AI Showstoppers

![]() AI Is Changing Everything (Even Massages?)

AI Is Changing Everything (Even Massages?)

The future of farming is here. Or at least, it’s on the floor of the Consumer Electronics Show in Las Vegas…

The future of farming is here. Or at least, it’s on the floor of the Consumer Electronics Show in Las Vegas…

Look, Ma, no hands! (No driver, come to think of it…)

Several members of the Paradigm Press team are on site in Vegas — scoping out the most investable opportunities. Publisher Matt Insley is there, along with retirement specialist Zach Scheidt and two of James Altucher’s most trusted deputies — Bob Byrne and Ari Goldschmidt. You can follow their discoveries in real-time on our exclusive Paradigm at CES 2024 liveblog.

One of the unlikely showstoppers is what you see above — a driverless tractor from Kubota. And Kubota is hardly alone. As Zach mentioned here on Tuesday, Deere & Co. is competing intently in the realms of satellite imagery and precision planting.

“John Deere is utilizing AI in a big way,” affirms Bob Byrne. “Will DE be the next Magnificent Seven stock?”

One thing’s for sure, says Ari Goldschmidt: “One of the things holding back fully autonomous passenger vehicles is unpredictable driver/pedestrian behavior on the road. But farms are far more predictable environments and ripe for robotic innovation.”

Given how the farming population is “aging out” — with few younger farmers coming up to replace the ones approaching retirement — the technology is arriving just in the nick of time.

Meanwhile, this video clip suggests the career security of massage therapists and manicurists might be in doubt…

Meanwhile, this video clip suggests the career security of massage therapists and manicurists might be in doubt…

I dunno — for all the Jetsons-esque vibe to it, does this robo-massager really have the human touch?

Still, Ari has a point when he says, “I love these use cases — seems like the future of self-care is going to be unlimited.”

It’s not all whiz-bang gadgetry to make you ooh and ahh, though…

It’s not all whiz-bang gadgetry to make you ooh and ahh, though…

Zach was particularly impressed with a presentation by Intel CEO Pat Gelsinger. After a decade in which companies raced to adopt cloud computing — outsourcing all their data to remote data centers — Gelsinger says the trend now will be to take that data back in-house.

The reason? That’s the only way companies can put AI to work — that is, if they want to keep their data from being hoovered up by AI platforms, becoming fodder for their competition.

“Obviously AI will not end cloud data and cloud computing,” says Zach. “But it may transform what data will and won’t be stored and manipulated on cloud platforms.”

Otherwise, Gelsinger’s presentation did everything to reinforce our own Ray Blanco’s bullish case for Intel — basically, that INTC will quickly play catch-up to Nvidia with high-end chips, and at a much more attractive price for customers.

That’s just a small sample of what our team is encountering on the convention floor in Vegas. You can keep up with their findings for the rest of today — and remember, it’s still relatively early in the Pacific Time Zone, so there’s a whole day of activity in store! — by following their liveblog.

![]() Bitcoin ETFs: The Noise and the News

Bitcoin ETFs: The Noise and the News

Now that Bitcoin ETFs are a sure thing, “There’s a TON of noise about what’s coming next. You can safely ignore 99.99% of it,” says Paradigm crypto maven Chris Campbell.

Now that Bitcoin ETFs are a sure thing, “There’s a TON of noise about what’s coming next. You can safely ignore 99.99% of it,” says Paradigm crypto maven Chris Campbell.

Late yesterday, the Securities and Exchange Commission followed through on expectations — and cleared the way for the launch of Bitcoin ETFs.

Fully 11 firms got the green light — everyone from upstarts like Bitwise Asset Management to traditional heavyweights like Fidelity, Franklin Templeton and BlackRock.

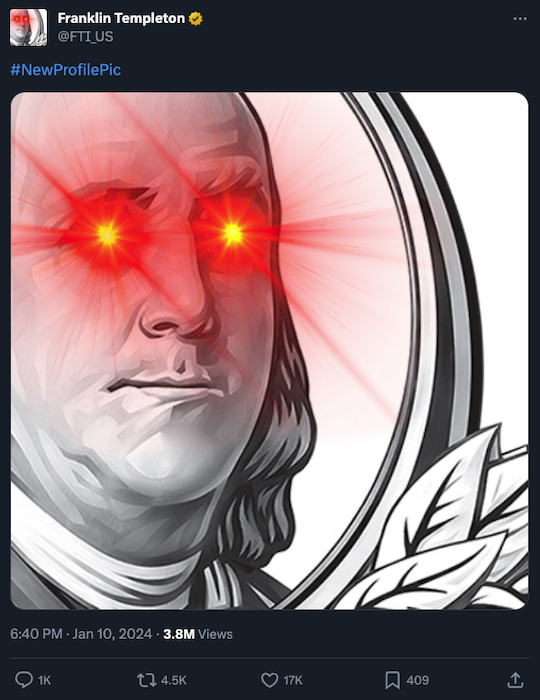

As our resident crypto evangelist James Altucher said here yesterday, what BlackRock wants, BlackRock gets. As it happens, BlackRock rang the opening bell on the Nasdaq this morning to herald the launch of its IBIT Bitcoin ETF. But Franklin Templeton gets the nod for the most creative announcement…

The SEC’s vote was 3-2 — with the two Republicans joined by chair Gary Gensler in voting “yea.”

The SEC’s vote was 3-2 — with the two Republicans joined by chair Gary Gensler in voting “yea.”

Still, in his statement accompanying the vote, Gensler couldn’t resist getting in a dig at Bitcoin.

He pointed out that the SEC is comfortable with ETPs (exchange-traded products) backed by precious metals — seeing as they’ve been around for 20 years now. “That experience,” he said, “will be valuable in our oversight of spot Bitcoin ETP trading.

“Though we’re merit neutral,” he went on, “I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast Bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing.”

The part about, “I’m only doing this because BlackRock CEO Larry Fink wants to make a metric crapton of money off Bitcoin” was merely implied.

Back to the original point: What does come next?

Back to the original point: What does come next?

To help answer that question James Altucher just conducted an interview with Omid Malekan, author of Re-Architecting Trust: The Curse of History and the Crypto Cure.We’ve posted it right here on our newest YouTube channel.

➢ Important housekeeping note: We’ve launched a second YouTube channel, called Paradigm Profits. Why a second one? Well, YouTube has already slapped us on the wrist for Jim Rickards’ recent election remarks on the original Paradigm Press YouTube channel.

So we figured our most prudent course of action was to launch a second channel focused exclusively on crypto, AI, technology and trading — stuff that won’t run afoul of the hall monitors. The original channel will continue to be the place where you can “get your doom on,” if that’s your thing…

Anyway, James’ interview with Mr. Malekan lays out everything you need to know and more about crypto ETFs. Once more, here’s the link. As always, we won’t try to sell you anything during our YouTube videos; they’re aimed only at making you a smarter investor.

Before we move on, a couple of hot takes that occur to your editor…

Before we move on, a couple of hot takes that occur to your editor…

- It’s way too soon to do a victory lap, but the future of CBDCs — central bank digital currencies — is a little more cloudy now. Bitcoin, indeed all cryptocurrencies, amount to private-sector competition for CBDCs — and Bitcoin is about to become much more entrenched in the financial system as we know it. It’s not the death knell for CBDCs by any stretch, but the saga just got more interesting

- As with gold ETFs, expect a vigorous debate over whether many of these Bitcoin ETFs are backed by actual Bitcoin — or by sketchy Bitcoin-linked financial instruments. From the beginning in the 2000s, questions have abounded about whether the biggest gold ETFs — State Street’s GLD and BlackRock’s IAU — have actual gold in a vault to back them up. Thus, there’s been a proliferation of newer vehicles you can buy on the stock exchange that make a point of full transparency — and even the ability to trade in your shares for physical metal. [Disclosure: I own shares in the best-known of those vehicles, the Sprott Physical Gold Trust (PHYS).]

Bitcoin’s price today, you ask? Swinging wildly — over $49,000 at one point but back below $47,000 as we write.

![]() Follow-up File: Biden Edges Closer to Economic Suicide Pact

Follow-up File: Biden Edges Closer to Economic Suicide Pact

The White House has thrown its support behind bipartisan legislation in Congress that would confiscate $300 billion in assets belonging to Russia’s central bank.

The White House has thrown its support behind bipartisan legislation in Congress that would confiscate $300 billion in assets belonging to Russia’s central bank.

That’s according to a Bloomberg story citing a memo from the National Security Council. “The bill would provide the authority needed for the executive branch to seize Russian sovereign assets for the benefit of Ukraine,” the memo says.

With Congress at loggerheads about additional funding for the Ukraine war, seizing Russia’s assets is looking more and more attractive to the Biden administration. $300 billion would go a long way toward Ukraine’s eventual reconstruction.

There’s bipartisan support for the bill — 14 sponsors in the Senate and 62 in the House. As we told you in November, House Speaker Mike Johnson is all on board with the idea.

We won’t belabor how reckless a step this is today: We went in depth with the help of Jim Rickards late last year. Suffice to say that…

- It will only encourage governments and central banks in the Global South to continue the process of “de-dollarization.” And even worse…

- Seeing as many of the assets in question are U.S. Treasuries, the rest of the world will look upon the confiscation as a default on U.S. government debt.

As always, we’ll keep you posted…

![]() Inflation Is “Sticky”? Say It Ain’t So!

Inflation Is “Sticky”? Say It Ain’t So!

Don’t say we didn’t warn you: Inflation is not yet “under control.”

Don’t say we didn’t warn you: Inflation is not yet “under control.”

The Labor Department is out this morning with the consumer price index, and it rings in hotter than expected — up 0.3% month-over-month.

Thus the year-over-year inflation rate has accelerated from 3.1% in November to 3.4% in December. Shelter costs drove fully half of that increase, along with auto insurance and health care.

As we’ve mentioned on several occasions — most recently on Christmas Day — history demonstrates that the Federal Reserve will have a devil of a time getting inflation back to its 2% target. There’s a high probability it won’t happen until the early 2030s.

Not surprisingly, the stock market is slumping on the narrative that “sticky” inflation will postpone the Fed’s plans to cut short-term interest rates this year.

Not surprisingly, the stock market is slumping on the narrative that “sticky” inflation will postpone the Fed’s plans to cut short-term interest rates this year.

All the major U.S. indexes are in the red — the S&P 500 by over a half-percent. At 4,756, the S&P is still about 40 points below its record-high close at the start of 2022.

Bonds and precious metals are also selling off on the resumption of the “higher for longer” narrative. The yield on a 10-year Treasury sits at 4.04%. Gold is down nine bucks to $2,015. Silver is off 36 cents at $22.52.

Crude, however, is staging a respectable rally — up 1.5% to $72.46.

Speaking of energy, big stock movers today include Chesapeake Energy (CHK) — up over 6% on its plans to take over Southwestern Energy (SWN), forming one of the country’s biggest natural gas producers. SWN shares are up a little under 1%.

![]() Interstate Moves to Escape the Taxman, Continued

Interstate Moves to Escape the Taxman, Continued

More reader feedback on the subject of interstate moves for tax reasons — only now I’m detecting potential downsides…

More reader feedback on the subject of interstate moves for tax reasons — only now I’m detecting potential downsides…

“I left high-tax California after being born in and living there my whole life,” a reader writes, “because of high income taxes, insane property taxes and repressive COVID policies that never let up.

“I moved to northwest AR, which has the lowest property taxes in the U.S.

“Let me give you an example of the pain of insane property taxes on overvalued real estate in the Bay Area. A house originally bought decades back for $200K that we rent out is now worth over $3 million.

“The rent is $6K a month, but the taxes eat up nearly half of that so the net yield is ridiculously low, below 1% annually. Even if you own the property outright, the tax payments are $2,500 a month you can never escape from.

“It is not just insanely high income taxes but also insanely high property taxes that people are fleeing from.”

Dave responds: Wait, you own that property? Do you intend to sell?

I’ve heard horror stories about Californians moving out of state and selling property they’ve owned for decades… and the appreciation is such that they get absolutely walloped on federal capital gains taxes. (The $500,000 exemption on a joint return hasn’t been raised since 1997 — one of several “gotcha taxes” tucked into the tax code.) Good luck…

“I purchased a home in North Carolina, 30 miles west of Charlotte,” writes our final correspondent.

“I purchased a home in North Carolina, 30 miles west of Charlotte,” writes our final correspondent.

“Tax value at just over $100,000 — total tax just under $600 for the year. Includes garbage pickup once a week.

“My home in Schoharie County, New York, tax value at $120,000 — total tax just over $5,300 for the year. Garbage pickup, just under $1,000 per year. This is only the start.

“Every item you can think of is less expensive in NC. No state income tax. Goodbye, NY”

Dave responds: Hate to break it to you, but North Carolina has a flat income tax rate for 2023 of 4.75%.

Probably a darn sight better than what you’ve been paying to Albany, but still… gotta do your research.

Happens to the best of us, though: For all the homework my wife and I did before we made our move a few years ago, we were still caught off-guard by high rates from the local water utility. Given our proximity to the Great Lakes, that one didn’t occur to us!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets