Biden Is One-Term Toast

- Joe Biden: A guaranteed one-term president

- The start of the year-end rally

- Janet Yellen’s “historic” blunder

- Blast from the past

- The mailbag: EVs and lockdowns

![]() Joe Biden: A Guaranteed One-Term President

Joe Biden: A Guaranteed One-Term President

After many discussions with highly connected sources, Paradigm’s Jim Rickards has concluded that the Democrats’ 2024 nominee for president will be… someone other than Joe Biden.

After many discussions with highly connected sources, Paradigm’s Jim Rickards has concluded that the Democrats’ 2024 nominee for president will be… someone other than Joe Biden.

Back in September, Jim was anticipating that impeachment proceedings by the Republican-controlled House of Representatives would furnish a pretext for Democratic Party power brokers to do what they already wanted to do — shove Biden aside.

Since then, as maybe you’ve heard, there was a falling-out among House Republicans — resulting in a new speaker after weeks of turmoil. Now Biden’s impeachment is just one item on a long list of competing priorities that no one can agree on.

But in the meantime, Biden’s sheer unpopularity makes the Democrats’ job of finding another nominee more urgent.

But in the meantime, Biden’s sheer unpopularity makes the Democrats’ job of finding another nominee more urgent.

“According to an aggregate of polls,” reports Newsweek, “the sitting president has a disapproval rating of 53.8% compared to 40.1% approval.”

The approval number is barely higher than that of Donald Trump at this time four years ago — when impeachment proceedings were much further along than they are now, by the way.

Thus the plan — as Jim understands it here in early November 2023 — goes like this…

Thus the plan — as Jim understands it here in early November 2023 — goes like this…

“Let Biden run in the primaries, accumulate as many delegates as possible, then sometime around May 2024 announce that he’s withdrawing from the race ‘for personal reasons’ and then release his delegates.

“At that point, the superdelegates (remember them?) who are unelected Democratic Party regulars will throw their support behind Gavin Newsom or perhaps Gretchen Whitmer, these newly released Biden delegates will fall into line and that will be that. Who needs elections when you have a central committee that calls the shots?”

To be sure, that’s not the only scenario in which Biden is pushed aside. And yes, however it shakes out, there will be implications for the markets.

Jim breaks it all down in the latest interview posted to our new Paradigm Press YouTube channel — and that’s just one of five earth-shaking predictions he serves up for 2024.

Watch and enjoy — and if you have a YouTube account, please subscribe.

![]() The Start of the Year-End Rally

The Start of the Year-End Rally

“If stocks are going to bounce, it has to be now,” writes Greg Guenthner at The Trading Desk. “So far, the bulls appear to be gaining traction.”

“If stocks are going to bounce, it has to be now,” writes Greg Guenthner at The Trading Desk. “So far, the bulls appear to be gaining traction.”

Stocks rallied yesterday afternoon after the Fed issued its latest proclamation on interest rates — and that rally is carrying into today. The S&P 500 is up more than 1.5% on the day, back above 4,300.

No surprise to Alan Knuckman — Paradigm’s eyes and ears at the Chicago options exchanges. As the S&P made one new low after another last week, he noticed that volatility as measured by the VIX did not make one new high after another. This morning the VIX sits below 16 for the first time in nearly six weeks. Mr. Market is feeling nice ’n’ mellow.

Another tell — the action in small caps. You might recall Rude Awakening editor Sean Ring telling us to watch IWM, the ETF linked to the Russell 2000 index. The $161–162 area was a crucial level of support — and wouldn’t you know it, IWM bounced off that very level as soon as the market opened Monday morning. As we write now, it’s at $168.57.

What next? Among the experts we follow outside the Paradigm stable, it’s worth noting that Craig Johnson of Piper Sandler has a knack for accurate year-end calls on the S&P 500. Several weeks ago on the Financial Sense podcast, he said the index would wind up 2023 at 4,825.

Not only would that be 500 points higher than today… it would be higher than the record close of 4,796 set on Jan. 3, 2022.

Also helping stocks this week is a drop this week in Treasury yields — the 10-year note is down to 4.63%, the lowest since mid-October.

Gold is moribund after the powers that be made certain to keep the monthly close below $2,000 on Tuesday. At last check, the bid is $1,984. Silver is down to $22.83. Crude is a shade over $81.

As for the Fed, chair Jerome Powell said the only thing he could say.

As for the Fed, chair Jerome Powell said the only thing he could say.

On the one hand, yes, the Fed might well be done with this rate-raising cycle — lifting the fed funds rate from near-zero levels in March 2022 to 5.5% as of the last increase in July.

But on the other hand, he won’t rule out additional increases altogether. Asked if the Fed has lifted rates high enough to bring down inflation, he replied, “We’re not confident that we haven’t, but we’re not confident that we have.”

What else was he going to say? The official inflation rate is running 3.7% — which is higher than the 3.0% reading three months earlier. What if the inflation rate keeps creeping higher, approaching the current fed funds rate of 5.5%? Suddenly, Fed policy is no longer “restrictive” — and he has no choice but to raise rates.

And at the pace Congress and the White House are spending money, accelerating inflation might well be inevitable going into 2024. Read on…

![]() Janet Yellen’s “Historic” Blunder

Janet Yellen’s “Historic” Blunder

Uncle Sam’s debt binge is becoming untenable.

Uncle Sam’s debt binge is becoming untenable.

“The Treasury Department announced plans Wednesday to accelerate the size of its auctions,” reports CNBC, “as it looks to handle its heavy debt load and with financing costs rising.”

Next week, the Treasury will auction $112 billion in debt to help roll over $102.2 billion in notes set to mature on Nov. 15 — $48 billion in 3-year notes, $40 billion in 10-year notes and $24 billion in 30-year bonds.

“From there, the department said it will increase the auction size of various maturities, focusing more on coupon-bearing notes and bonds. The Treasury will maintain its current auction size for bills until late November, when it expects to have its general account replenished enough to implement ‘modest reductions’ through mid- to late-January.”

Monday, the Treasury announced it needs to borrow $776 billion this quarter and $816 billion during Q1 2024.

Doing a little back-of-the-envelope math, that would bring the national debt to $34.76 trillion by the end of next March. For perspective, it was $23.69 trillion at the end of March 2020. As we said last month, federal spending simply is not returning to pre-COVID levels.

Worst of all, rising interest rates translate to substantially higher debt-service costs. Unlike many homeowners and corporations, Treasury Secretary Janet Yellen opted not to lock in long-term debt at record-low interest rates in 2021. This week on CNBC, billionaire investor Stanley Druckenmiller called it “the biggest blunder in the history of the Treasury.”

By some calculations, interest payments on the national debt already exceed the annual military budget.

Foreigners are selling Treasuries. The Federal Reserve is selling Treasuries. If other buyers don’t step up, supply and demand will do their thing — prices will fall and rates will rise further. That’s inflationary.

![]() Blast From the Past

Blast From the Past

Briefly, a follow-up to our item yesterday about McDonald’s price increases…

Briefly, a follow-up to our item yesterday about McDonald’s price increases…

![]() The Mailbag: EVs and Lockdowns

The Mailbag: EVs and Lockdowns

On the subject of the “real” cost of powering an electric vehicle, we heard from one of our longtimers…

On the subject of the “real” cost of powering an electric vehicle, we heard from one of our longtimers…

“I always read between the lines, especially when emotional responses seem overblown.

“My guess is this reader who cries BS about simple math because he doesn’t like the answer is just angry about his choice in buying an EV and wants to blame someone else.

“My position has always been that EVs make plenty of sense for certain applications, like fixed-route city driving of short distance. I’m invested in such applications.

“But the math, as well as real-world driving experience, is starting to pile up and people are finding that in many instances range anxiety is very real and completely defeats the freedom to get in your car and go anywhere, anytime without a second thought to finding fuel or waiting in long lines potentially.

“Insurance rates are starting to escalate on EVs because of higher repair costs in general, but mainly due to the unwillingness to take a chance with fires if there is even a slight nick to the battery. What is a fender bender with a normal vehicle has reportedly caused the insurance company to take zero battery fire risk and ‘total’ the whole vehicle.

“Electricity costs have reached parity with gas costs as well in several areas. Shocker (pun intended) — as you ramp up demand on a declining supply of electricity (due to coal plants being shuttered) you end up with rising prices and blackouts.

“Just another example of how so many people can’t accept responsibility for their own choices and want to blame others for outcomes. There’s a lot of that going around. Everybody’s a victim!”

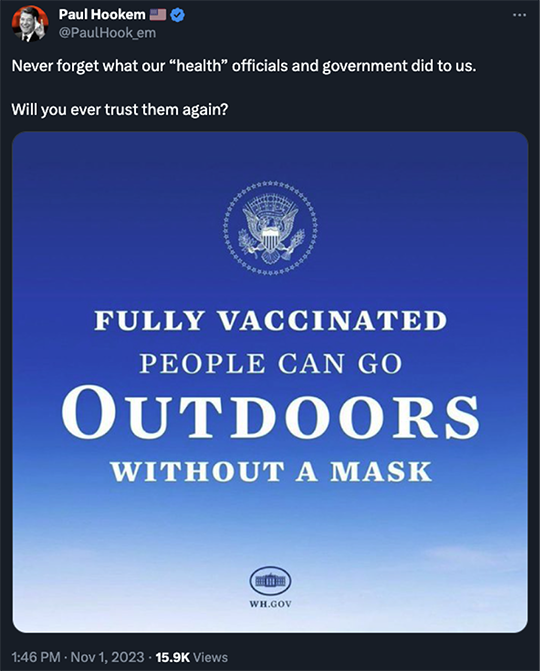

After we took note of mainstream media finally acknowledging that COVID lockdowns were a failure, we heard from a couple of readers…

After we took note of mainstream media finally acknowledging that COVID lockdowns were a failure, we heard from a couple of readers…

“Your meme of a cop stopping someone in a park with his gun drawn was closer to right on than you gave it credit for.

“I recall a scene at Manhattan Beach in Los Angeles where someone had the audacity to go surfing while all parks and shorelines were closed. It took a number of cops on the shore to finally corral him — presumably with guns drawn. He was assessed a $1,000 fine.”

“Lockdown measures were not harsh?” says another.

“Lockdown measures were not harsh?” says another.

“The most prescient moment in my eye was residents in, sorry I forgot the name of the town, Minnesota watching a regimented column of gub'ment thugs screaming at people to get back in their houses and then being pelted by paintballs when they don't comply.

“Pretty harsh and concerning to me.”

Dave responds: Hmmm… I’m almost certain the incident you’re recalling was enforcement not of COVID lockdowns but rather a post-George Floyd curfew.

The confusion is understandable. It all kinda ran together — as I chronicled at the time, including the incident you mention.

Please don’t get the idea that I think COVID lockdowns were not harsh. They were. The damage from those measures and others has been incalculable. And no one has been held accountable.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets