Tesla’s Tipping Point

![]() Investors’ Love-Hate Relationship (TSLA)

Investors’ Love-Hate Relationship (TSLA)

“Tesla has had an eventful 2024 so far,” says a Financial Times article.

“Tesla has had an eventful 2024 so far,” says a Financial Times article.

Never mind CEO Elon Musk won a contentious legal battle over his $56 billion pay package, rubber-stamped for a second time by TSLA shareholders. Or that Musk promised to take the wraps off a fully autonomous “robotaxi” on Aug. 8. (Stay tuned.)

Yesterday, the EV company reported Q2 global vehicle deliveries were down 4.7% year-over-year. Bearish, right? Nope. The automaker still beat Wall Street’s estimate, delivering 4,654 more vehicles than analysts anticipated.

“Tesla also retained its position as the world’s largest EV company,” FT says, selling more EVs than Chinese competitor BYD for two straight quarters, after getting trounced by BYD in the fourth quarter of 2023.

“This was a huge comeback performance from Tesla and Musk… with EV demand still choppy globally,” says Wedbush analyst Dan Ives.

“While it’s been a difficult period for Tesla, and the company has been through some significant cost reductions to preserve its bottom line/profitability, it appears better days are now ahead,” he says.

But are better days ahead for TSLA shares?

“I can sense skepticism every time I make a bullish Tesla argument,” says Paradigm’s trading pro Greg “Gunner” Guenthner. “This is a company that evokes strong emotions from just about everybody.

“I can sense skepticism every time I make a bullish Tesla argument,” says Paradigm’s trading pro Greg “Gunner” Guenthner. “This is a company that evokes strong emotions from just about everybody.

“Whether we’re talking about dwindling demand throughout the EV space, the latest Cybertruck recalls or Elon Musk’s online trolling…

“… even casual investors hold strong opinions on Tesla. Most of them are negative!”

“But the ‘Magnificent Seven’ laggard Tesla might take the lead during the third quarter,” Gunner says.

“But the ‘Magnificent Seven’ laggard Tesla might take the lead during the third quarter,” Gunner says.

