Musk’s Unified Mars Theory

![]() Energy Storage in Space

Energy Storage in Space

Chinese scientists have achieved a breakthrough in battery technology that could transform energy storage.

Chinese scientists have achieved a breakthrough in battery technology that could transform energy storage.

Researchers at the Dalian Institute of Chemical Physics developed new organic molecules for aqueous organic flow batteries (AOFBs).

- Mechanism: Aqueous organic flow batteries generate electrical current using molecules dissolved in liquids stored on opposite sides of a membrane.

- New Molecules: The Chinese team created novel naphthalene-based derivative molecules that remain stable in normal air, minimizing side reactions that degrade battery performance.

In fact, the study “found that the battery worked for about 22 days when exposed to continuous airflow ‘without obvious capacity decay,’” says The Cool Down (TCD).

Of course, no discussion of battery technology would be complete without taking a look underneath the hood at Tesla…

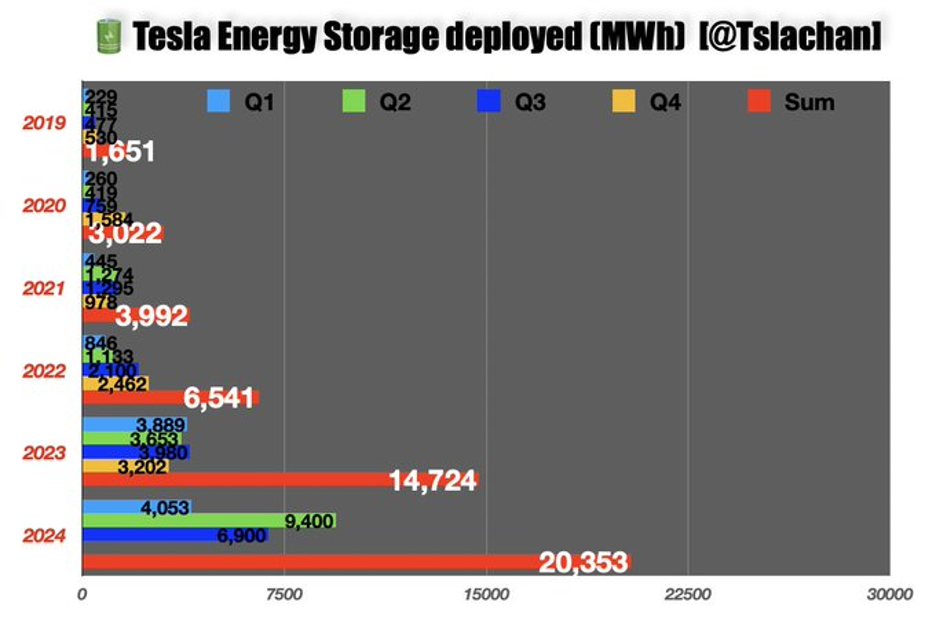

Tesla Energy reported record-breaking energy storage deployments for its Powerwall and Megapack products in the second quarter of 2024, according to Paradigm editor — and James Altucher’s right-hand man — Chris Campbell.

Tesla Energy reported record-breaking energy storage deployments for its Powerwall and Megapack products in the second quarter of 2024, according to Paradigm editor — and James Altucher’s right-hand man — Chris Campbell.

Powerwall is Tesla's rechargeable lithium-ion battery designed for residential use. With a capacity of 13.5 kWh, Powerwall stores excess solar energy or grid electricity for later use, providing backup power during outages and helping homeowners optimize energy usage, ideally for cost savings.

Source: Tesla.com

Powerwall 3

Megapack, on the other hand, is Tesla's large-scale energy storage solution, intended for commercial applications. Each Megapack unit can store up to 3.9 MWh of energy…

Source: Tesla.com

One Megapack unit

Meanwhile, multiple Megapacks can be combined to create energy storage installations — to be used for grid stabilization, load shedding and managing power supply and demand more efficiently.

Tesla's energy storage business? Showing massive growth potential.

Tesla expects its energy-storage revenue to outpace revenue from its automotive business this year.

“In practical terms, this means Tesla installed more battery storage systems than ever before so far in 2024,” Chris says.

“In practical terms, this means Tesla installed more battery storage systems than ever before so far in 2024,” Chris says.

“While Tesla Energy’s 6.9 GWh worth of deployments in Q3 2024 are lower than Q2 2024’s 9.4 GWh, it remains extremely impressive. It is, if any, still the highest energy deployments in the third quarter by Tesla Energy to date,” according to Teslarati.

Source: X

“Large-scale storage can help us out here on Earth, no doubt,” says Chris.

“Powerwall and Megapack technologies are training grounds for creating self-sufficient energy systems. (Even if nuclear power is the play, advanced storage systems are necessary.)

“These storage solutions are crucial for managing intermittent solar power… key for Mars,” Chris adds.

“These storage solutions are crucial for managing intermittent solar power… key for Mars,” Chris adds.

To Chris’ way of thinking, all Elon Musk's ventures are interconnected with the goal of establishing life on Mars. (And here you thought yesterday’s episode was ripped from the pages of a sci-fi novel.)

The Cybertruck, for example, uses the same stainless steel as SpaceX's Starship… Designed perhaps as a prototype Mars ground vehicle? Musk said as much when he X-tweeted the Cybertruck will be the “official truck of Mars.”

And other Musk projects align with Mars colonization:

- Starlink for interplanetary communication

- The Boring Company for underground Martian habitats

- Neuralink for enhancing human capabilities in space

- Tesla robots for automated labor on Mars.

“Once you see it, you can’t unsee it,” Chris says. “All these seemingly disparate and random moves are part of [Musk’s] master plan.

“And there’s one thing that’s going to pull it all together: AI,” Chris concludes. “Artificial intelligence isn’t just a trend,” he says, “it’s the driving force behind the most groundbreaking advancements of today.”

And don’t forget Musk is about to reveal another huge piece of the puzzle tomorrow at Tesla’s AI-themed investor day event.

Of course, Musk’s companies can’t do it alone. Tesla might well be partnering with a small AI company. Without it, Musk’s plans would be dead in the water.

Says James Altucher: “If Musk mentions this stock by name tomorrow when he gives his speech in Burbank, California, shares of this AI stock could explode.”

Of course, the time to be in position is before Musk starts name-dropping. James urges you to click here and check out this talk with his top tech analyst Ray Blanco while there’s still time.

![]() United States v. Google

United States v. Google

Yesterday, the DOJ filed a proposed remedy framework — “asking a judge to force Google to divest parts of its business,” according to an article at The Register.

Yesterday, the DOJ filed a proposed remedy framework — “asking a judge to force Google to divest parts of its business,” according to an article at The Register.

“Structural remedies” in antitrust cases “typically refers to the breaking up of a company into smaller businesses, or divestment of particular assets. In this specific case, that might mean Google's Chrome browser or its Android mobile operating system.

- “Within the proposed remedy framework, the DoJ says it is considering remedies to address four categories of harms related to Google's conduct, comprising search distribution and revenue sharing; generation and display of search results; advertising scale and monetization; and accumulation and use of data,” The Register says.

If the DOJ pushes its case through federal court, “it would represent arguably the biggest regulatory intervention in the history of Big Tech,” the BBC notes.

In a blog post response, Google’s vice president of regulatory affairs, Lee-Anne Mulholland, claims “government overreach.”

(Which is rich coming from the company which quietly jettisoned its “Don’t be evil” motto after partnering with the DOD on AI-drone tech Project Maven in 2018. And embarrassing itself with the ultra-woke AI platform Gemini early this year.)

GOOG shares so far today are down about 2%. Taking a look at the overall stock market, the three major U.S. indexes are in the green. The Dow leads the way, up 0.70% to 42,375; at the same time, the Nasdaq and S&P 500 have both gained about 0.50% to 18,270 and 5,780 respectively.

As for commodities, crude’s pulled back about 0.50% to $73.17 for a barrel of WTI. (More on oil in a moment.) Gold, too, has pulled back about 0.10% to $2,632.30 per ounce. Silver, however, is up 0.80% to $30.85.

Peeking at crypto, Bitcoin is up 0.10% to $62,250 while Ethereum’s up about 1% to $2,460.

![]() The Optimal “Fear Trade”

The Optimal “Fear Trade”

“What’s the ideal fear trade that’s ready to blast higher over the next few weeks?” asks Paradigm’s chart hound Greg “Gunner” Guenthner.

“What’s the ideal fear trade that’s ready to blast higher over the next few weeks?” asks Paradigm’s chart hound Greg “Gunner” Guenthner.

“Of course, the situation in the Middle East is aiding the dramatic rise in oil and energy names…

- “Goldman Sachs is now warning Brent crude could see $90-plus if Iranian oil comes off the market.

- “Turning to WTI, buyers have stepped up every time light crude has retreated to the mid-$60 range. And thanks to the fear factor, it has enjoyed a 15% bounce off those lows.”

“You simply cannot buy an index fund and expect to capture any returns from the energy sector, especially since many of the most prolific ‘dirty’ energy names have been purged from the indexes,” says Gunner.

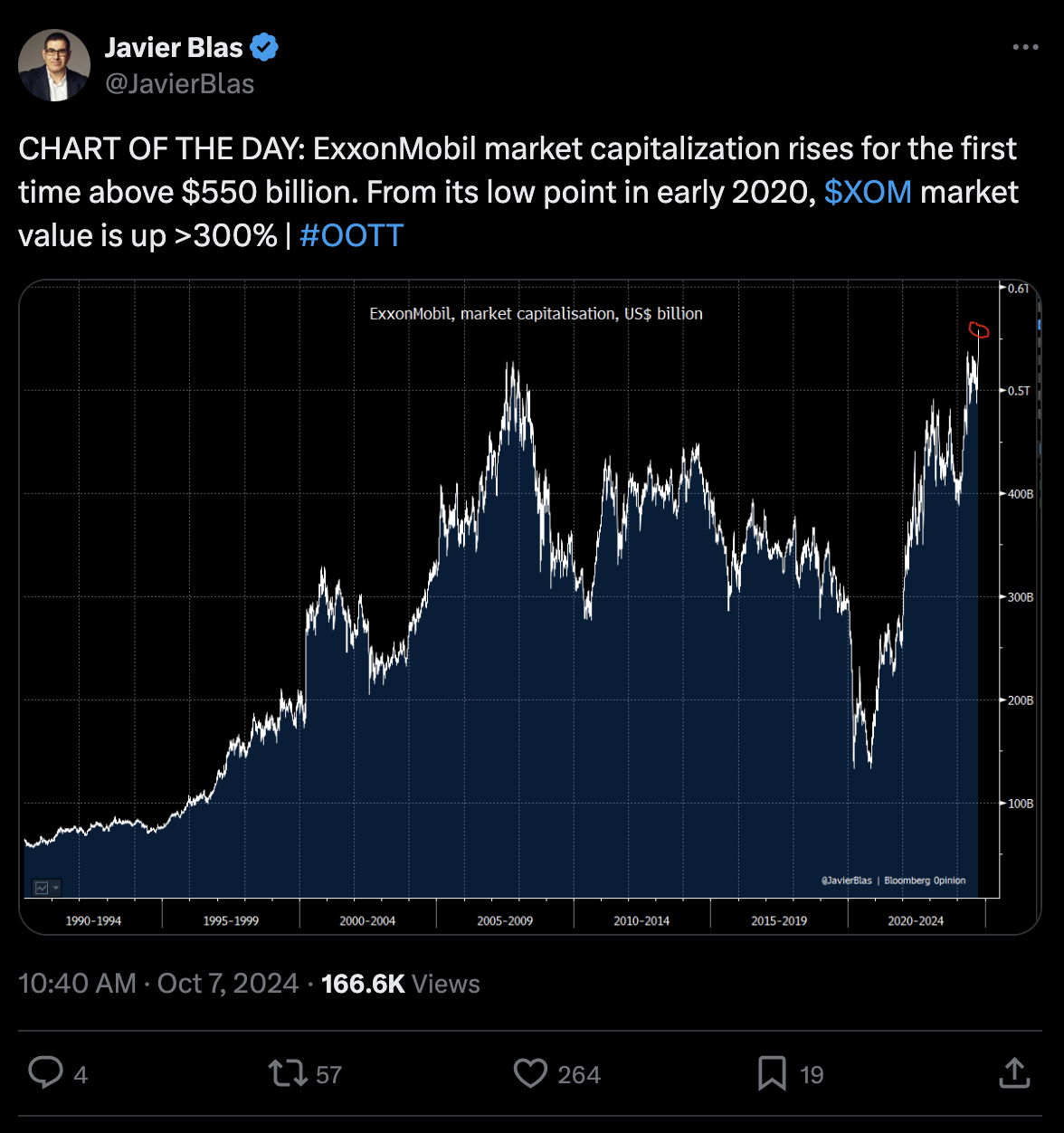

“Case in point: XOM. The Dow booted Exxon Mobil in 2020 shortly after oil futures went negative in the midst of the pandemic crash. At the time, XOM was trading near 15-year lows.

“Not anymore! XOM is casually hitting new all-time highs this week,” Gunner says. “The stock has now climbed around 300% off its 2020 lows…

“XOM also doubled its Permian Basin holdings after acquiring Pioneer Natural Resources for $60 billion last fall.

“As more investors notice Exxon Mobil’s sly breakout, money will flow upstream to the exploration and production industry,” adds Gunner.

“As more investors notice Exxon Mobil’s sly breakout, money will flow upstream to the exploration and production industry,” adds Gunner.

“These are the companies pulling the raw material from the earth: Transocean (RIG), Occidental Petroleum (OXY), Diamondback (FANG) and Marathon Oil Corp. (MRO).

“We could also see additional mergers and acquisitions in the sector since ESG makes it more attractive for the majors to acquire, rather than develop, acreage,” Gunner notes:

- The FTC recently approved Chevron’s acquisition of Hess

- Diamondback Energy closed its merger with Endeavour Energy Resources last month

- Even midstreams are merging, with Oneok acquiring Magellan Midstream Partners last fall.

Gunner’s takeaway: “Once money starts pouring in — combined with a little bit of fear — we’ll know we’re in the thick of a strong energy bull,” he says.

![]() “Deeply Undervalued Gold Miners”

“Deeply Undervalued Gold Miners”

Despite gold's impressive 27.71% year-to-date gain, mining stocks have lagged behind, creating a compelling investment opportunity.

Despite gold's impressive 27.71% year-to-date gain, mining stocks have lagged behind, creating a compelling investment opportunity.

“We believe the stage is set for a powerful advance in gold mining equities,” says heavyweight industry analyst John Hathaway, who notes that “precious metals mining shares are just beginning to stir.”

This disconnect between gold prices and mining stock performance has created what Hathaway calls “significant catch-up potential for deeply undervalued gold miners.”

Factors supporting Hathaway’s outlook include…

- Favorable fundamentals: “The investment fundamentals for miners have rarely been so favorable against a backdrop of such disinterest.” For instance, Q3 2024 average gold prices are up 18.8% year-over-year, which should boost miners' earnings.

- Underpriced gold: Many investors remain skeptical about gold's sustainability at current prices, but the mainstream financial media has underreported variables like de-dollarization and central bank buying.

- Lack of Western participation: “Gold's 78.92% five-year advance has occurred with almost no participation from U.S. and European investors,” says Hathaway, suggesting significant potential for inflows when sentiment shifts.

- Early-stage bull market: “The current bull market for gold is embryonic,” he adds, with classic signs like widespread skepticism and under-positioning present.

Hathaway concludes: “Gold stocks, in our opinion, are coiling for a sharp advance during the remainder of 2024.”

But he advises patience: “Valuations remain exceptionally attractive [and] the upside potential that likely lies ahead may be well worth any additional wait.”

![]() Big Brother: Kuwait and U.K. Editions

Big Brother: Kuwait and U.K. Editions

Kuwait will begin enforcing its biometric fingerprinting requirement for citizens who missed the Sept. 30 deadline.

Kuwait will begin enforcing its biometric fingerprinting requirement for citizens who missed the Sept. 30 deadline.

In fact, nearly 60,000 Kuwaitis failed to register in time, and now the government has set a final deadline of Nov. 1 for citizens to comply.

And the punishment for noncompliance is exceptionally harsh: nothing short of financial cancellation.

“Individuals who have not completed the biometric process are subjected to immediate account freezing and banking transaction suspension,” Arab Times reports.

Source: X

Banks are already notifying affected customers that by mid-October, their bank cards will be deactivated.

By Nov. 1? Even in-person withdrawals will be blocked. Plus, the government says it will suspend civil ID cards for non-compliant individuals.

As one might imagine, daily registrations have increased from 600 to 6,000 as people rush to comply.

On a less serious (but still intrusive) note…

Starting Oct.1, 2024, British chicken owners — namely, backyard enthusiasts who keep 50 or fewer chickens — are now required to register their birds with the government.

Starting Oct.1, 2024, British chicken owners — namely, backyard enthusiasts who keep 50 or fewer chickens — are now required to register their birds with the government.

The regulation, ostensibly aimed at combating bird flu, requires the registration of even a single chicken. The process involves providing contact details and bird location to the Animal and Plant Health Agency (APHA).

And the rule extends to other domesticated birds as well — if a pet bird spends any time outdoors, “for example to be exercised, trained or taken to bird gatherings or shows,” according to guidance at Gov.uk.

Of course, cheeky pranksters briefly crashed the government’s website by registering rubber chickens, roast chickens and even chicken nuggets. Well done, you!

But the law is no joke: Bird owners who run afoul of registration could risk fines of £5,000 or even being cooped up for six months in prison.

What a world…

Take care, reader. And join us again tomorrow!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets