Gold’s Next Catalyst (Today)

![]() Gold’s Next Catalyst (Today)

Gold’s Next Catalyst (Today)

There was a meme going around a couple of years ago after a summit among leaders of the G7 countries. We’re updating it today with the current cast of characters…

There was a meme going around a couple of years ago after a summit among leaders of the G7 countries. We’re updating it today with the current cast of characters…

By the way, the reason there are nine people in that photo and not seven is that two EU functionaries get a seat at the table — European Commission President Ursula von der Leyen and European Council President Charles Michel.

It appears even before the summit got underway today in Italy that there’s already agreement on what Paradigm’s Jim Rickards has labeled as “Biden’s Big Steal”

It appears even before the summit got underway today in Italy that there’s already agreement on what Paradigm’s Jim Rickards has labeled as “Biden’s Big Steal”

We laid out the outlines of this scheme yesterday and the day before. Recall that after Russia invaded Ukraine in 2022, Washington and Brussels froze about $300 billion in U.S. Treasuries held by the Russian Central Bank.

For much of this year, there’s been chatter inside the Beltway about not just freezing those assets, but seizing them and handing them to Ukraine. Under legislation that passed Congress in April, Joe Biden now has the power to seize about $10 billion of those Treasuries.

The other $290 billion is under the control of European banks and thus requires European cooperation — and not all European leaders are keen on the idea.

If Bloomberg’s anonymous sources are to be believed, the G7 has struck a convoluted compromise: They’ll seize the interest payments generated by those Treasuries — estimated at $4.3 billion annually, give or take — and use that as collateral for $50 billion in loans the G7 nations will extend to Ukraine.

Even though this is a compromise move, the market impact will amount to an earthquake — and a severe aftershock.

Even though this is a compromise move, the market impact will amount to an earthquake — and a severe aftershock.

The earthquake is a flight out of U.S. Treasuries. Why would foreigners trust them if Washington can arbitrarily freeze them and confiscate the interest payments?

Or as Jim put it here on Tuesday, “One immediate impact would be the decline of trust in the U.S. Treasury market and an aversion to holding U.S. Treasury securities in sovereign reserves. Major holders of U.S. Treasuries such as China, Japan, Taiwan, Saudi Arabia, Brazil and others would gradually reallocate reserves away from Treasuries toward assets that cannot be frozen or seized such as gold bullion.”

Yep, even G7 member Japan — now the biggest foreign holder of U.S. Treasuries after years of selling by China.

The aftershock will be enormous foreign buying of gold. Just the freezing of Russia’s Treasuries two years ago prompted record gold buys by central banks around the world during 2022 and 2023. Now that the interest payments will be confiscated, the rush into the Midas metal will only accelerate.

Jim is on record saying gold will zoom from today’s $2,300 to $15,000 by 2026. That would be a massive gain on its own… but Jim believes now is the time to juice gold’s potential with just nine “penny gold” stocks this year.

They’re all spotlighted in a brand-new report called: The Ultimate Penny Gold Portfolio… How to Build a Large Retirement Nest Egg as Gold Goes to $15,000.

This report is available free to all members of The Situation Report With Jim Rickards. If you’re not one of them, best act now — before the G7 announcement is made official tomorrow or over the weekend. For that reason, access to this exclusive report closes at midnight tonight.

![]() Fed Gives up on 2% Inflation

Fed Gives up on 2% Inflation

The real news from yesterday’s policy statement by the Federal Reserve is that “inflation hawk” Jerome Powell is about to give up on the Fed’s 2% inflation target.

The real news from yesterday’s policy statement by the Federal Reserve is that “inflation hawk” Jerome Powell is about to give up on the Fed’s 2% inflation target.

Not that the media played it up particularly. Look at the front page of The Wall Street Journal or watch CNBC… and you’re told that the Fed is holding interest rates steady, anticipating only one cut this year.

But during his press conference… Powell let it slip that going forward, an average inflation rate of 2.6–2.7% might be “a good place.” For the record, the Fed’s preferred measure of inflation currently sits at 2.8%.

And there’s your reason the stock market didn’t tank yesterday even though only one rate cut is in view before year-end.

And there’s your reason the stock market didn’t tank yesterday even though only one rate cut is in view before year-end.

All else being equal, the Fed will act to cut rates sooner if it’s willing to settle for 2.6% inflation rather than holding out for 2%. Lower rates add up to more of that EZ money heroin that’s jacked up Wall Street routinely for the last 15 years.

Both the S&P 500 and the Nasdaq notched record closes yesterday. Checking our screens today, the Nasdaq is inching up to 17,660 and the S&P is pancake-flat at 5,421. Big movers include Tesla, up nearly 4% after Elon Musk said TSLA shareholders are likely to approve his $56 billion pay package. (We’ll know for sure after the close today.)

Bonds are rallying, pushing yields lower; the yield on a 10-year Treasury is now 4.27%, the lowest since late March.

But precious metals sold off after the Fed made its move. At last check, gold is clinging to $2,300 and silver has slipped back below $29. Crude is off slightly at $78.10. Crypto is stuck in the mud, Bitcoin at $66,593.

As for the major economic numbers of the day…

- First-time unemployment claims for the week gone by rang in way higher than expected — 242,000. That’s the highest reading since last August. It’s not a recession-level figure… but the trend has been steadily higher since the first of the year.

- Meanwhile, inflation at the wholesale level is going into reverse, at least for the moment — the Producer Price Index down 0.2% in May. Year-over-year, wholesale inflation is now running 2.2%.

Speaking of the job market, Powell acknowledged yesterday that the headline number Wall Street obsesses on each month — the number of new jobs allegedly created — “may be a bit overstated.” That too is a subtle cue the Fed won’t hold the line on interest rates indefinitely…

![]() Power Grid Under Stress: Prepare for “Flex Events”

Power Grid Under Stress: Prepare for “Flex Events”

A new study affirms what we’ve been warning you for two years: The U.S. power grid is so shaky that Americans are at increasing risk of blackouts.

A new study affirms what we’ve been warning you for two years: The U.S. power grid is so shaky that Americans are at increasing risk of blackouts.

The study was commissioned by North Dakota’s state government and conducted by a firm called Always On Energy Research. Its conclusion? The EPA’s new rules governing “greenhouse gases” will force the shutdown of many coal-fired power plants… while new solar and wind capacity coming online won’t be nearly enough to replace them.

As the Washington Free Beacon site points out, “The study largely echoes concerns that have been voiced by the U.S. grid watchdog, the North American Electric Reliability Corporation; regional grid operators; and power utility companies.”

It’s absolute madness at a time when the capacity of the power grid is no greater now than it was a decade ago… while AI’s demands on the power grid are growing an estimated 26–36% a year.

"Biden's Green Agenda is shutting down baseload power and is rapidly destabilizing our electrical grid,” says North Dakota Gov. Doug Burgum. “Electricity costs are up 30% under Biden already."

Yeah, Burgum is auditioning to be Donald Trump’s running mate. But he’s not wrong.

As we mentioned last month, a coalition of attorneys general from “red states” is suing in hopes of putting a stop to the rules.

In the meantime, electric customers in the Seattle area are already being prepped for rolling blackouts.

In the meantime, electric customers in the Seattle area are already being prepped for rolling blackouts.

Late last year, Puget Sound Energy launched a program called “PSE Flex.”

As its website explains, “Our region’s demand for energy is growing, which can put stress on the electrical grid. Residential electric customers can help by voluntarily reducing energy usage on days when demand for electricity is forecast to peak, known as ‘Flex events.’”

And get a load of this creepy language: “We’re using a combination of behavioral change and smart technology to maintain steady and efficient energy consumption during critical periods of high demand. Additionally, PSE Flex will play a pivotal role in our commitment to providing 100% carbon-free electricity by 2045.”

For now, it’s voluntary. In the future? Don’t count on it…

![]() Fed Funnies

Fed Funnies

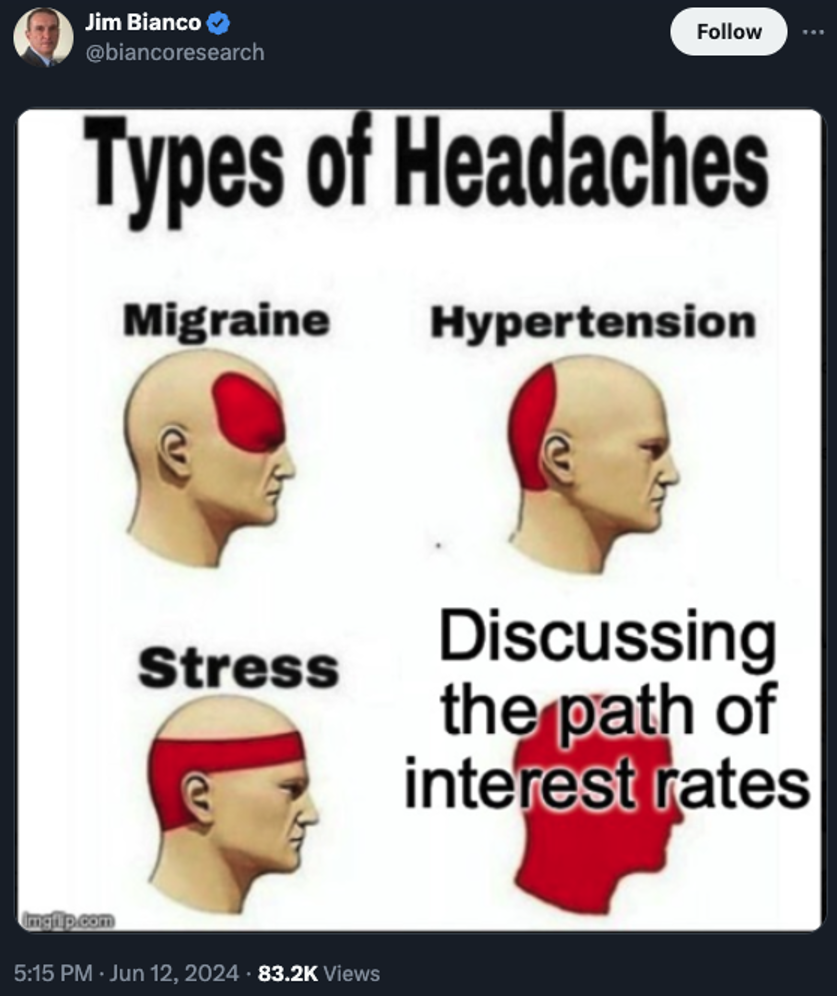

Before the mailbag, we pause for some Fed humor courtesy of the Twittersphere (Xspere?)...

Before the mailbag, we pause for some Fed humor courtesy of the Twittersphere (Xspere?)...

![]() Mailbag: Russia-Ukraine, Beer Taxes

Mailbag: Russia-Ukraine, Beer Taxes

Our exploration this week of “Biden’s Big Steal” prompts the following reader inquiry…

Our exploration this week of “Biden’s Big Steal” prompts the following reader inquiry…

“Jim Rickards has opined many times that the U.S. freezing and (perhaps) seizing of American securities registered to Russia is a violation of international law, and that other countries, especially our adversaries, have been dumping their U.S. IOUs for fear that they will be next.

“But Jim has never proffered an opinion (that I remember) of what actions he thinks would have demonstrated to Russia that the invasion of, first, Georgia, and then Ukraine, were deplorable in the eyes of the global community? Perhaps he thinks that supplying weapons to Ukraine is sufficient?”

Dave responds: With intelligent diplomacy, Russia’s invasion could have been headed off before it began.

The trouble all comes back to Washington’s insistence that Ukraine be allowed to join NATO. Moscow, in contrast, sought guarantees that Ukraine — the nation on its doorstep — would be independent and neutral.

As Jim explained a few weeks before the invasion in 2022, “This is what Austria was during the Cold War.

“Austria was not in NATO at the time. It was, I would say, culturally, religiously and politically pro-Western, but they had to maintain neutrality to avoid either being absorbed behind the Iron Curtain, absorbed into the Soviet Union's sphere of influence. They couldn't be fully Western, even though culturally, they were.”

Alas, Joe Biden and his not-so-dynamic duo of Antony Blinken and Jake Sullivan had other ideas — throwing young Ukrainians into the meat grinder for the purpose of “weakening” Russia. The effort is floundering, both militarily and financially.

“Yikes!” writes one of our regulars after one of our periodic explorations of beer taxes in yesterday’s edition.

“Yikes!” writes one of our regulars after one of our periodic explorations of beer taxes in yesterday’s edition.

“Did you have to show the beer taxes map and link to the Tax Foundation’s article and chart? I shudder to think what these Washington (the state, not D.C.) lawmakers will see that we are in the middle of the road for beer taxes.

“You know, Washington doesn't have an income tax, which is such a misnomer. We put up with some of the highest sales, real estate and gas taxes in the country to ‘take up the slack.’

“Egads, now they'll have an idea to increase those already high ‘sin taxes’!

“Somehow, my nice cold one just got warmer, sigh…”

Dave: They always get you one way or another, right?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets