Middle East War Spreads Like Cancer

![]() Middle East War Metastasizing

Middle East War Metastasizing

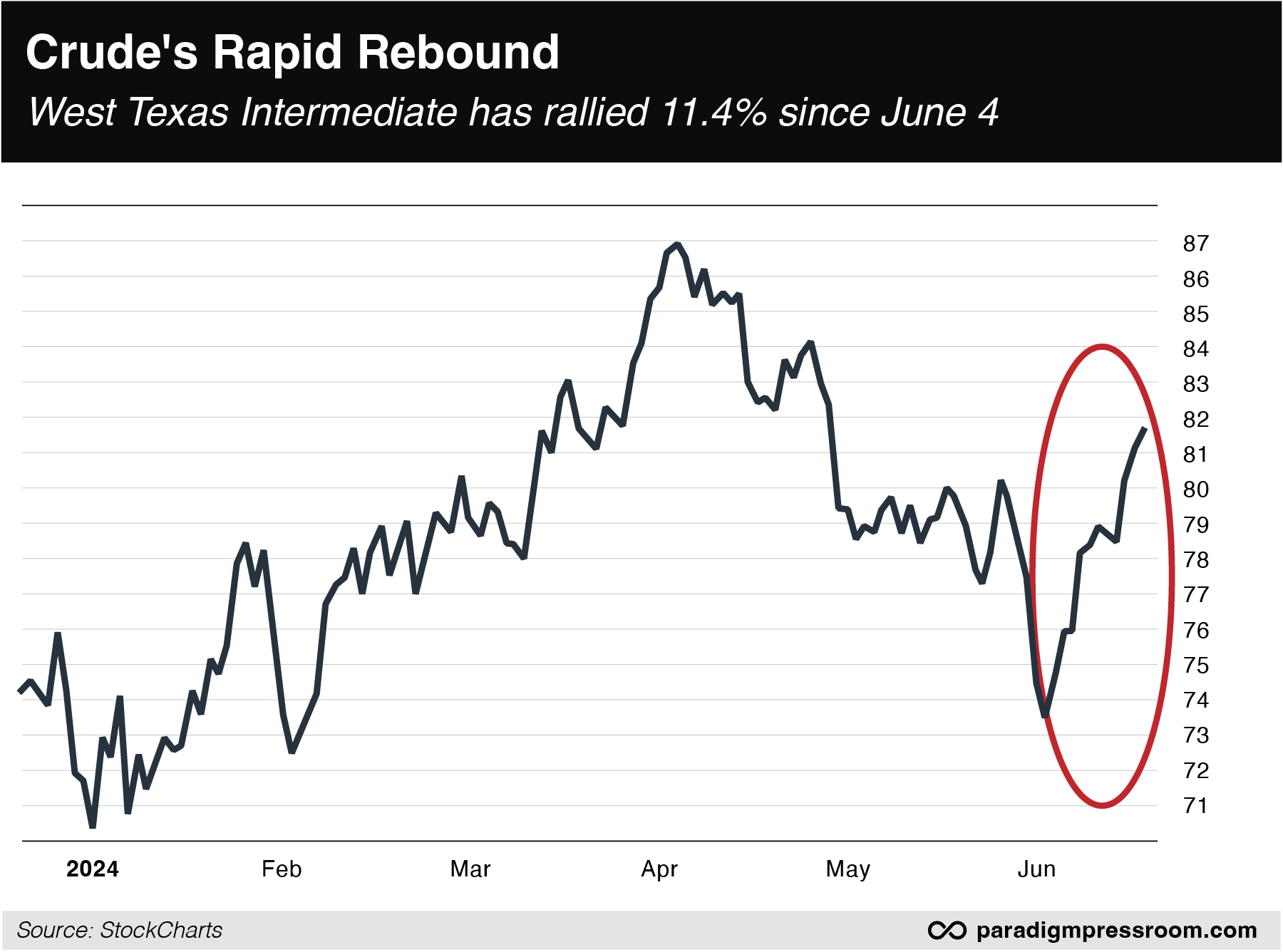

It’s often dangerous to attach reasons to one or another market move — but it’s safe to say that crude oil’s sharp rally this month…

It’s often dangerous to attach reasons to one or another market move — but it’s safe to say that crude oil’s sharp rally this month…

… has something to do with the prospect of a widening war in the Middle East.

Israel’s ongoing assault on Gaza has receded from the headlines, becoming so much background noise. But it’s becoming evident that Prime Minister Benjamin Netanyahu is keen to open up a second front in southern Lebanon — a move that could easily put U.S. troops in harm’s way.

Before we go any further, a geography lesson of sorts from Paradigm’s macro maven Jim Rickards…

Before we go any further, a geography lesson of sorts from Paradigm’s macro maven Jim Rickards…

When it comes to Israel, the West Bank, southern Lebanon, southern Syria, “it’s amazing how compact and close together it all is,” says Jim — who’s been in or near all of those places.

“It's only about 40 miles from the Israeli border to Damascus [the Syrian capital] and another 40 miles from the Golan Heights to the Mediterranean Sea.”

More to the point, “It only takes minutes from takeoff to do a bombing run or a missile attack and perhaps only a day or two to move tank battalions depending on resistance.”

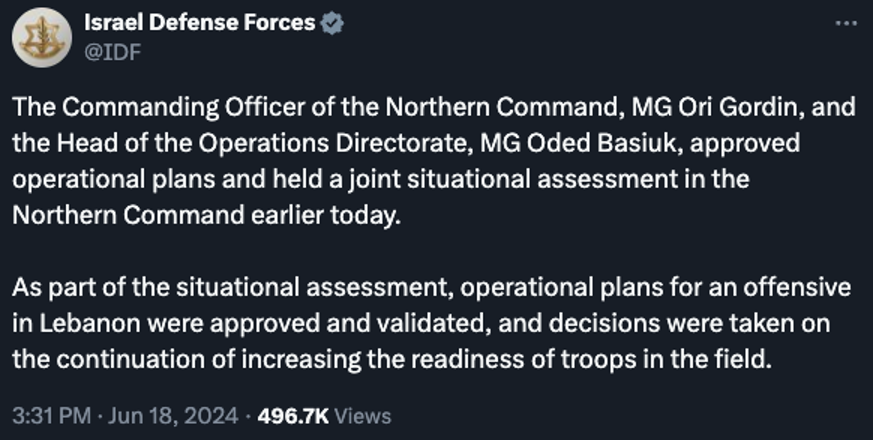

On Tuesday, the Israel Defense Forces left no doubt that they’re readying a full-on assault against the Hezbollah militant group in southern Lebanon.

On Tuesday, the Israel Defense Forces left no doubt that they’re readying a full-on assault against the Hezbollah militant group in southern Lebanon.

Hezbollah and the IDF have been waging low-grade warfare for months. In recent weeks, it’s escalated — Israel carrying out assassinations and airstrikes deeper inside Lebanon, Hezbollah launching bigger missile volleys at Israel. Tens of thousands of people on both sides of the border have fled their homes.

One of Joe Biden’s Middle East envoys, a dual U.S.-Israeli national named Amos Hochstein, was dispatched to Lebanon this week. It doesn’t seem as if his mission was to calm the waters.

According to a “senior Arab official” cited by the Middle East Eye website, the message Hochstein delivered to Lebanon’s prime minister is that Washington will back an Israeli assault on Lebanon.

Yesterday, Hezbollah leader Hassan Nasrallah said his group is ready for anything: “We have more than 100,000 fighters, and even more, even in the worst-case scenario.” He added, “No place… will be spared our rockets.”

![]() Hezbollah: Much More Potent Than Hamas

Hezbollah: Much More Potent Than Hamas

Lebanon-based Hezbollah is a far more potent fighting force than Gaza-based Hamas… but an attack targeting Hezbollah might be the only way Prime Minister Netanyahu can cling to power.

Lebanon-based Hezbollah is a far more potent fighting force than Gaza-based Hamas… but an attack targeting Hezbollah might be the only way Prime Minister Netanyahu can cling to power.

“Beleaguered” doesn’t even begin to describe his political position.

For one thing, the Israeli military is pouring cold water on his war aims in Gaza. “This business of destroying Hamas, making Hamas disappear — it’s simply throwing sand in the eyes of the public,” says Rear Adm. Daniel Hagari, the Israeli military’s chief spokesman. “Hamas is an idea, Hamas is a party,” he told Israel’s Channel 13 outlet yesterday. “It’s rooted in the hearts of the people — whoever thinks we can eliminate Hamas is wrong.”

For another thing, it’s now evident Israeli leaders overlooked the military’s own warnings ahead of Hamas’ attack inside Israel on Oct. 7 last year. Israel’s state-media outlet KAN-TV reports that the Israeli army’s Gaza Division issued a document warning about the attack before it went down — even citing the number of Israeli hostages Hamas aimed to take, between 200–250. Sure enough, Hamas captured about 250.

On top of all that, Netanyahu’s fractious governing coalition is falling apart. The Times of Israel describes “a growing number of high-profile spats involving members of his coalition.”

Key point: As long as Netanyahu holds onto power, he can continue to drag out his trial on corruption charges — a trial that’s been underway since May 2020. Out of power, he might well face a prison term in short order.

All of these bad headlines go away, at least for a while, if he launches another war.

Yes, the risks of an Israeli assault on Lebanon are huge.

Yes, the risks of an Israeli assault on Lebanon are huge.

Back to Jim Rickards: “The best information is that Hezbollah has devised ways to avoid Israel's Iron Dome air defense system, most likely through the use of drones…

“In the past, Israel could rely on its Iron Dome to protect most major cities and many settlements. That defense has now proved inadequate, and Hezbollah is systematically attacking Israeli bases, radars, intelligence-collections facilities and other defense system components…

“These attacks have three effects: They break down Israeli military and intelligence systems, terrorize the civilian population and handicap Israel's ability to conduct air attacks on Syria or Lebanon. Iron Dome is being referred to in the region as ‘Iron Done.’

“Israel's recourse is to stop playing defense and go on offense,” Jim continues.

“Israel's recourse is to stop playing defense and go on offense,” Jim continues.

“That means massive air strikes on Lebanon and Syria, even at the cost of missile attacks on Israel. The Israelis might be able to scrounge up some Patriot anti-missile systems from the U.S., but there are very few left because they've been wasted in Ukraine.” [Just in: “The Biden administration will rush the delivery of air-defense interceptors to Ukraine by halting delivery to allied nations,” reports The Wall Street Journal.]

It’s true that Lebanon is not a major oil producer. But the longer that war rages in the Levant, the greater the likelihood of war spilling into nearby countries that are major oil producers. That might be what the oil price is sniffing out as spring turns to summer.

[Editor’s note: To date, 2,583 people have claimed a financial war kit courtesy of Jim Rickards — and only a few hundred remain in our warehouse.

Right now, its contents are worth around $300. But in the event of an all-out global financial war — which could easily break out amid the Middle East conflict — its value could be much, much more. For the time being, we still have enough stock in our warehouse for you to claim yours. Details here.]

➢ Speaking of the war spilling over… If an Israeli assault on Lebanon leads to attacks by Islamist militants on U.S. troops in nearby Jordan, Syria and Iraq… so much the better from Netanyahu’s standpoint. U.S. casualties will reflect badly on Joe Biden — and it’s the worst-kept secret in both Tel Aviv and Washington that despite the unprecedented level of support Biden has given Israel since Oct. 7, Netanyahu wants to see Donald Trump back in the White House.

![]() Nvidia: Dot-Com Redux?

Nvidia: Dot-Com Redux?

The Nvidia skeptics are out in force…

The Nvidia skeptics are out in force…

At the close of trading Tuesday, Nvidia took Microsoft’s crown as the world’s biggest publicly traded company — with a market cap of $3.335 trillion. Impressive, considering it wasn’t even in the top 20 five years ago.

Nvidia shares have tripled in the last year. Checking our screens this morning, they’re up another 2% on the day.

Even the mainstream is casting a side-eye toward this monster rally. The front page of today’s Wall Street Journal is likening Nvidia in June 2024 to Cisco in March 2000: CSCO became the biggest company by market cap at the very moment the dot-com bubble was starting to burst.

NVDA might be overstretched, but woe be to anyone betting against it by short selling or put options right now.

As John Maynard Keynes famously observed, “The market can remain irrational longer than you can remain solvent.”

As for the major stock averages today, the Nasdaq and the S&P 500 are both creeping higher into record territory. At last check, the S&P is only six points away from 5,500.

As for the major stock averages today, the Nasdaq and the S&P 500 are both creeping higher into record territory. At last check, the S&P is only six points away from 5,500.

Precious metals are rallying big-time — gold up nearly 29 bucks to $2,356 and silver vaulting past the $30 level for the first time in over a week. The aforementioned crude is now over $82. But Bitcoin has sunk below $65,000.

A handful of economic numbers worth mentioning…

- For a second week running, first-time unemployment claims are running hot by recent standards — 238,000 in the week gone by

- Housing starts for May came in less than expected — down 5.5% from April and down 19.3% from a year earlier. Much of that drop has to do with a collapse in apartment and condo construction. Meanwhile, permits — a better indicator of future homebuilding activity — came in way under expectations, indeed the lowest figure since the pandemic month of June 2020

- Mid-Atlantic manufacturing is barely growing, with the Philadelphia Fed Manufacturing Index turning in a near-flat reading of plus 1.3. The new-orders component of the index remains stuck in negative territory at minus 2.2.

None of these numbers spells imminent recession, but neither do they suggest robust growth. And there’s little relief in sight from high home prices.

![]() Fake News and “More Americans Renouncing Citizenship”

Fake News and “More Americans Renouncing Citizenship”

A little bit more today, if you’ll beg your editor’s indulgence, about “fake news.”

A little bit more today, if you’ll beg your editor’s indulgence, about “fake news.”

Consider this a follow-up to Monday’s edition about Saudi Arabia “allowing the petrodollar arrangement to expire after 50 years” — which, as we made clear, did not happen, even if the dollar’s status as the globe’s reserve currency is surely eroding.

As the week has worn on, two more hoax stories emerged — one about fencing being erected around the U.S. Supreme Court ahead of several major rulings and another about the death of Noam Chomsky, the renowned linguist and leftist activist.

As it turns out the fencing footage was over two years old… and while Chomsky has been recovering from a stroke at age 95, he was released from the hospital Tuesday.

Which brings us to the following item that went semi-viral this month…

Which brings us to the following item that went semi-viral this month…

The “paid partnership” disclaimer should be the first clue that something’s amiss: The ImExpat website posted an article by Olivier Wagner, who runs a company that helps people contend with the thicket of tax challenges that face U.S. citizens living overseas.

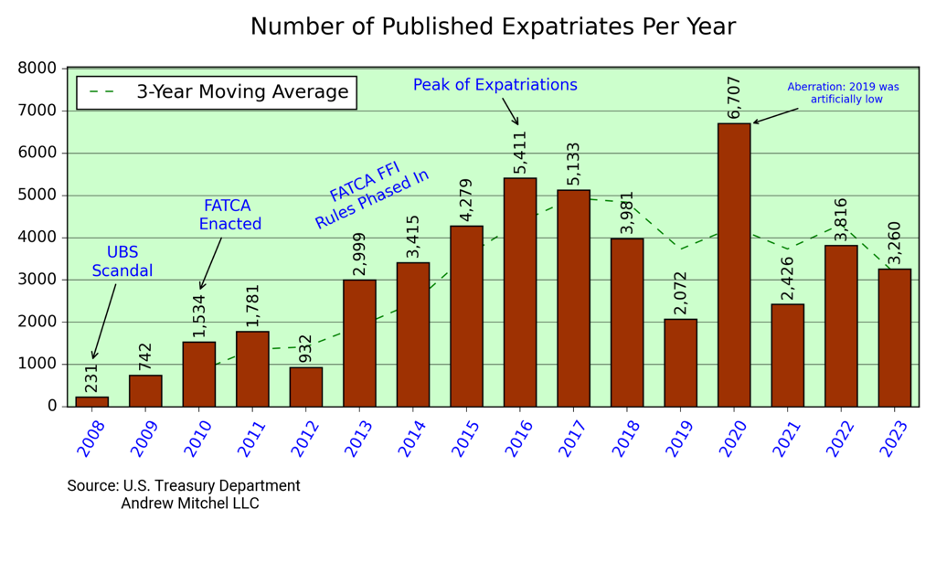

I’ve been following the saga of Americans abroad giving up their citizenship for over a decade — back to a time when the media made it seem as if it was something only rich people did to avoid taxes, like Tina Turner or Facebook co-founder Eduardo Saverin. The reality is that many people taking that step are very middle class — because the IRS’ burdens on middle-class expats can be prohibitive.

To be clear, there’s nothing really wrong with Wagner’s article — but the headline is incredibly misleading.

As Connecticut-based international tax attorney Andrew Mitchel points out, the number of Americans surrendering their citizenship peaked in 2016–17. There was a deceptive spike in 2020, the result of a backlog from 2019. Here, we reproduce verbatim an annotated chart from Mitchel’s website…

And in the first quarter of 2024, the total was only 344.

Even if the numbers aren’t what they used to be, colleague Sean Ring of the Rude Awakening says every American abroad should at least consider giving up his or her U.S. passport. As he related to readers earlier this year, he left the United States in 1999 and surrendered his citizenship in 2011.

And for the rest of us, he urges us to give ourselves the flexibility that comes from obtaining a second passport.

![]() A Golden Mailbag

A Golden Mailbag

After our special edition yesterday in which Jim Rickards laid out his forecast of $27,000 gold, we got a couple of reader inquiries…

After our special edition yesterday in which Jim Rickards laid out his forecast of $27,000 gold, we got a couple of reader inquiries…

“How much do I have to purchase?” asked one.

“I have a question about numismatic gold coins,” says another.

[Uh-oh…]

“My gold broker is always talking me out of bullion to collectible coins,” he continues. “The price of PF70 coins is about $10,000 for 1.6 oz of gold. They are nice-looking coins but how do they compare with the earning potential of gold bullion? What is your recommendation when buying physical gold?”

Dave responds: Jim has long recommended keeping 10% of your portfolio in physical gold bullion, preferably in your personal possession and definitely not in a bank’s safe-deposit box. (The time you most want to pull your gold out of the bank will likely be the time there’s a bank holiday.)

And for God’s sake, don’t include collectible coins in the mix. Well-meaning investors have been getting a song-and-dance about numismatic coins for over a decade now — it’s infuriating. (We wrote about the latest variation on the theme last summer.)

If you want to get into numismatic coins because you’re interested in old coins and/or you’re intrigued by their speculative value, knock yourself out — but don’t do it without guidance from a knowledgeable professional. Sorry, we can’t recommend any names for numismatics; that’s just not our collective area of expertise at Paradigm.

But for bullion coins to help preserve and grow your wealth, you can’t do better than our friends at Hard Assets Alliance.

Check them out at this link. The usual disclaimer applies: Paradigm owns a piece of Hard Assets Alliance and will collect a small cut once you fund your account. But we took on that ownership stake only after Hard Assets Alliance proved for several years that they do right by our customers.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets