The Red Dragon Steels Its Soft Underbelly

![]() China Endorses… Kamala Harris?

China Endorses… Kamala Harris?

“China depends on foreign resources,” says Robert Friedland — founder of Ivanhoe Mines — to The Economist.

“China depends on foreign resources,” says Robert Friedland — founder of Ivanhoe Mines — to The Economist.

“Although the country is the world’s refining center for many metals, it imports the raw material required,” he notes, “ranging from 70% of bauxite to 97% of cobalt.”

Take bauxite, for instance. While it’s not one of the rare earth elements (REEs) — which are commonly associated with the green-energy transition — bauxite frequently contains REEs that are extracted in the refining process.

And until recently, China had the REE market cornered, accounting for 90% of global REE production. But that figure’s shrunk recently to about 70%, according to MarketWatch.

Friedland further notes: “[China] has a lot of coal, but its deposits of other fuels do not match its needs.”

“China keeps the lights on [with] imported energy,” he claims.

“China keeps the lights on [with] imported energy,” he claims.

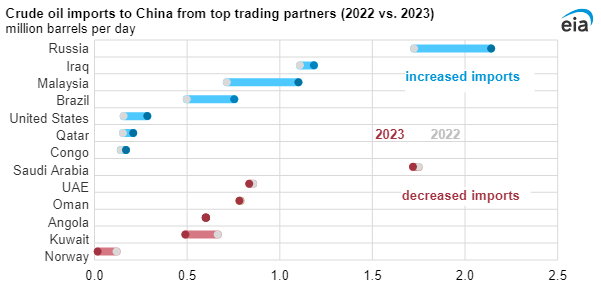

In fact, the country imports 40% of its natural gas. Likewise, the second-largest economy in the world imports 70% of its crude oil.

Source: EIA

“Aware of this vulnerability,” Friedland says, “China started building ‘strategic’ stockpiles [of] minerals at the end of the Cold War, which it then added to at the peak of its economic boom with petroleum and industrial metals.”

Which brings us to 2023: “China’s imports of many basic resources broke records, and imports of all types of commodities surged by 16% in volume terms.

“At a time when commodities are expensive — China appears to be stockpiling materials at a rapid pace.”

According to Friedland: “Three recent events have prompted more stockpiling…

According to Friedland: “Three recent events have prompted more stockpiling…

“In 2018, President Donald Trump imposed tariffs on Chinese exports, [forcing] China to retaliate,” he recalls.

- In March 2018, Team Trump announced a 25% tariff would be applied to some 1,300 Chinese goods — everything from medical equipment to machine tools to auto parts. All told, $50 billion in imports.

- Not long after came the “polite reciprocation” from Beijing — a 25% tariff on 106 U.S. goods, also totaling $50 billion worth. They would leave a mark on key sectors of the U.S. economy, including soybeans, orange juice and autos.

“Next came Covid-19, which disrupted supply chains and raised the cost of materials,” Friedland says. “War in Ukraine then inflated prices and showed America’s will to use embargoes.”

All three events lead directly to the upcoming U.S. elections, just about three months from now.

“Policymakers in Beijing seem to be worried [a] new, hawkish American president could try to choke crucial supply routes to China.” Specifically, by leaning on trade partners — including metal-rich Australia and Chile, for instance.

“Now [Trump] has a decent chance of returning to power,” Friedland concludes, and the former president “makes no secret of wanting to hobble China.”

![]() Then There Was One (And Gold)

Then There Was One (And Gold)

Two more Mag 7 companies reported earnings yesterday afternoon: Apple and Amazon.

Two more Mag 7 companies reported earnings yesterday afternoon: Apple and Amazon.

Apple’s revenue exceeded Wall Street estimates, and record-high Apple Services revenue — from app purchases, Apple Music, etc. — helped offset weaker iPhone sales, down 0.9% for the quarter. It’s also worth noting that softening iPhone sales in China, down 6.7%, knocked Apple off the top-five list of smartphone brands in the country.

Meanwhile, Amazon missed on revenue and advertising sales — notwithstanding revenue was up 10% and ad sales were up 20% year-over-year. Unfortunately, these misses overshadowed Amazon Web Services’ (AWS) earnings beat, with revenue up 19%. In after-hours trading, AMZN shares slumped 7%.

As for the job numbers out this morning…

Economists expected the U.S. economy to have created 180,000 jobs in July. Instead, the wonks at the Bureau of Labor Statistics could only gin up 114,000.

Economists expected the U.S. economy to have created 180,000 jobs in July. Instead, the wonks at the Bureau of Labor Statistics could only gin up 114,000.

The official unemployment rate — which ticked higher in April, May and June — was expected to hold steady at 4.1%. Not so much. For the fourth straight month, the unemployment rate ratcheted up again, this time to 4.3% in July.

Job gains below the 150,000 threshold, we must mention, are incompatible with a growing U.S. economy.

Considering the sucky job numbers, stocks are getting walloped today. The DJIA and S&P 500 have both lost about 2%, at 39,595 and 5,335 respectively. At the same time, the techie Nasdaq is down 2.25% to 16,800.

In sympathy with stocks, the price of crude’s been slashed 3.40% to $74.70 for a barrel of WTI. Silver and gold, you wonder? Both have reversed course this afternoon after an impressive run this morning. (Mr. Slammy?) At the time of writing, gold is down 0.35% to $2,471.20 per ounce. Likewise, silver is down 0.30%, hanging out above $28.

As for the crypto market — you guessed it — red all over with Bitcoin down a fraction of a percent to $63,280 and Ethereum down 2.75% to $3,000.

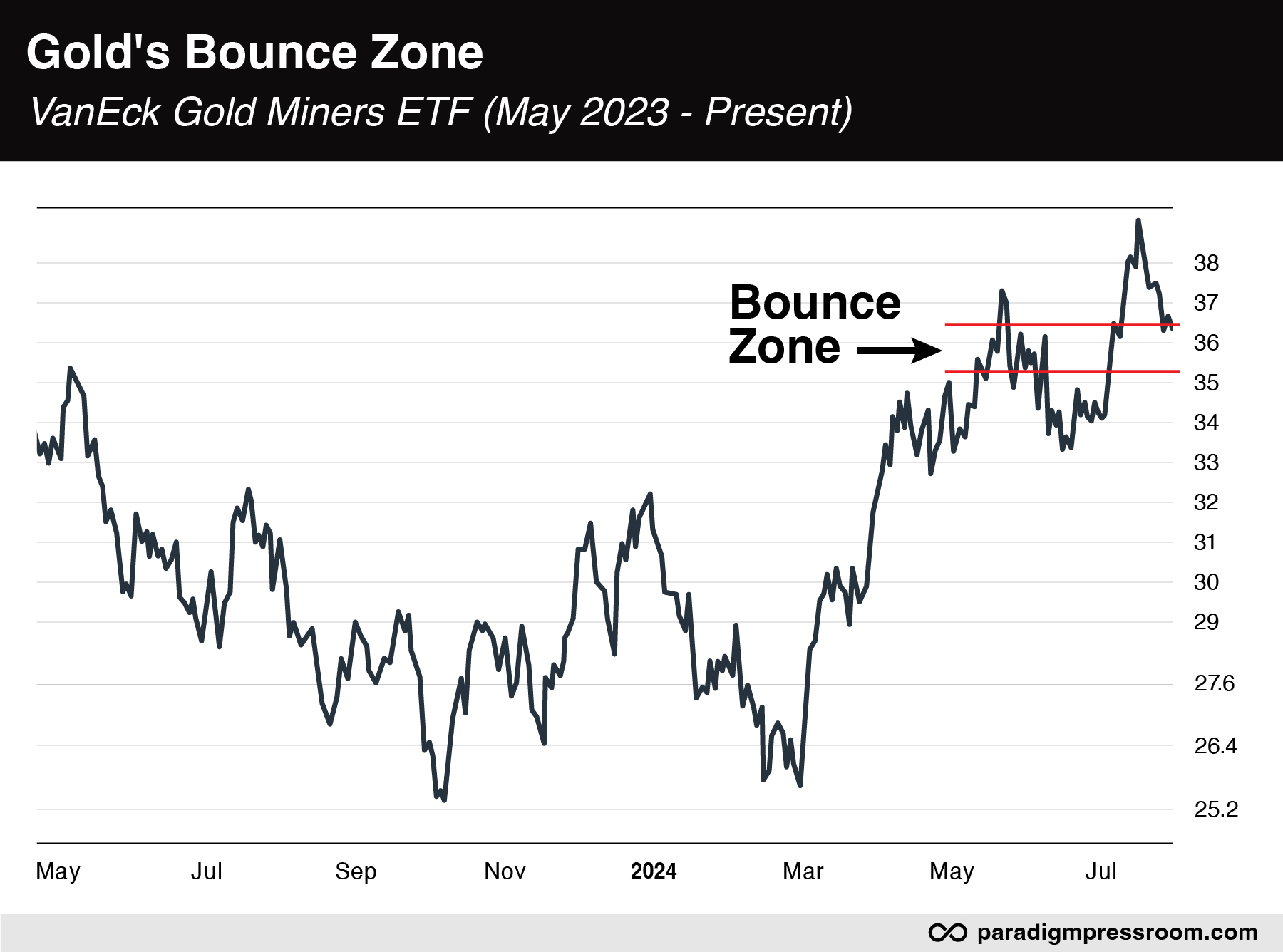

“I suspect the shiny yellow metal could continue to attract buyers,” says Paradigm’s chart hound Greg “Gunner” Guenthner, if gold avoids “getting dragged down to the lower bounds of its consolidation zone near $2,300.

“I suspect the shiny yellow metal could continue to attract buyers,” says Paradigm’s chart hound Greg “Gunner” Guenthner, if gold avoids “getting dragged down to the lower bounds of its consolidation zone near $2,300.

“Throughout this bout of summer volatility, gold has remained relatively calm,” Gunner observes. “I’m even more impressed with the resilient VanEck Gold Miners ETF (GDX)...

“Yes, the miners flew a little too close to the sun as they roared higher in early July,” he concedes. “But GDX can remain a viable long-side play if it can put in a strong bounce before cracking below $35.”

![]() Bitcoin and Biofuel

Bitcoin and Biofuel

Public pension funds from two Midwest states disclose stakes in Bitcoin.

Public pension funds from two Midwest states disclose stakes in Bitcoin.

In its quarterly 13-F filing with the SEC, the State of Michigan Retirement Fund disclosed a $7 million investment in the ARK 21 Shares Bitcoin ETF (ARKB).

The move aligns with neighboring Wisconsin’s retirement pension fund — a.k.a. SWIB — which invested in both the iShares Bitcoin Trust (BRL) and the Grayscale Bitcoin Trust (GBTC) between Jan. 1 and March 31 this year. To the tune of $99 million and $64 million respectively — figures that blow Michigan's tiny investment out of the water.

The trend appears to be gaining traction, with Jersey City, New Jersey's pension fund considering a similar allocation. The city's mayor says they're exploring a 2% investment, mirroring Wisconsin's approach.

“Pension fund boards often fear reputational risk, leading to a prolonged status quo. Not exactly a climate in which you would easily invest in Bitcoin,” notes Jeroen Blokland of the Blokland Smart Multi-Asset Fund.

But investors and boards can sometimes get a wild hare. At which point “the hunt for truly scarce assets can quickly escalate,” Blokland says.

Air New Zealand jettisoned its goal to cut carbon emissions 29% by 2030. The airline’s new target? Net-zero emissions by 2050.

Air New Zealand jettisoned its goal to cut carbon emissions 29% by 2030. The airline’s new target? Net-zero emissions by 2050.

“The move makes it the first major carrier to back away from such a climate target,” the BBC notes. (Something tells us Air NZ won’t be the last.)

“The aviation industry is estimated to produce around 2% of global carbon dioxide emissions, which airlines have been trying to reduce with measures including replacing older aircraft and using fuel from renewable sources,” the article says.

Notwithstanding: “Scientists and engineers have been working on the chemistry of oil-based jet fuel for about 85 years, and by now they pretty much have it right,” says Paradigm’s natural resource-and-energy whiz Byron King.

“Jet fuel is not the same thing as the gasoline you buy at the filling station…

“[Refined kerosene] is the best fuel to burn in an axial turbine jet engine, for a long list of reasons” — not least, its high flash and low freezing point.

“[Refined kerosene] is the best fuel to burn in an axial turbine jet engine, for a long list of reasons” — not least, its high flash and low freezing point.

“Not to mention, you want your fuel to be affordable. It [can’t cost] too much to produce and store,” Byron says.

According to the BBC: “Sustainable Aviation Fuels (SAF) are a key part of the sector's strategy to cut emissions but airlines have struggled to purchase enough of it.”

Ellis Taylor of aviation data firm Cirium confirms: “The price of [SAF] is more expensive than traditional fuels, and there is not enough capacity to produce that at scale.”

The International Air Transport Association says: “We need scale up of all solutions including SAF production as well as emerging technological solutions including the use of hydrogen and carbon removals.”

That’s the fairy-tale future of aviation — “airplanes powered by biofuels, batteries or even pure hydrogen” — Byron concludes: “Nope. Won’t happen.”

![]() Phone a Friend

Phone a Friend

Now you can pre-order an imaginary “friend” for $99. Or, you know, not.

Now you can pre-order an imaginary “friend” for $99. Or, you know, not.

Thanks to AI, the latest wearable technology from friend.com promises companionship via your smartphone.

Image courtesy: friend.com

A Life Alert knockoff?

To start a conversation, simply tap the pendant and a text message from “friend” is forthcoming. Unlike its human counterpart, this friend requires an internet connection and a device with bluetooth.

Among the more chilling FAQs at friend.com: “What does 'always listening' mean?”

Answer: When connected via bluetooth, your friend is always listening and forming their own internal thoughts. We have given your friend free will for when they decide to reach out to you.

According to the company’s website: “Pre-orders will start shipping Q1 2025 on a first come first serve basis. Currently friend is only available in the United States and Canada.”

[The company’s CEO Avi Schiffman spent $1.8 million (of the $2.5 million VC raised) just to land the domain friend.com… Wish I’d had the foresight to lock that domain name down!]

![]() Mailbag: Left, Right and Center

Mailbag: Left, Right and Center

A self-described “childless single woman with a dog” comments on yesterday’s issue…

A self-described “childless single woman with a dog” comments on yesterday’s issue…

“You have a woman who is a Marxist running for president and you are all bothered by Vance’s cat lady comment? We have really big problems in this country. Seriously!”

A second reader chimes in: “Dave, I think you’re looking at this from a purely libertarian perspective. When a government stops being a tool for society’s benefit (i.e. wielding carrots and sticks), it should be shrugged off and replaced.”

And wait for it…

“If any of you support the PIG 🐷 DJT or any of his cult followers, shame on you! I feel sorry for all of you who are so ignorant and bigoted.”

Emily:

We at the 5 Bullets remain, as ever, firmly anti-partisan. But glad we can still keep you guessing!

Have a wonderful weekend, and we’ll be back with a fresh-baked issue on Monday. In the meantime, don’t forget to peruse Saturday’s 5 Bullets highlight issue.