The Truth About AI

![]() For Once, the Reality EXCEEDS the Hype (AI)

For Once, the Reality EXCEEDS the Hype (AI)

“This is the first time in any industry I've actually seen when the reality almost instantly became greater than the hype,” says Paradigm Press AI authority James Altucher.

“This is the first time in any industry I've actually seen when the reality almost instantly became greater than the hype,” says Paradigm Press AI authority James Altucher.

James spoke on Monday at the annual SXSW gathering in Austin, Texas. The twin topics he addressed — artificial intelligence, and how budding AI companies can raise money.

James knows a thing or two about both. He had an academic paper about AI published at the tender age of 20 (he’s in his mid-50s now!) and he had a hand in developing IBM’s Deep Blue chess-playing robot. In more recent years he was active in the venture capital space alongside some of Silicon Valley’s legends.

When it comes to AI and AI investing… he’s been there, done that.

Yesterday in Austin, James did a livestream exclusively for Paradigm readers, expanding on his latest AI thoughts.

And yes — while the hype for the Internet and crypto got ahead of itself over the last 30 years, the reality of AI is even better than the hype. “People aren't even fully aware of what AI is capable of and how valuable it is and how it's really at this point in time propping up the entire economy,” James said.

“And that's going to continue. For instance, if AI creates a trillion dollars of value in the economy, that means some investors out there are dividing up that trillion dollars. And so yes, there's a lot of difficult things happening in the market right now, but we want to be able to participate in the growth and the wealth that's being created by AI.”

We’re going to address an immediate objection you might have: Isn’t AI in a bubble? Isn’t this as dangerous as investing in, say, Amazon in 1999 just before the dot-com crash?

We’re going to address an immediate objection you might have: Isn’t AI in a bubble? Isn’t this as dangerous as investing in, say, Amazon in 1999 just before the dot-com crash?

“Let me just define ‘bubble’ really quickly,” said James. “A bubble is when a stock or any asset, but let's say a stock is up today for only one reason, because it was up yesterday. Everybody said, ‘Oh, this is going up. I'm going to buy it.’ So they're only buying it because something's going up. So then it keeps going up until the bubble bursts, because it can't go up forever.”

That’s not where AI is now. “AI actually is generating — I think in 2023, $600 billion was spent by companies directly buying AI products and services,” he went on.

“And the number's actually much greater and the number's going to be even greater still in 2024, 2025, 2026. So our job is to find the companies that are getting these hundreds of billions of dollars because they're going to surprise everyone with their earnings and revenues and so on. So that's the key.”

We’ll leave it there today. You’re cordially invited to watch the entire replay of James’ talk with our VP of Publishing Doug Hill. In the first half-hour or so, he rattles off the names of two AI-related companies for your investing consideration. Later on, he and colleague Chris Campbell name two more AI stocks along with two cryptos worth a look.

This is free content we’re serving up for you — especially if you’re a longer-term reader and you’re not yet fully on board with the potential of crypto and AI. Watch the replay at this link, get to know James a little better and grab a pen and paper to take down the names and tickers.

No hard sell, just solid info: Watch now

![]() The Markets Today: Copper Shines

The Markets Today: Copper Shines

The most interesting market action today is in the commodity complex.

The most interesting market action today is in the commodity complex.

Start with oil: The Energy Department issued its weekly inventory figures this morning — and they show a drawdown in stockpiles of crude for the first time in several weeks. With that, a barrel of West Texas Intermediate is up $1.50 at last check, back above $79.

Next, precious metals: As mentioned yesterday, they got smacked down a bit after the official inflation numbers came out… but they’re aiming to stage a comeback today.

Gold is up $14.50 to $2,172 — not too far off the $2,180–2,185 range where it was trading on Monday. Silver is looking stout as well, up 60 cents to $24.67.

And then there’s copper. Don’t look now, but the red metal is back within spitting distance of $4 a pound.

And then there’s copper. Don’t look now, but the red metal is back within spitting distance of $4 a pound.

It’s flirted with this level several times since Thanksgiving, only to take a spill back toward the $3.70–3.75 level.

One possible catalyst behind the latest rally is the launch of a new copper-miners ETF by the Canadian financial giant Sprott. Logically called the Sprott Copper Miners ETF (COPP), its top three holdings are Freeport-McMoRan, Antofagasta and Southern Copper — together making up about a third of the portfolio.

As for stocks, not much to say. The major indexes are mixed.

As for stocks, not much to say. The major indexes are mixed.

At last check, the S&P 500 is down a mere eight points from yesterday’s record close, now 5,166. The Dow is up just over a third of a percent to 39,161… while the Nasdaq is down a half-percent to 16,181.

The fortunes of the Nasdaq and to a lesser extent the S&P 500 continue to follow the fortunes of Nvidia (NVDA) — down big on Friday, down again on Monday, up sharply yesterday, but down 3.4% today.

![]() Race to the Bottom: An Update

Race to the Bottom: An Update

It appears Congress is waking up to the potential of deep-sea mining — nine months after we started talking it up in this space.

It appears Congress is waking up to the potential of deep-sea mining — nine months after we started talking it up in this space.

“U.S. lawmakers introduced a new bill to Congress on Tuesday aimed at stepping up American interests in deep-sea mining, specifically pushing for financial, diplomatic and infrastructure support for the industry,” says The Wall Street Journal.

“Deep-sea mining, the process of collecting minerals from the seafloor, remains controversial with environmental groups but has been gaining traction with U.S. lawmakers as a way of providing alternate sources of minerals needed for U.S. industry needs without having to rely on China.”

Paradigm’s technology-investing maven Ray Blanco has been on the case since last year: Sections of the ocean floor are littered with “polymetallic nodules” — easily mined clumps of valuable metals like nickel, cobalt, manganese and copper.

But only a handful of nations have opened the door to deep-sea mining — most recently Norway, as we mentioned last month.

Back to the Journal article: “The draft bill calls for the Commerce Department to produce a report to be submitted to the president and Congress detailing a description of the current legislation pertaining to sourcing seafloor products from outside U.S. waters and details on how a tariff system would work.”

So far, the bill in Congress seems to have the support of only Republicans — who are sold on the metals’ value in weaponry. But given the use of those same metals in electric vehicle batteries, it shouldn’t be a hard sell for Democrats.

![]() Google Gemini “Nopes out” of the Election

Google Gemini “Nopes out” of the Election

Yeah, so under the circumstances, this seems like a prudent move.

Yeah, so under the circumstances, this seems like a prudent move.

As you’ll recall, Google’s AI chatbot Gemini beclowned itself last month when it proved so “woke” that it was unwilling or unable to generate images of white faces — going so far as to serve up pictures of Black and Asian Nazis.

Thus, Gemini will bow out of answering questions related to elections in the many countries where elections take place this year, starting with India next month. “Out of an abundance of caution,” says a Google statement, “we're restricting the types of election-related queries for which Gemini will return responses."

BBC reporters tried their hand at posing election questions and each time got the response: “I'm still learning how to answer this question. In the meantime, try Google Search."

Which could also be problematic — but at least that’s a known quantity?

![]() The Mailbag (and an Update): TikTok Ban

The Mailbag (and an Update): TikTok Ban

“The banning TikTok thing is really interesting, and I think your perspective about it is spot on,” writes a reader — who has three points he’d like to make.

“The banning TikTok thing is really interesting, and I think your perspective about it is spot on,” writes a reader — who has three points he’d like to make.

“(1) Once you start banning media of communication, where does it end? I think this is a real problem with this plan. I am not sure what the limiting principle is. If it's misinformation and private data collection, there are going to be a whole lot more banned than TikTok.

“(2) If anything TikTok is a cultural problem, not a legislative problem. Is it horrible? Yes. But so are a lot of other things we both fight tooth and nail to keep. There is no question that it is a tool of psychological warfare and cultural demise being used by the Chinese. I couldn't care less whether there is any ‘proof’ that the Chinese are collecting data and using it to power its AI and using it to manipulate Americans. They are, as anyone with any experience with business in China knows.

“But to your point, this problem can and should only be solved by using the bully pulpit, the church pulpit and parents. Too many don't want to do this hard work and would rather legislate. So what now? Ban TikTok. OK, it will pop back up with another name. Maybe focus in on the data collection instead. For example, almost every country has laws relating to the collection and storage of citizen data except the U.S. Maybe focus in on that and smack TikTok around for violating that law. But banning TikTok just seems silly to me.

“(3) Lastly, I find it interesting that Trump changed his mind on this. I know that you are not a big fan of his, but in thinking back about Trump a thought comes to mind: Trump rarely if ever says he was wrong. For example, he won't admit that his Warp Speed permitted the fox (Big Pharma) into the henhouse and a lot of injuries and death resulted. He did the right thing by moving mountains to get a vaccine, but I would like him to admit that the result was that he let the devils run free. In other words, a very bad result.

“On the other hand, he also seems to be persuadable about certain things. For example, he has changed many of his positions over the years. Some would say that means he is being opportunistic (which is just a negative spin on being pragmatic, a key for business success), but it could also mean that he changes his mind upon gaining further knowledge or having thought about it more deeply.

“Is this hypocrisy? I am not sure. Is every person that changes their mind a hypocrite? Probably not.”

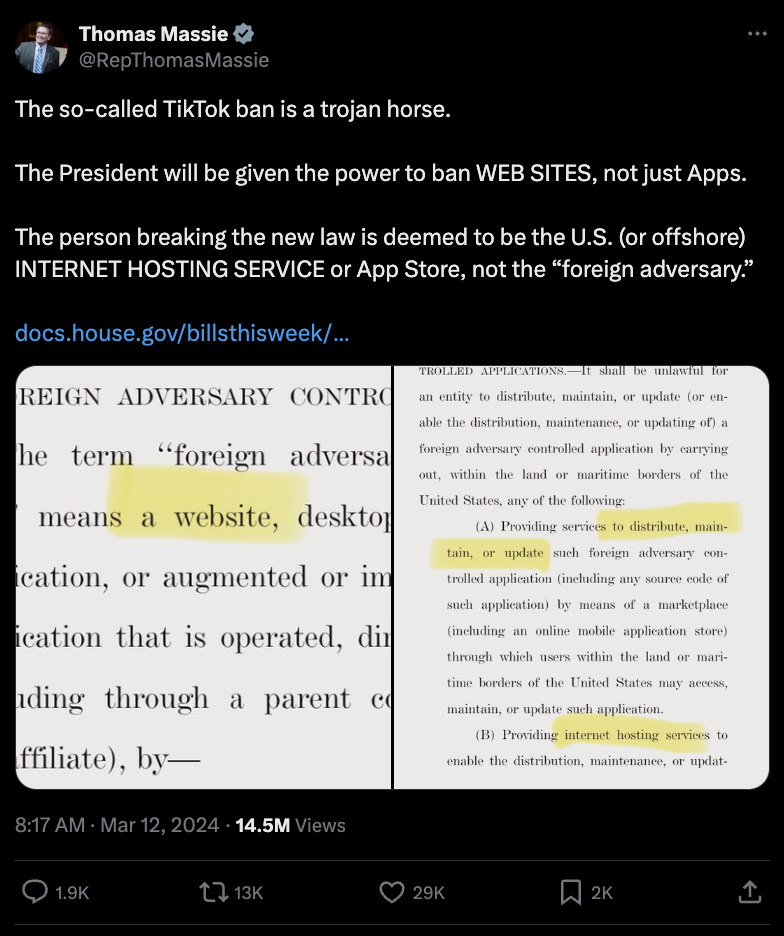

Well, it’s as good a time as any to update the story: The TikTok ban passed the House overwhelmingly this morning.

Well, it’s as good a time as any to update the story: The TikTok ban passed the House overwhelmingly this morning.

Curiously, when the customary 15-minute voting window ended, there were at least 225 “yea” votes, more than enough for passage — but more than 100 members had yet to cast a vote.

So the vote was kept open for at least 10 more minutes, as if to accommodate the legions of fence-sitters who couldn’t decide who they wanted to risk offending more — TikTok users or the national security state.

In the end, the vote was 352-65, with 1 present. You can see how your congresscritter voted here. In general, it was only the hard-core progressives and constitutional conservatives who voted “nay” — the AOCs and Matt Gaetzes of the world — along with our favorite cantankerous Kentuckian, Thomas Massie.

He’s absolutely right: Should TikTok’s Chinese parent fail to divest within six months of the bill’s enactment, Apple’s App Store and Google’s Play Store would have to remove TikTok to comply with the law. And whoever hosts TikTok on the web — presumably Amazon AWS or Microsoft Azure — would likewise be under federal orders to give TikTok the boot.

As the tireless Glenn Greenwald pointed out on his nightly webcast, this is the exact mechanism through which the powers that be nuked the alt-social media site Parler in 2021 — days after it was (wrongly) held responsible for the Jan. 6 riot.

Make no mistake: This new form of censorship will start with TikTok, but it absolutely won’t end there.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets