.S. Dollar as a Banana Republic Currency

The U.S. Dollar as a Banana Republic Currency

See, there’s a reason I went on the record Monday about the prospect of Civil War 2.0 and the potential impact on the economy and markets.

See, there’s a reason I went on the record Monday about the prospect of Civil War 2.0 and the potential impact on the economy and markets.

True, the markets aren’t evincing much of a reaction today to the Colorado Supreme Court’s ruling that keeps Donald Trump off the Centennial State’s primary ballot. But that doesn’t rule out the possibility of future developments that would be market-moving.

There’s no shortage of commentary about the ruling, and there’s no need for us to add to it here. We’ll simply point out how the news might be going over abroad…

Yeah, probably doesn’t do much to reinforce confidence in the dollar — or reverse the long-term trend of de-dollarization. Got gold?

The major U.S. stock indexes are consolidating their December gains — setting up for what looks like a year-end push to all-time highs on the S&P 500.

The major U.S. stock indexes are consolidating their December gains — setting up for what looks like a year-end push to all-time highs on the S&P 500.

At last check, the S&P is up microscopically — less than a tenth of a percent — to 4,771. The high-water mark is 4,798 set on the first trading day of 2022. Treasury rates are meandering, the 10-year note at 3.91%.

Gold is hanging on to most of yesterday’s gains at $2,033. Silver is adding to yesterday’s gains at $24.33. Bitcoin pushed back above $44,000 within the last few hours, only to pull back a bit.

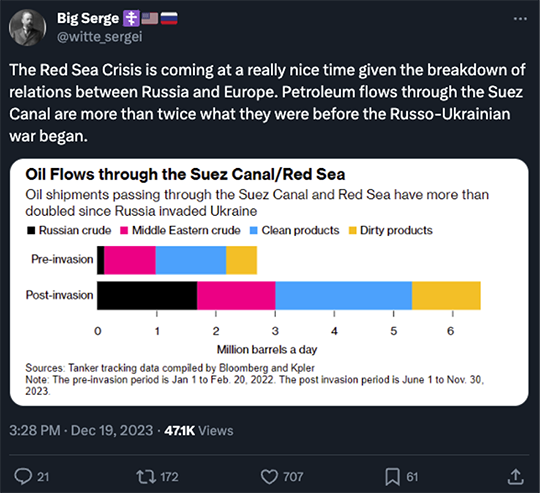

Crude has rallied another dollar, pushing a barrel of West Texas Intermediate back above $75 for the first time in nearly three weeks. The rumor mill continues to crank up that the United States will launch airstrikes against Yemen’s Houthi faction. (Much more about that in yesterday’s edition if you missed it.)

Even if that doesn’t happen, crude oil shipments via the Red Sea continue to be constrained — at a time when that route is needed more than ever…

Just one economic number of note today: Existing home sales rose more than expected in November, but they’re still down 7.3% year-over-year. Falling mortgage rates are starting to move inventory in a still-tight market — but not much.

![]() Stupid Legislation Tricks, Chick-fil-A Edition

Stupid Legislation Tricks, Chick-fil-A Edition

“A new bill introduced in New York could force Chick-fil-A at rest stops along Interstate 90 in the state to be open on Sundays,” reports USA Today.

“A new bill introduced in New York could force Chick-fil-A at rest stops along Interstate 90 in the state to be open on Sundays,” reports USA Today.

As you might be aware, the family that’s owned the chicken chain since its founding in 1946 is Southern Baptist — and they take their Sunday Sabbatarianism seriously. Thus, the doors are locked if you try to walk in on Sunday.

But under Bill AO8336, all food services along New York’s toll road system would be required to stay open seven days a week — on the theory that “allowing for retail space to go unused one seventh of the week or more is a disservice and unnecessary inconvenience to travelers who rely on these service areas.”

The operators of the New York State Thruway Authority aren’t sure what the problem is, Or at least that’s the drift you get from Thruway spokeswoman Jennifer Givner: "Our requirement is that we have at least one hot food option available," she tells USA Today. "If Chick-fil-A is closed on Sundays we have other alternatives for our customers."