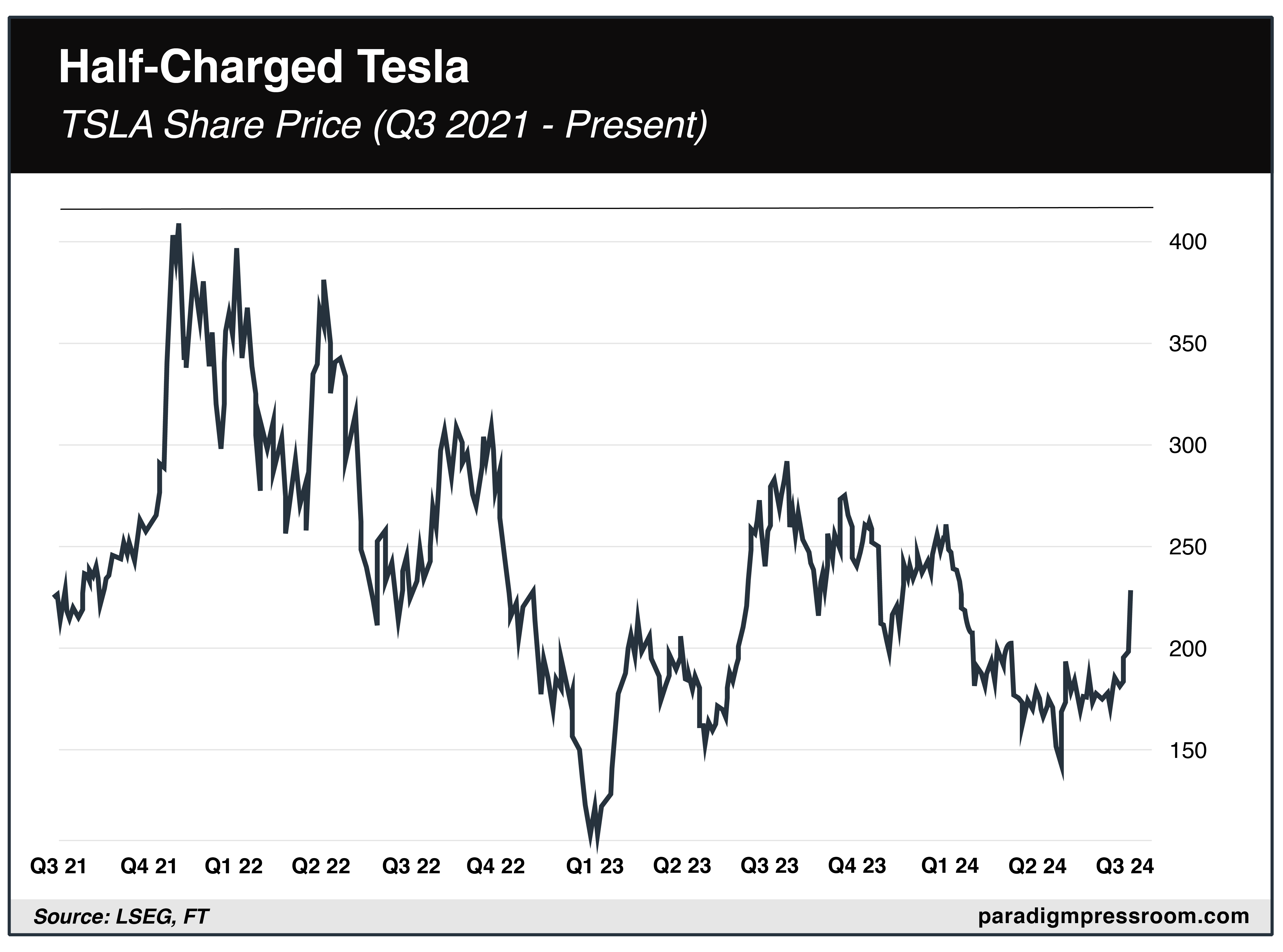

“As most of the household-name mega-caps were soaring to new highs back in the spring, TSLA shares remained out of favor for nearly three years.”

Not to mention, during the first half of 2024 alone: “Tesla shares have lost as much as half their value.”

“Based on performance alone,” says Gunner, “we can reasonably assume sentiment has been extremely bearish.

“But something changed in the spring that would set the stage for the incredible comeback unfolding this week…

“The stock turned higher last Wednesday, then broke above the $200 level on Monday on a decisive 6% move,” says Gunner.

“The stock turned higher last Wednesday, then broke above the $200 level on Monday on a decisive 6% move,” says Gunner.

“Not only did TSLA break above $200 for the first time since February — it also closed at a five-month high.”

Gunner adds: “Remember, most investors continue to expect the worst from Tesla. Bearish sentiment remains, a clean breakout.

“This could add fuel to the fire should Tesla continue to post any positive surprises.” And yesterday’s vehicle deliveries number certainly qualifies: Shares soared 10%, and they’re up an additional 3% today.

“Sometimes a stock is so hated that the bar for ‘good news’ is extremely low. I think that’s the case here.

“No one thinks Tesla can beat earnings” — coming July 17 — “but what if they’re wrong?” he wonders.

“Price is telling a very different story. If this breakout above $200 holds and extends higher,” Gunner concludes, “the downtrend that’s trapped TSLA since late 2021 could be over.”

Our customer records show that you have not been receiving research from Paradigm’s most successful expert… You just heard his take on Tesla’s breakout.

Gunner currently holds the most profitable track record in our industry.

He’s delivering average results of 57% in nearly two weeks — and active customers are raving about their experience:

And in a two-year span, Gunner had the power to grow a $40,000 model portfolio to $266,000.

That’s a 565% compound return!

It’s one of the most successful strategies in our industry.

And it’s about time you participate. Check out all the details by clicking here.

![]() Attention Seekers: Gold and Silver

Attention Seekers: Gold and Silver

As we slide into the second half of the year…

As we slide into the second half of the year…

It’s not a prediction, mind you. It’s just, er, interesting.

Amid the raft of economic numbers out today, the big surprise is one we don’t always report — ISM services clocked in below 50, indicating contraction in the services economy in June. The number was 48.8; the lowest guess among dozens of Wall Street economists was 52!

Elsewhere, the signs point to a job market that continues to soften. New private-sector jobs as calculated by the payroll firm ADP came in lower than expected. First-time unemployment claims came in higher than expected.

The market closed at 1 p.m. (EST) this afternoon… And the big story today: precious metals.

The market closed at 1 p.m. (EST) this afternoon… And the big story today: precious metals.

Gold and silver both rallied, with the price of the yellow metal rising 1.35% to $2,365.20 per ounce. Silver? Up 3.85% to $30.80. The other commodity we regularly report on, crude oil, gained 0.29% to $83.04 for a barrel of WTI.

On the other end of the spectrum, the market that never closes — crypto — is churning in the red. At the time of writing, Bitcoin (down 2.5%) is barely hanging onto $60,000 while Ethereum is (down 3%) is hanging out at $3,300.

Stocks, on the other hand, mostly closed in the green. The tech-heavy Nasdaq gained 0.88% to 18,188 and the S&P 500 gained 0.51% to 5,537. The Big Board, however, was in the red by a fraction of a percent, closing at 39,308

![]() “Chinesium”

“Chinesium”

“Counterfeit titanium was sold to Boeing and Airbus using fake documents,” says an article at Equities.com.

“Counterfeit titanium was sold to Boeing and Airbus using fake documents,” says an article at Equities.com.

“The fake titanium was first discovered by Spirit AeroSystems, which noticed small holes in the titanium from corrosion. After a thorough investigation, they realized that the bogus titanium was used in Boeing’s 737 Max and 787 Dreamliner jets, and the Airbus A220.”

Both companies “voluntarily disclosed to the FAA that one of their foreign distributors ‘falsified or provided incorrect records,’” the article adds.

(In Paradigm’s lively internal Slack channel, our science-and-technology editor Ray Blanco said one word: “Chinesium.”)

The New York Times reports: “The issue appears to date to 2019 when a Turkish material supplier, Turkish Aerospace Industries, purchased a batch of titanium from a supplier in China.”

So we gather that supply-chain snafus were happening before the pandemic. And this is an intriguing angle…

“Unfortunately for Europe, their decades-long titanium arrangement with Russia was disrupted [after] Russia invaded Ukraine on Feb. 24, 2022,” Equities.com notes.

“Unfortunately for Europe, their decades-long titanium arrangement with Russia was disrupted [after] Russia invaded Ukraine on Feb. 24, 2022,” Equities.com notes.

When the U.S., Canada and the EU imposed strict sanctions against Russia, Boeing and Airbus were forced to seek alternative titanium sources. (Enter China.)

According to a 2023 article at the Journal of Travel Research: “The negative consequences of sanctions spill over much more into airlines than other publicly traded aviation-related companies, with [a] greater impact on larger firms than small firms.” Doesn’t get much bigger than Boeing and Airbus.

The kicker?

Back to the Equities.com article: “This was not only economically costly to Russia” — debatable — “but is also a safety hazard.” Verifiable.

“Unless the U.S., Canada, or Europe can increase domestic production of titanium (and that won’t happen quickly), the supply chain problems will continue.”

Safe travels this Fourth of July, everyone!

![]() “Miss Cleo” and the First Amendment

“Miss Cleo” and the First Amendment

Career psychics in Norfolk, Virginia can celebrate their independence this Fourth of July.

Career psychics in Norfolk, Virginia can celebrate their independence this Fourth of July.

In mid-June, Norfolk’s City Council repealed a 45-year ban on “the practice of palmistry, palm reading, phrenology or clairvoyance, for monetary or other compensation.”

The Associated Press reports: “It’s unclear exactly why this city of 230,000 people on the Chesapeake Bay, home to the nation’s largest Navy base, nullified the 1979 ordinance.

“Soothsaying [had] been a first-degree misdemeanor and carried up to a year in jail.”

Professional psychic medium Ashley Branton has earned a living in Norfolk for the past seven years. “I had no idea that [the ban] was even a thing,” she says. “I’m glad it’s never come down on me.”

I guess the universe didn’t give Ms. Branton the memo…

In all seriousness, “courts have increasingly viewed bans on fortune tellers with skepticism on First Amendment grounds,” the AP says. “Maryland’s Supreme Court ruled in 2010 that fortune telling for a fee is protected free speech.”

You might not agree with psychic services in the U.S. on religious grounds. Or you might think the entire $2.3 billion industry is throwing good money after bad, but we’ll pound the table for the First Amendment’s protection of free speech.

![]() Are You Still on Facebook? (Or Were You Ever?)

Are You Still on Facebook? (Or Were You Ever?)

After our item yesterday about how bizarre AI-generated images are messing with Facebook’s algorithm, we got a blizzard of replies to our query “Are you still on Facebook?”

After our item yesterday about how bizarre AI-generated images are messing with Facebook’s algorithm, we got a blizzard of replies to our query “Are you still on Facebook?”

“Do NOT have time 2 waste on FB,” says a representative response, “with dumb ‘discussions,’ slutty-looking women wanting a friend request answered, blah, blah, blah, ad nauseam…

“Have one — don't use it,” says another. “I don't think my kids’ grandchildren will care what they ate at the Cheesecake Factory 40 years from now.”

“Every few weeks, I look in on FB to see what some of my zombie offspring are doing,” chimes in a third. “Can only take it for a few minutes before I have to escape. If I could find a bidet for my head, I'd use it to hose out my brain. GIGO (garbage in garbage out)!”

We also got a nice cross-section of ages…

We also got a nice cross-section of ages…

“I turned 60 last month. I never was on Facebook, but my wife is 45 and she is. She uses Messenger daily to communicate with family overseas. She also has a small business on Facebook so I would say we are dependent on Facebook and will always be until something better comes.

“Sadly, yes, I’m still on,” says a 64-year-old. “I use it to keep track of obituaries, which is kinda weird but that in turn allows me to live without the local newspaper, which remains on life support and is firmly MSM. “I post very infrequently, and I could really live without it.”

“I created an account on Facebook when it was a new thing,” says a 70-year-old who belongs to our Omega Wealth Circle, “and looked around for 20 minutes or so. I decided it looked like a worthless time sink, and I've never been back.”

“I'm 30 and stopped using Facebook about five years ago. My wife is 40 and only uses it for Marketplace. Facebook is really depressing nowadays, honestly. If it isn't AI-generated images, it's something inflammatory that just gets the adrenaline pumping and silly arguments in the comments with no open minds or discussion, only thick skulls and holier-than-thou ‘my way or the highway’ type arguments.

“I don't agree with all of this establishment's viewpoints, but I deeply appreciate the hard work, great info and wisdom put forth by each of you.”

For one reader, the censorship we’ve been spotlighting over the years was too much.

For one reader, the censorship we’ve been spotlighting over the years was too much.

“I am 46 years old and I haven't touched my Facebook account since I was censored for sharing a Children's Health Defense post on vaccines in 2021. F*** Facebook.”

“I never was on Facebook,” says our final correspondent. “Or LinkedIn. Or Instagram. Or X. Or TikTok.

“I never was on Facebook,” says our final correspondent. “Or LinkedIn. Or Instagram. Or X. Or TikTok.

“In fact I have never been a subscriber to any social media site. When Twitter launched, it struck me as running around smelling other people's (brain) farts. Tremendous time-wasters that have arguably destroyed several generations of our kids and degraded public discourse.

“That plus I have very few precious IQ points to sacrifice to the high-tech dopamine dealers.”

Emily: Anecdotes aren’t data, but from the anecdotes we’ve collected, it seems Facebook has passed its sell-by date. (That’s Facebook the platform, not necessarily Meta the company.)

Crazy as it seems now, we conducted a brief experiment in 2018 — encouraging readers to join a Facebook Messenger list where we’d send a “We just posted a new issue!” message, with a link for instant access. We even went to the trouble of having our art team work up an emoji of Dave…

“They’ve done an admirable job capturing your expression,” said Dave’s wife…

But we aborted the experiment after a few months at most.

We never really bought into the notion that “Email Will Be Obsolete By 2020” — that was part of the headline to an Inc. article in 2015 — but we’re always on alert as times and technologies change, ready to go wherever the readers are.

For the time being, that’s still email — even though, as a New York Times writer said way back in 2010, having an email account is a “sign you’re an old fogey” who “still watches movies on a VCR, listens to vinyl records and shoots photos on film.”

Go figure, heh, vinyl and analog photography are making a comeback!

Take care, reader… Happy Independence Day!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets