After 25 Years of Locked Doors, a Door Opens

![]() After 25 Years of Locked Doors, A Door Opens

After 25 Years of Locked Doors, A Door Opens

Sorry if the last three days of these 5 Bullets have been a downer — everything about how the American Dream has been locked away for more and more Americans over the last 25 years and how we got here.

Sorry if the last three days of these 5 Bullets have been a downer — everything about how the American Dream has been locked away for more and more Americans over the last 25 years and how we got here.

Today we hope to make it up to you.

We’re coming to you a bit later than usual because moments ago Jim Rickards wrapped up our exclusive event titled “The American Dream Unlocked.” (You can watch the replay right here if you missed it.)

He introduced them to the newest member of the Paradigm team, Matt Badiali — aka “the CEO.”

We call him that because he was chief executive officer of a company that made a lot of its shareholders rich last year.

He took his mining company public several years ago. Then last August he brokered a deal to grow his company’s operations — acquiring a firm called Silverco Mining. This deal unlocked a huge 608% peak gain for its shareholders in only two months.

That’s only one achievement of many across a 20-plus year career in the mining and energy sector as an executive, analyst and consultant.

Now in 2026, Matt has spotted an opportunity that could be as lucrative as anything that came out of the natural resource boom during the 2000s.

Now in 2026, Matt has spotted an opportunity that could be as lucrative as anything that came out of the natural resource boom during the 2000s.

If you don’t recall that episode, “it was epic,” he says. “I personally know a lot of people who simply retired after that market. They made so much money that they were set for life.”

A mere $5,000 grubstake turned into…

- $130,000 in less than five years with Southern Copper

- $320,000 in about five years with the steelmaker Cleveland-Cliffs

- $1.1 million in less than five years with Azimut, a miner of copper, nickel and lithium.

Did you miss out on those? Well, Matt sees a similar opportunity shaping up here in the 2020s — with a little-known federal agency set to make an earthshaking move before the end of the month.

Just one announcement a few days from now could unlock the American Dream for those who are bold enough to act.

“I’m talking about an unstoppable trend that could be the biggest wealth-creation event of the decade,” Matt says.

If your curiosity is piqued, once more here’s Jim Rickards’ introduction to Matt — and the replay to our exclusive event, “The American Dream Unlocked.”

![]() Gee, It Took Only Two Years

Gee, It Took Only Two Years

We’ve been screaming from the rooftops about this story for two years — and today it finally got to the front page of The Wall Street Journal.

We’ve been screaming from the rooftops about this story for two years — and today it finally got to the front page of The Wall Street Journal.

Well, you heard it here first: “The rapid growth in internet traffic and cloud computing has led to skyrocketing energy demands for data centers,” said our Ray Blanco in this space on Jan. 18, 2024.

By the summer of 2024 we were calling AI “the monster that ate the power grid.” Last year, we gave you a rare free pick in these virtual pages — Constellation Energy (CEG) — which soared 52% in less than six months. Enrique Abeyta’s paying subscribers fared even better.

Along the way we also told you about the problems facing the nation’s biggest grid operator — PJM, which serves 67 million people in 13 states from the mid-Atlantic to the Midwest. Its territory includes the biggest concentration of data centers in the world, “Data Center Alley” in northern Virginia.

Finally the WSJ is perking up: “Rates are going up for consumers. Older power plants are going out of service faster than new ones can be built. And the grid’s capacity is in danger of maxing out during periods of high demand, which could force PJM to call for rolling blackouts during heat waves or deep freezes to avoid damaging grid infrastructure.”

Again, none of this is new if you keep up with these daily missives. We even warned real-time about potential blackouts specific to PJM like a Christmas Eve cold snap in 2022. (Fortunately matters did not reach a crisis level.)

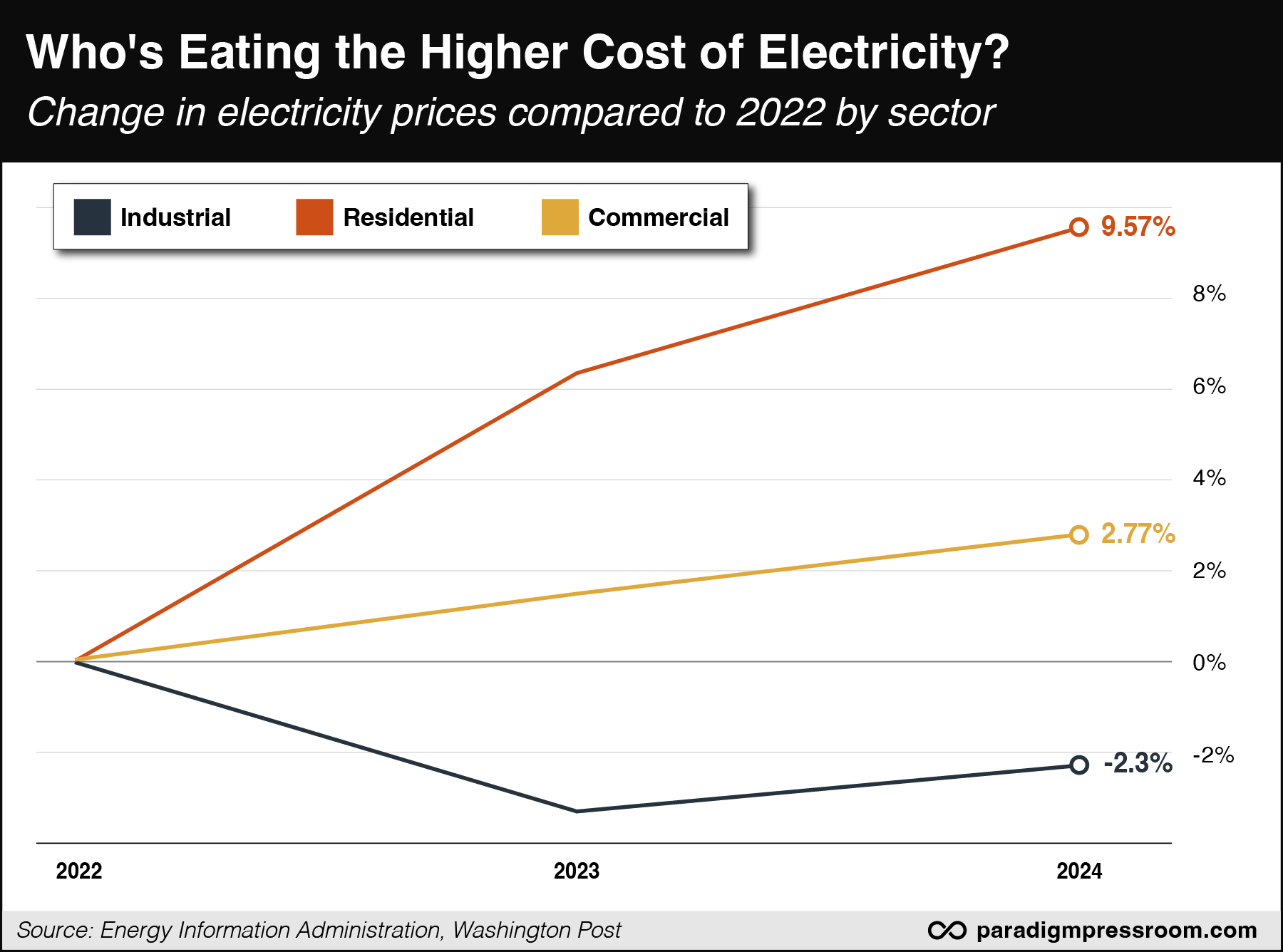

“Here is the frustration of the affordability crisis in one chart,” says Enrique Abeyta, with a follow-up today.

“Here is the frustration of the affordability crisis in one chart,” says Enrique Abeyta, with a follow-up today.

“Residential electricity prices have risen almost +10% since 2022,” he says, “while rates for commercial (+3%) and industrial (-2%) have gone up less or even down.”

To be sure, not all the blame lies with AI: In some states, “green” mandates supporting solar and wind have also driven up power prices.

This morning brings news that the data center buildout is affecting sectors other than just technology and electricity: Amazon just signed a two-year deal for access to copper mined at an Arizona site by Rio Tinto. Last year, that mine became the first new source of U.S. copper in more than 10 years — and now Amazon’s got dibs.

Paradigm will continue to stay on top of the story — and keep you ahead of the mainstream.

[By the way: Enrique first brought that chart to readers’ attention this morning in the “Daily Feed” section of the Paradigm Press mobile app.

Only the app gives you access to a host of instant insights — along with convenient one-stop-shopping for all the buy and sell alerts in your paid publications. (No more sifting through your email!) Download here.]

![]() Oil… and Iran

Oil… and Iran

The big market story today is a tumble in the oil price because peace is breaking out again in the Middle East. For the moment. Maybe.

The big market story today is a tumble in the oil price because peace is breaking out again in the Middle East. For the moment. Maybe.

Only two days ago, Donald Trump told anti-government protesters in Iran that “help is on the way.” Then last night, he seemed to reverse course — saying he’d been told “the killing in Iran has stopped.”

He didn’t say who told him, but traders are taking it as a sign that tensions are easing.

Meanwhile, an eye-opening Washington Post story puts the timeline of the last three weeks in an interesting new light.

Meanwhile, an eye-opening Washington Post story puts the timeline of the last three weeks in an interesting new light.

“Days before protests erupted in Iran in late December, Israeli officials notified the Iranian leadership via Russia that they would not launch strikes against Iran if Israel were not attacked first…

“[T]he contacts reflected Israel’s desire to avoid being perceived as escalating tensions toward Iran…”

Hmmm… The article does not specify exactly when these contacts took place. But consider what else was going on around that time…

- Dec. 29: Israeli Prime Minister Benjamin Netanyahu visits Donald Trump at Mar-a-Lago, urging Trump to attack Iran

- Dec. 29: Israel’s overseas intelligence service, the Mossad, posts a message on social media in Iran’s Farsi language: “Go out together into the streets. The time has come.” Mossad said pointedly its agents were already in the streets: “We are with you. Not only from a distance and verbally. We are with you in the field”

- Jan. 2: Israel’s Channel 12 outlet reports that roughly half of politically active accounts on Israeli social media are bots, not real people — and much of the traffic amplifies messaging from Netanyahu. “When he posts a five-minute video in Hebrew, in the first 60 seconds, most of the shares are from abroad, and [those] posts happen within about five seconds,” said Jonathan Hasidim of the Scooper research group.

So Mossad is ginning up mobs in Iran while social media worldwide is flooded with posts urging Donald Trump — not Netanyahu — to attack Iran in defense of the protesters.

Brings to mind the old joke about “Let’s you and him fight.”

But in recent days the anti-government protests have fizzled — presumably because the regime’s opponents want to be seen as Iranian patriots and not tools of Israel and the United States.

And now Trump is signaling no U.S. airstrikes are imminent. Not that the U.S military is in a position to do much anyway: There isn’t even a U.S. aircraft carrier in the region right now.

With that, a barrel of West Texas Intermediate is down more than three bucks — sitting as we write a hair under $59.

Beyond oil, the other big market story is a whipsaw in silver.

Beyond oil, the other big market story is a whipsaw in silver.

The trouble began during electronic trading in New York last night, the price collapsing from over $93 to under $87. Then the white metal started clawing its way back. At last check it’s back over $92!

Gold has looked positively calm by comparison – down modestly but still holding the line on $4,600.

It was a modestly positive day for the major U.S. indexes, the Dow up 0.6%. The S&P and the Nasdaq both ended the day up a quarter percent – not enough to make up for yesterday’s losses.

Crypto is looking stout – Bitcoin over $95,000 and Ethereum in sight of $3,300.

![]() “Trumpcare for the Oil Industry”

“Trumpcare for the Oil Industry”

Big Oil is skeptical about big money to be made in Venezuela.

Big Oil is skeptical about big money to be made in Venezuela.

Last Friday, Donald Trump met with a group of oil executives at the White House. He urged them to invest at least $100 billion in rebuilding and building out Venezuela’s oil infrastructure.

No one stepped up with an immediate commitment — even though Venezuela sits on the world’s biggest oil reserves and its oil is the kind that’s tailor-made for Gulf Coast refineries. Exxon Mobil CEO Darren Woods called the country “uninvestable” because there are no “legal and commercial frameworks.”

Gee, it’s almost as if Woods was urging Trump to follow through with full-on regime change; as it happens, Exxon has funded think tanks advocating exactly that.

"I didn't like Exxon's response,” Trump said Sunday. “They’re playing too cute.”

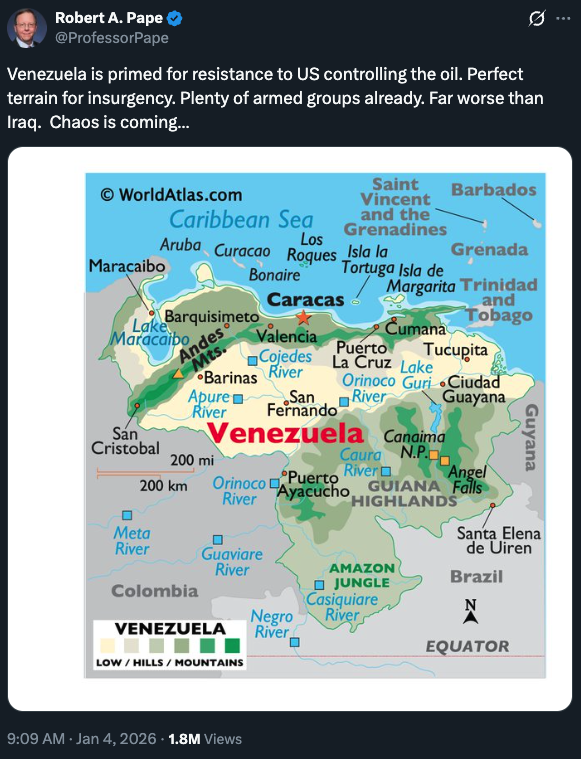

Regardless, Exxon’s Woods merely said out loud what every other CEO in the room was thinking: What’s the point of investing billions when leftist paramilitaries could start blowing up pipelines willy-nilly to deprive the Yanquis of Venezuelan crude?

University of Chicago poli-sci prof Robert Pape might be a little hyperbolic here…

… but then again, he’s the world authority on suicide bombing, so his warnings shouldn’t be dismissed out of hand.

Is it any wonder that last week Trump floated the idea of the U.S. taxpayer subsidizing Big Oil’s investment in Venezuela?

One wag on social media likens the scheme to Obamacare for the health insurers — “Trumpcare for the oil industry.”

- Meanwhile, Chinese firms like CNPC keep a significant presence in Venezuela — and that hasn’t changed even with former President Nicolas Maduro sitting in a New York lockup. For whatever reason, you don’t see much about that angle of the story in Western media…

![]() Mailbag: Affordability and the American Dream

Mailbag: Affordability and the American Dream

Tuesday’s edition resonated with readers — especially the two charts laying bare how the American Dream seems out of reach for so many.

Tuesday’s edition resonated with readers — especially the two charts laying bare how the American Dream seems out of reach for so many.

“I thought your Jan. 13th 5 Bullets was on point, particularly the way you anchored data to lived experience rather than official narratives. The affordability breakdown you describe is real, persistent and increasingly undeniable.

“A challenge I continue to wrestle with regarding economic machinations is whether we sometimes mistake mechanisms for causes. The Fed, subsidies, tariffs and red tape clearly matter; outcomes, however, are remarkably consistent across administrations, parties and policy regimes. The same small group keeps winning, while most Americans keep falling behind.

“That persistent result makes me wonder whether the deeper story is less about ideology or incompetence and more about incentive structures and ownership models that quietly shape outcomes regardless of who’s ‘in charge.’ The system keeps performing exactly as designed, despite which actor appears to be steering it.

“I often think about this in terms of two money games: a collaborative, value-creating, making game that sustains the real economy and a competitive, zero-sum taking game that overlays and increasingly dominates it. Whether or not it’s a frame worth naming, it’s one I can’t seem to unsee once the patterns are laid side by side.

“Always appreciate the clarity of your thinking.”

“It seems to me that when you view a number of charts that productivity and affordability have widened the gap since a certain date in 1971,” writes another — “when Nixon took us off the gold standard.

“It seems to me that when you view a number of charts that productivity and affordability have widened the gap since a certain date in 1971,” writes another — “when Nixon took us off the gold standard.

“Until then, the gap between the two was quite consistent.

“I'm no economist, but in viewing some of these charts it was about that time when the gap really began to widen. What is the Paradigm team's thought on this?”

Dave responds: Well, we don’t all think alike around here, but I think you’re onto something — and so does the operator of this website — who we hasten to add has no connection with us.

“Good information here, but you missed a big piece of why Americans of median income are struggling with the almighty dollar being so almighty weak today,” writes one more.

“Good information here, but you missed a big piece of why Americans of median income are struggling with the almighty dollar being so almighty weak today,” writes one more.

“Check out the Solari report on Substack. $21 trillion missing? My guess is that this would be a huge factor in the overall numbers of everything you include on your charts. $6.5 trillion in 2015 alone...

“FRAUD is the biggest problem we have today, and have had for some time. Everyone (or most) in government at every level everywhere is on this gravy train, and it is not going to stop. Another $750 million just took off from Minnesota bound for Somalia yesterday — all cash in suitcases, and we just seem to let it happen. And Bessent says 10% of all federal money is not accounted for.

“So what went wrong?”

Dave: I’m familiar with the research you reference — even wrote about it when Catherine Austin Fitts and Michigan State’s Mark Skidmore first issued it in 2017. (And I revisited it last year when the DOGE boys were supposed to be auditing the Pentagon. Remember that?)

To be clear, the $21 trillion in “undocumented adjustments” at the Pentagon and HUD from 1998–2015 aren’t all fraudulent necessarily. It’s just that there’s no clear paper trail, such is the sloppy nature of government recordkeeping.

Anyway, I will gently disagree: There will always be “waste, fraud and abuse” in government. It’s just the nature of the beast. The key is to shrink government to a size where the inevitable fraud will be a rounding error!