So… the bill isn’t about convenience for travelers as much as it is about culture-war posturing?

As if the Empire State has solved all its other problems, right?

No comment from Atlanta-based Chick-fil-A so far. If it were up to me to respond on its behalf… well, I’d probably resort to language the family wouldn’t approve of.

![]() Mailbag: Red Sea Shipping, Civil War Catalyst

Mailbag: Red Sea Shipping, Civil War Catalyst

“With the drastic reduction in shipping going through the Red Sea,” a reader inquires after yesterday’s edition, “doesn’t that mean less revenue for Egypt?

“With the drastic reduction in shipping going through the Red Sea,” a reader inquires after yesterday’s edition, “doesn’t that mean less revenue for Egypt?

“I’d bet they’re between a rock and a hard place between stopping the Houthis and supporting the Palestinians.”

Dave responds: Colleague Byron King addresses that very point in a guest edition of today’s Rude Awakening. “A lowball number for economic loss to Egypt’s economy is over $25 million per day,” he writes, “likely more when all the secondary and tertiary impacts add up.”

“I’m on the fence about there being a new civil war,” a reader writes after Monday’s edition — even as he allows that “I think you did a great breakdown of the possible scenarios and the death and catastrophe such an outcome would cause.

“I’m on the fence about there being a new civil war,” a reader writes after Monday’s edition — even as he allows that “I think you did a great breakdown of the possible scenarios and the death and catastrophe such an outcome would cause.

“I don’t see much difference between Democrats and Republicans,” he goes on to explain, “as they both are big-government, tax-and-spend parties that love war and deficits. There are some differences between them on freedom issues so I think a civil war would hinge on these (think Covid restrictions and which states were more or less free) if we are indeed heading that way.

“Over half of Americans are overweight and too tired to fight. This won’t do if these same Americans are to fight for their freedoms/beliefs. I think a more likely alternative is that the chaos that the Marxists are fostering through all levels of society will create enough chaos and disorder that Americans will be willing to give up what freedom remains to restore order… even if that means a dictator or something along those lines.

“Thank you always for your ideas and analysis and I hope you all at Paradigm enjoy a Merry Christmas!”

Dave responds: Thank you, and likewise.

Going back to my original musings in 2017, I was always stumped by what the catalyst would be for a new civil war. As I said of the “burning issues” back then, border walls and Supreme Court nominations seemed like weak tea. Liberals threatened to “burn the m*****f***** down” when Republicans installed Amy Coney Barrett on the high court — and then nothing came of it.

By the time we got to late 2020, I thought the catalyst might be pushback against COVID lockdowns and restrictions. But that too did not pan out.

Upon further reflection this week, I don’t even think the catalyst would be something related to the 2024 election — although that’s where all the media speculation is centered, and the possibility certainly can’t be ruled out.

In the end, if Civil War 2.0 breaks out, the most likely catalyst would be an attempt at secession.

In the end, if Civil War 2.0 breaks out, the most likely catalyst would be an attempt at secession.

While grade-school history paints the American Civil War as all about slavery, the more fundamental issue at the outset was about secession.

In an 1862 letter to newspaper editor Horace Greeley, President Lincoln made clear that his primary goal in waging the war was preserving the Union…

My paramount object in this struggle is to save the Union, and is not either to save or to destroy slavery. If I could save the Union without freeing any slave I would do it, and if I could save it by freeing all the slaves I would do it; and if I could save it by freeing some and leaving others alone I would also do that. What I do about slavery and the colored race, I do because I believe it helps to save this Union; and what I forbear, I forbear because I do not believe it would help to save the Union.

Lincoln came around to the abolitionist cause only when it became politically expedient.

By the way, the American Revolution was also a civil war — and a war of secession.

So there’s no reason to believe secession won’t be what’s at stake this time — even if the proximate cause is something else.

To be continued…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Confidential to readers in Texas: What’s your take on the “Texit” secession referendum that might be coming to the Republican primary ballot in March? Write here: feedback@paradigmpressroom.com